Convert Sole Proprietorship to LLC: Step-by-Step

You started your business from home as a way to earn some extra income, and now it's blossoming into a thriving operation. You have steady clients, consistent revenue, and growing recognition both online and in your community. After operating as a sole proprietorship for a while, you realize it's time to take your business to the next level. You want the liability protection of a formal business structure to help protect your personal assets and present yourself as a professional, legitimate business, not just a local mom-and-pop.

But how do you transition your sole proprietorship and everything you've built into an LLC? The process isn't overly complicated, but it does require careful attention. Converting from a sole proprietorship to an LLC can protect everything you've worked hard to build while opening new doors. However, you will need to understand the right steps to take and the importance of proper timing to maximize legal protections and tax benefits.

Many businesses start as sole proprietorships and later convert to LLCs. A sole proprietorship is the default structure for anyone earning business income without formal registration. In this setup, you and your business are considered the same legal entity. While this offers complete control and minimal paperwork, it also means your personal property, savings, and other assets are fully exposed to business debts and lawsuits. On the other hand, limited liability companies (LLCs) are a popular choice for entrepreneurs seeking more protection. The LLC structure creates a legal barrier between your personal and business finances while maintaining operational flexibility.

In this article, we'll walk you through exactly how to make this transition. We'll cover everything from legal requirements to tax implications. You'll learn the step-by-step process, understand the costs involved, and discover common pitfalls to avoid during your conversion.

Why Convert a Sole Proprietorship to an LLC?

Converting a sole proprietorship to an LLC is one of the best decisions small business owners can make, as it can enhance legal protection and business opportunities. Generally speaking, four compelling advantages make LLCs the preferred choice for many entrepreneurs.

Limited Liability Protection

The most critical benefit of converting a sole proprietorship to an LLC is personal liability protection. As a sole proprietor, you're personally responsible for every business debt, lawsuit, and obligation.

An LLC creates a separate legal entity that shields your personal finances and assets from business liabilities. Any lawsuit stemming from an LLC's actions would target the business entity and its assets, not you or your personal wealth. According to the U.S. Small Business Administration, "LLCs protect you from personal liability in most instances; your personal assets — like your vehicle, house, and savings accounts — won't be at risk in case your LLC faces bankruptcy or lawsuits."

Real-World Example: Mona runs a cleaning service operating as an LLC. When a client claims an expensive vase was broken during cleaning and sues for $15,000, Mona's home, car, and personal savings are generally protected. Only her business assets are fully exposed. If she had operated as a sole proprietor, all of her personal assets would be at risk.

Improved Credibility

Operating under sole proprietorship status can hurt your professional image. Many clients, vendors, and lenders prefer formal business entities because they signal stability and lawful business practices.

Adding "LLC" to your business name can immediately enhance how your business is perceived. As Shopify notes, "Forming an LLC adds credibility to the business by showing clients, suppliers, and potential investors that the company is a legitimate and serious entity."

Banks typically view LLCs more favorably for loans and credit lines. The formal structure demonstrates a commitment to professional operations, making financial institutions more willing to extend credit or higher limits.

Easier Business Expansion

Sole proprietorship structures aren't intended for multiple owners, making growth challenging when you want to bring in partners, investors, or employees with ownership stakes.

LLCs accommodate growth seamlessly and can provide more protection and structure. You can start as a single-member LLC and transition to a multi-member LLC when opportunities arise. The LLC operating agreement provides frameworks for profit distribution, management roles, and decision-making, which are essential for successful business partnerships.

Potential Tax Benefits

Switching from a sole proprietorship to an LLC can have a beneficial impact on how you pay taxes. Both sole proprietorships and LLCs are pass-through entities by default, meaning business profits flow to your personal tax return. However, LLCs offer greater tax flexibility. Brex, a financial services provider for growing businesses, explains, "One of the clearest advantages of having an LLC is the option to elect how you're taxed. As an LLC, you can choose to be taxed as a sole proprietor, partnership, C-corporation, or S-corporation."

