Top 14 Mistakes To Avoid While Choosing a Formation Service

Many business owners think that filing their initial business paperwork is the hard part. However, for many entrepreneurs, the real problems often start after the forms are submitted. Choosing a formation service that isn't the right fit can quietly sow the seeds for compliance violations, costly delays, or legal entanglements you never saw coming.

It's easy to get lured in by the fastest or cheapest option, but speed and low cost won't matter if your company faces penalties down the line. The real difference between long-term success and unnecessary headaches often comes down to overlooked essentials, like dependable registered agent service, ongoing compliance reminders, and proper guidance when choosing the right business structure from the start.

These 14 common mistakes will show you exactly what to watch for when picking a provider, so you end up with a true partner in your business journey, not just a quick transaction that leaves you to fend for yourself.

Mistake 1: Skipping Due Diligence on Business Structures

Many formation services bundle business entity types like limited liability companies (LLCs) into standard packages, often steering clients toward forming an LLC without fully assessing their unique needs. But as the U.S. Small Business Administration (SBA) cautions, "Choose carefully. While you may convert to a different business structure in the future, there may be restrictions based on your location. This could also result in tax consequences and unintended dissolution, among other complications."

Skipping this due diligence can lead to unexpected tax obligations, compliance headaches, and missed opportunities to protect personal assets. While forming an LLC can generally protect personal assets from business liabilities, it's not always the best fit depending on your goals, funding needs, or tax strategy.

A reliable formation service will ensure you understand the differences between a sole proprietorship, partnership, LLC, C‑corp, and S‑corp, and will provide clear resources so you can evaluate which business structure best aligns with your long-term plans. The right choice will shape how your business assets and liabilities are handled, what taxes you owe, and the level of liability protection you receive.

A reputable provider won't just push cookie-cutter packages. Instead, they'll give you the knowledge to navigate your options so you can see how each structure will impact the future of your business. Choosing the right structure from the start can help you avoid costly conversions and legal challenges later.

Mistake 2: Focusing Solely on Price

Many business owners hunt for the cheapest option for business entity formation without considering the hidden costs. Low-cost providers often advertise "free LLC formation" but then surprise you with poor customer support, hidden charges or expensive upsells for essential services like registered agent service.

Beware of "free LLC service" packages that lure you in and then push additional services without clear, upfront pricing. While the initial filing might seem inexpensive, you could end up paying far more than you would with transparent, all‑inclusive options.

Quality formation services are upfront about every cost, including compliance reminders, annual report filings, and business document templates. The best providers keep pricing simple, either offering affordable standalone services or bundling essential features into easy‑to‑understand packages that help you save money in the long run.

Always read the fine print and make sure you know exactly what you're signing up for. Choosing value over the lowest advertised price can help you avoid hidden fees, protect your budget, and ensure your business stays compliant.

Mistake 3: Ignoring State-Specific Requirements

Each state has unique business formation rules, including licensing, varying state fees, registered agent requirements, and publication mandates. Overlooking these differences can lead to rejected filings and unexpected costs. It's important to verify that your formation service understands these state-specific requirements, especially if you operate in multiple states. Look for providers experienced in handling multi-state filings and ongoing compliance support to ensure your business stays in good standing, no matter where you operate.

Some entrepreneurs may choose to form their entity outside their home state to access certain business or tax advantages. As Stripe explains, "Each US state has its own set of benefits, regulations, and tax implications that can impact the operations and profitability of your LLC. From the business-friendly environments of Delaware and Wyoming to the tax advantages of Nevada, the state you incorporate in can affect your business's legal liability, financial health, and more." However, most business owners choose to register in their home state to simplify operations and reduce compliance burdens.

Mistake 4: Skipping Name & Trademark Checks

Your business name needs to be unique and legally available. Rushing this step can lead to costly rebranding, rejected filings, or even trademark infringement lawsuits. Many automated online LLC services perform only basic state‑level name searches, skipping federal trademark records and domain availability, both of which are essential to protect your brand. Choose a formation provider that offers a comprehensive business name search so you can avoid these risks and secure your business identity from the start.

Mistake 5: Overlooking Compliance & Licenses

Forming your LLC is just the starting line. Many business owners mistakenly think that filing the articles of organization completes all their legal obligations, but critical steps remain. These include obtaining your federal tax ID number or EIN (employer identification number), registering for state and federal income taxes, securing necessary business licenses and permits, and setting up proper record-keeping systems.