Depending on your LLC's income level, S corp election may provide significant self-employment tax savings. Instead of paying self-employment taxes on all profits, you take a reasonable salary (subject to payroll taxes) and receive additional profits as distributions not subject to those taxes. For profitable businesses, this can mean thousands in annual savings.

When Is the Right Time to Make the Switch?

Knowing when to convert sole proprietorship to LLC can save you money and protect your assets before problems arise. While every situation is unique, the following indicators consistently signal that it's time to make the transition to an LLC.

Business Growth or Increased Risk

As your business activities expand, so does your exposure to potential liability. More clients, larger contracts and hiring employees all increase the risk of something going wrong.

The tipping point often comes when you realize that a single lawsuit could wipe out everything you've worked to build, not just in your business but in your personal life as well. Registering as an LLC can put a lot of these worries to rest.

Bringing on Partners or Investors

If you're considering adding business partners or seeking investors, this is a great time to convert to an LLC. Sole proprietorships cannot have multiple owners by definition. While a general partnership allows shared ownership, it offers no liability protection, exposing all partners to unlimited personal liability. LLCs are safer and more flexible for shared ownership.

Converting to an LLC demonstrates professionalism and provides the legal framework for investment. The LLC operating agreement defines ownership percentages, profit distribution, and management responsibilities, protecting all parties involved.

Needing a More Formal Structure

Applying for business loans, government contracts, or industry-specific business licenses often requires operating as a recognized business entity rather than a sole proprietorship.

The formal LLC structure demonstrates compliance with business regulations and provides the accountability framework that clients, lenders, and regulators expect.

Step-by-Step Process to Convert Sole Proprietorship to LLC

Converting your sole proprietorship to an LLC involves several administrative steps that vary slightly by state. Sole proprietors must follow specific steps to ensure a smooth transition, including transferring the sole proprietorship's assets to the new LLC.

This guide breaks down each required action to ensure your transition is complete and legally compliant. Understanding the business formation process can help you avoid mistakes and navigate these requirements effectively.

Step 1 – Choose a Business Name

Your new LLC needs a name that complies with your state's naming requirements. You cannot pick the same name that another business in your state has already registered. Most states also require LLC names to include "Limited Liability Company" or "LLC" and prohibit certain words like "bank" or "university" without special licensing.

Check name availability through your state's secretary of state website before proceeding, or use a professional service like InCorp that can perform a name check for you. Many states allow you to reserve your chosen name for a small fee while completing the formation process.