Missing these steps can delay opening business bank accounts and cause compliance issues. The best LLC formation services can provide comprehensive guidance through these requirements.

Mistake 6: Not Having Governance Documents

Operating agreements and corporate bylaws define how your business runs and set the rules for ownership, management, and decision-making. Many formation services treat these essential legal documents as costly add-ons instead of foundational tools. Without them, you could face ownership or profit-sharing disputes, problems bringing in partners, or delays opening business bank accounts, since many banks require an operating agreement.

The operating agreement gives you an opportunity to customize how your business will operate, instead of being bound by your state's default rules. As SCORE notes, "For decisions that require a vote by members, your operating agreement should identify if they need a majority or unanimous outcome. In many states, the default is for voting power in LLCs to be proportional to ownership percentage. If this suits your business, great! But if it doesn't, you can modify it so it makes sense for your situation."

These documents also help preserve limited liability protection by showing your company operates separately from personal affairs. Quality formation services like InCorp provide customizable templates and guidance when you sign up for business formation at no additional cost. Avoid providers that sell them as expensive add-ons.

Mistake 7: Underestimating Customer Support

Formation questions can arise at any time, and compliance deadlines don’t wait for a slow response. Many discount providers only offer email support with multi‑day response times, leaving you frustrated when you need answers quickly.

Quality entity formation services provide multiple support channels, including phone, email, and live chat, along with comprehensive online resources. The best providers deliver personalized customer support from dedicated business specialists who understand your company and its specific needs, rather than generic reps with limited knowledge or experience.

Your formation service should be consistently available during normal business hours. Before you sign up, check reviews and testimonials, and test their responsiveness to ensure you’ll receive timely, knowledgeable help. Working with a service that offers dedicated specialists can improve accuracy and give you peace of mind throughout the formation process.

Mistake 8: Neglecting Registered Agent Continuity

Your registered agent receives official legal documents on behalf of your business, so continuity is essential. Many formation services offer a low‑cost first year of registered agent service, only to surprise you later with steep price increases or discontinued coverage.

Gaps in registered agent service can cause compliance violations, missed legal deadlines, and even put your personal assets at risk if important notices go unreceived. A professional registered agent service should provide consistent, long‑term coverage with transparent pricing. Look for providers that offer multi‑year contracts and clear communication.

The best registered agent services include prompt document forwarding, compliance monitoring, and proactive alerts for upcoming deadlines. You might consider using a free registered agent service for the first year if it's included with your business formation, but make sure the provider is dependable for the long haul and fits your budget when the annual renewal fee begins. While it's possible to act as your own registered agent, it's rarely the best choice. Doing so can make your personal address public, limit your availability during business hours, and increase the risk of missing critical legal notices.

Mistake 9: Lack of Post-Formation Guidance

The corporate or LLC formation process is just the beginning of your compliance responsibilities. Annual reports, tax elections, and regulatory changes require ongoing attention, and missing deadlines can result in penalties or even the loss of your liability protection.

Quality business formation services provide ongoing relationship management. They should offer annual report filing, compliance reminders, and updates about regulatory changes that could affect your business structure. Look for providers that deliver comprehensive post‑formation support and additional business services you may need in the future, such as Articles of Amendment, foreign qualification, and trademark services.

Mistake 10: Not Considering Privacy & Transparency

One of the biggest mistakes you can make when forming your business is choosing a provider that doesn't respect your privacy. Your business information becomes part of the public record, but poor data handling or shady registered agent practices can create additional privacy risks.

Avoid services that use shell addresses for registered agent service, sell client information to third parties, or hide their own contact details and ownership structure. Legitimate formation providers maintain transparent contact information, clear data‑handling policies, and never compromise your business identity or ownership privacy.

Mistake 11: Choosing a Service Without Clear Refund or Cancellation Policies

Business plans can change, and sometimes the business formation process needs to be postponed or canceled. Many services bury cancellation terms in fine print or charge excessive fees for changes.

Before committing, carefully review refund and cancellation policies. Understand what happens if your business name is rejected or if delays require postponing your formation. Reputable business formation services typically offer transparent, reasonable refund policies for situations beyond your control.