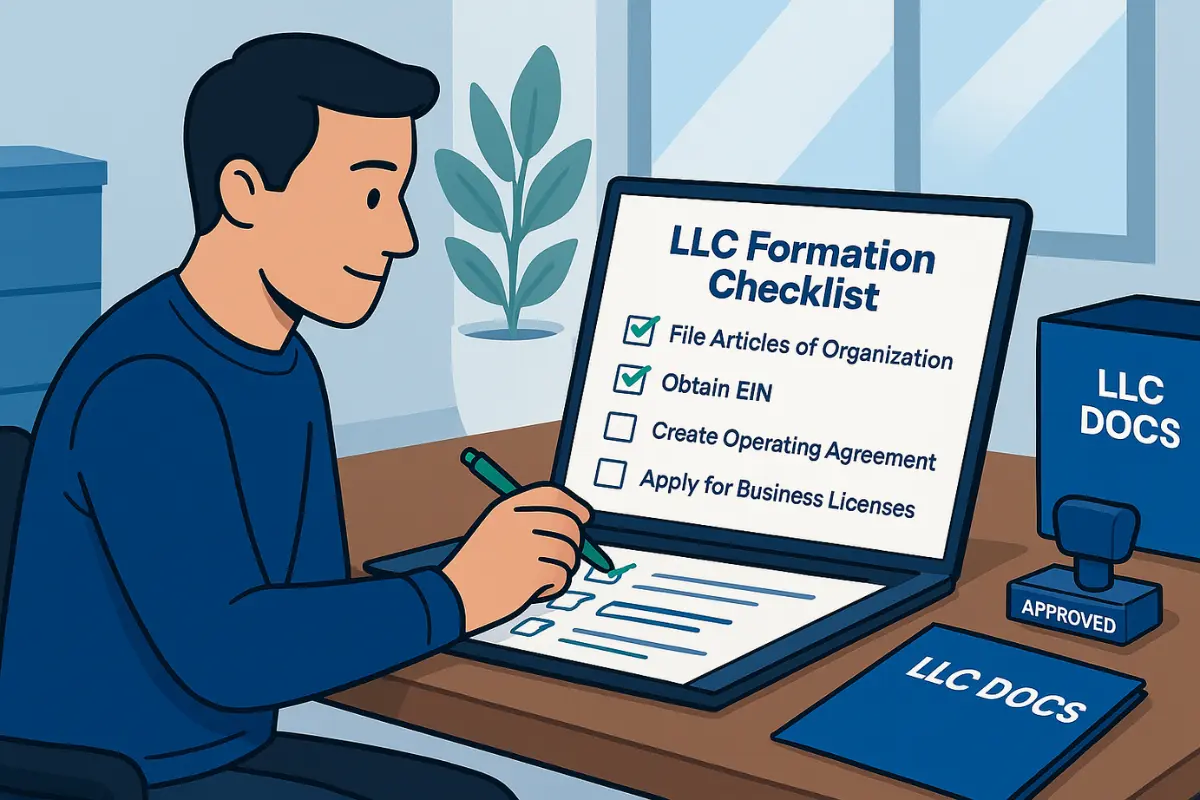

Step 2 – File Articles of Organization

File articles of organization with the state to legally create your LLC. This document is typically submitted to your secretary of state's office and includes basic information like your business name, business address and registered agent information.

Filing fees and forms vary by state. Some states require additional information, such as member names or business purposes, while others keep requirements minimal.

Step 3 – Create an LLC Operating Agreement

Draft an LLC operating agreement even if your state doesn't require one. This document defines ownership structure, management roles, profit distribution, and decision-making processes.

As a single-member LLC, this document is still important. A well-drafted and up-to-date operating agreement becomes essential if you later add members or face legal challenges. It demonstrates that your LLC operates as a separate entity, which is crucial for maintaining limited liability protection.

Step 4 – Apply for a New EIN from the IRS

Your newly formed LLC should apply for a new EIN (employer identification number) from the Internal Revenue Service, even if you had one as a sole proprietor. While single-member LLCs can use the owner's Social Security number, most banks require an EIN to open a business bank account. Getting an EIN also helps maintain your LLC's limited liability protection by separating personal and business finances.

Step 5 – Update Business Licenses and Permits

Review all existing business licenses and permits to determine which needs updating under your new LLC. Some transfer automatically, while others require reapplication or formal name changes.

Business licensing requirements vary significantly by industry and location. Professional licenses, sales tax permits, and industry-specific certifications often have different transfer rules. Contact each licensing agency directly for their specific requirements.

Step 6 – Open a New Business Bank Account

Establish a new business bank account under your LLC name and new EIN. This keeps business and personal finances separate, which helps maintain your liability protection. Banks typically require your Articles of Organization, EIN confirmation, and operating agreement to open the account.

Step 7 – Notify the IRS and State Tax Agencies

Inform tax authorities about your business structure change to avoid filing errors. The IRS and state tax agencies need to update their records to reflect your new LLC status and EIN. Some states require specific forms or notifications when businesses change structure.

Step 8 – Inform Clients, Vendors, and Stakeholders

Communicate your business structure change to everyone who interacts with your business: clients, suppliers, banks, payment processors, and professional service providers. Update contracts, invoices, marketing materials, and digital profiles to reflect your new LLC status.

Existing contracts may need formal amendments to substitute your LLC as the contracting party.

Legal and Tax Considerations

Legal and Tax Considerations Converting from sole proprietorship to LLC can create significant legal and tax changes that vary by state and require careful attention. For example, under California law, LLCs must pay annual franchise taxes and fees. Understanding these implications helps ensure compliance and maximizes your business structure benefits.

How LLC Taxes Differ from Sole Proprietorship

Both sole proprietorships and single-member LLCs use pass-through taxation by default, meaning business profits flow directly to your personal tax return. Single-member LLCs are treated as disregarded entities for tax purposes, resulting in similar tax treatment to sole proprietorships.

However, LLCs offer greater tax flexibility by being able to choose from different tax classifications if they feel this will be beneficial to them in the near future. LLCs can elect S corporation or C corporation tax status, potentially providing significant self-employment tax savings. Comparing sole proprietorship vs. LLC tax options shows how this flexibility can benefit growing businesses.

Do You Need to Dissolve the Sole Proprietorship?

Generally speaking, forming an LLC creates a new legal entity. You are essentially starting a new business, but you may still need to formally close your sole proprietorship, depending on your state's requirements. If you operated under a DBA name, you'll typically need to cancel that registration.

Closing a business involves notifying relevant agencies and completing final tax obligations. Contact your state's secretary of state or business filing agency to understand specific dissolution requirements and ensure clean separation between your old and new business entities.

What Happens to Business Debts and Contracts?

Business debts and existing contracts from your sole proprietorship don't automatically transfer to your new LLC. These obligations typically remain with you personally unless specifically assigned to the LLC through formal agreements.

For existing contracts, notify creditors, landlords, and clients about your business structure change and request amendments to substitute your LLC as the contracting party. You can transfer assets to your LLC using bills of sale or assignment agreements to maintain clear ownership records.

Common Mistakes to Avoid During Conversion

While converting a sole proprietorship to an LLC is generally straightforward, overlooking important details can lead to legal, financial, or operational problems. The following mistakes are common among new LLC owners but are easily avoidable with proper attention.

Skipping the Operating Agreement

Many small business owners skip creating an LLC operating agreement because their state doesn't require one or because they have a single-member LLC, but this can be costly. Without this document, your LLC operates under default state laws that may not align with your business needs.

An operating agreement defines profit distribution, management structure, and member responsibilities, helping prevent confusion and disputes. For single-member LLCs, it demonstrates that your business operates as a separate entity, which is essential for maintaining limited liability protection.

Not Updating Business Licenses or Bank Accounts

Failing to update business licenses and permits under your new LLC name can result in compliance violations. Each licensing agency has different requirements, so don't assume they'll update automatically. Using your old sole proprietorship bank account after forming an LLC blurs the legal separation between personal and business activities and can compromise your liability protection. Open a new bank account under your LLC name and EIN.

Failing to Inform IRS or State Agencies

Not notifying the IRS and state tax agencies about your business structure change can lead to filing errors, missed obligations, or penalties. Tax authorities must update their records to reflect your new LLC status and EIN.

Some states require specific forms when businesses change structures. Missing these requirements can result in penalties or your LLC being dissolved for non-compliance.

Costs Involved in Converting to an LLC

Converting to an LLC comes with upfront costs that vary depending on your state and whether you use professional services. While most conversions are relatively affordable, understanding the potential expenses can help you budget effectively and avoid unexpected fees.

State Filing Fees

Filing fees for Articles of Organization are the primary mandatory cost for LLC formation. These fees vary by state, typically ranging from $50 to $500. To check LLC filing fees by state, be sure to contact your secretary of state or relevant business filing authority for the most accurate and up-to-date information. Some states charge additional ongoing taxes and fees. For example, California LLC owners must pay an annual franchise tax in addition to the filing fee.

Registered Agent Fees

All 50 states require LLCs to maintain a registered agent, a person or a company authorized to receive legal documents and official correspondence on behalf of the business. While you can serve as your own registered agent if you have a physical address in the state and are available during business hours, this isn't always practical and can be risky if you miss critical legal documents.

Professional registered agent services typically cost $100–$300 annually and provide privacy protection, reliable document handling, and compliance assurance, which is especially valuable for home-based businesses or frequent travelers who prefer to keep their personal addresses private.

EIN Application

For tax purposes, your newly formed LLC generally needs its own employer identification number (EIN), even if your sole proprietorship had one since they are legally different entities.

Federal-level EIN applications are free when filed directly with the IRS, or you can use a professional service to handle the application on your behalf. Some states also require separate state tax IDs or business registration numbers, which may involve additional fees.

Legal or Filing Service Fees (if applicable)

While DIY filing will only cost you state filing fees, many business owners choose professional services for convenience and accuracy. Online services typically charge $50-$300 plus state fees. They also often include features like name availability checks, operating agreement templates, and compliance reminders. Licensed professionals or attorneys may charge significantly higher fees but can provide personalized guidance for more complex situations.

Do You Need a Lawyer to Convert to an LLC?

Hiring a lawyer isn't legally required to convert a sole proprietorship to an LLC. However, legal guidance can be valuable for complex situations. An attorney can also provide tax advice and help draft or optimize your operating agreement.

Consider hiring an attorney if you have complicated existing contracts, operate in regulated industries, need to transfer significant business assets, or plan to have more than one member. For straightforward conversions, the process is simple enough to handle without having to hire a lawyer.

FAQs

Can I convert my sole proprietorship to an LLC at any time?

Yes, you can convert a sole proprietorship to an LLC at any time. However, it's ideal when your business is growing, taking on more risk, or needs a formal structure for funding or contracts.

Will I need a new EIN after forming an LLC?

Yes, your newly formed LLC generally requires a new Employer Identification Number (EIN) from the IRS, even if your sole proprietorship already had an EIN. The LLC is a different business entity for tax purposes.

Do I need to notify my clients and vendors after forming an LLC?

Yes, you should inform all stakeholders about your business structure change. Update contracts, invoices, and payment information to reflect your LLC's name and new EIN. This ensures compliance and avoids confusion.

Where do I file my LLC articles of organization in the state of California?

You file with the California Secretary of State, and the process can be conveniently completed online through their website. The filing fee is $70, and processing typically takes 3–5 business days.

Is converting to an LLC expensive?

Costs vary by state but are generally affordable. Expect state filing fees ($50-$500), optional registered agent services ($100-$300 annually), and potentially professional filing service fees.

Can I continue using my sole proprietorship bank account?

No, you should open a new business bank account under your LLC name and EIN to maintain proper legal separation between personal and business finances. Using your old account could compromise your limited liability protection by blurring the distinction between personal and business activities.

Do I need to cancel my DBA if I convert to an LLC?

In most states, yes. If your sole proprietorship operated under a DBA ("Doing Business As") name, you'll typically need to cancel that registration to avoid confusion and potential compliance issues. Check with your state's secretary of state or equivalent agency for specific requirements in your jurisdiction.

Final Thoughts: Is Converting to an LLC Worth It?

Converting from a sole proprietorship to an LLC is one of the smartest decisions a small business owner can make. The liability protection alone often justifies the modest cost, especially as your business grows and faces increased risk.

LLCs also offer tax flexibility and growth opportunities that sole proprietorships can't provide, including S corp elections, partnership structures, and enhanced business credibility.

Evaluate your business's growth trajectory, risk exposure, and long-term goals to determine whether LLC conversion aligns with your vision. For most established businesses generating consistent income, the benefits far outweigh the conversion costs.

Ready to make the transition? InCorp can guide you through the entire process, helping you maximize the benefits while minimizing the hassle. We can also serve as your designated registered agent and provide additional services to support you throughout your business journey. Contact us today to get started.

Share This Article:

Stay in the know!

Join our newsletter for special offers.