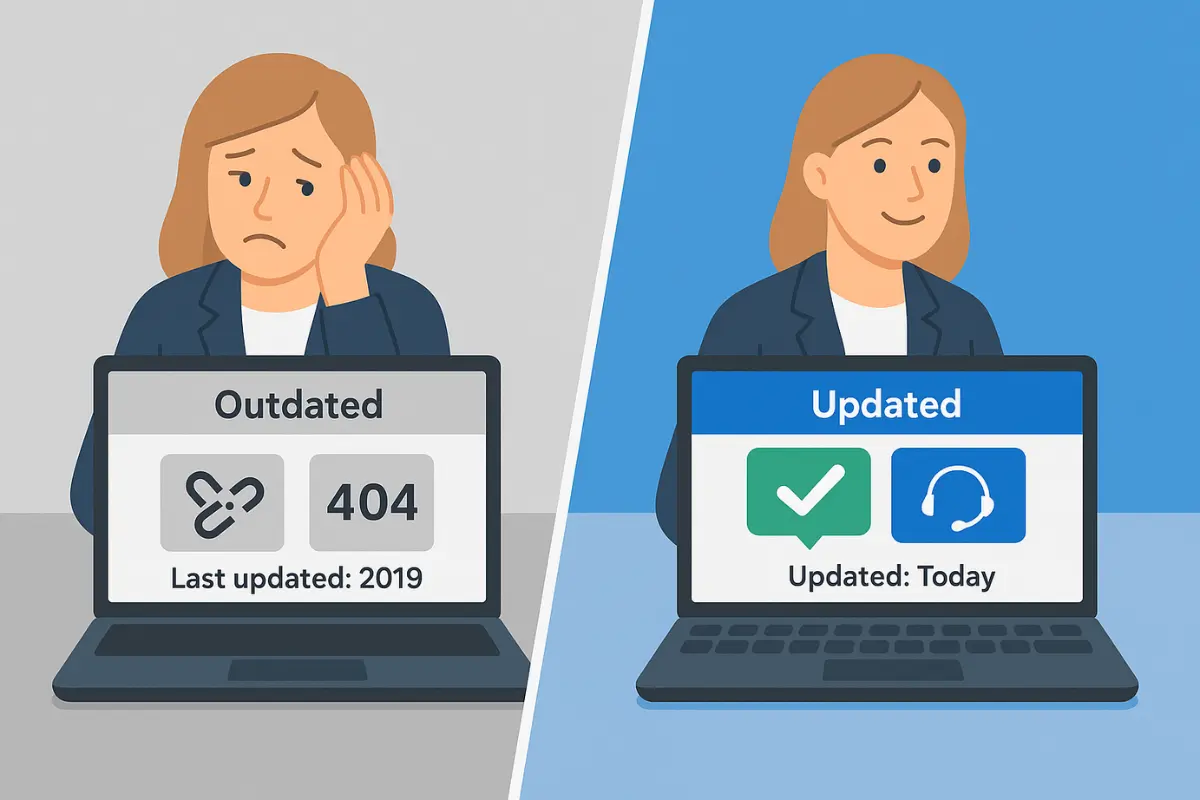

Mistake 12: Relying on Outdated or Inactive Services

The business formation landscape evolves constantly with new regulations and compliance requirements. Signs that a formation service may be outdated include inactive blogs, outdated pricing information, and stale or old customer reviews.

Active, professional business formation services regularly update their websites, maintain current resource libraries, and stay engaged with industry developments. They provide up-to-date information about state filing fees, processing times, and regulatory requirements. Before choosing a provider, check for recent blog posts, refreshed FAQ sections, and current customer testimonials to ensure the company remains active and reliable.

Mistake 13: Falling for "One-Size-Fits-All" Packages

Every small business is unique, but many online entity formation services offer generic packages that overlook industry-specific needs. Real estate investors require different protections than SaaS startups, and nonprofits have distinct requirements compared to manufacturing companies.

Quality formation services offer flexible packages tailored to different industries and business models. Look for providers who ask detailed questions about your business before recommending packages. The best business structure and services depend on your specific circumstances.

Mistake 14: Not Checking Integration With Other Tools

Modern small business operations rely on integrated software for accounting, banking, marketing, and legal services. Quality formation providers often offer integrations with popular tools like QuickBooks or partner with banks to help new business owners open business bank accounts.

Consider how your formation service fits into your broader business technology stack. Ideally, it should support your entire business ecosystem and help with ongoing needs such as accessing contract templates or offering professional service referrals.

Choosing a formation provider that helps maintain operational alignment with trusted business tools can save time and support growth beyond just forming your entity.

Ready to Launch Your Business the Right Way?

Starting your small business shouldn't feel like navigating a minefield. By avoiding these 14 common mistakes, you can protect your time, money, and peace of mind while setting up the essential services that support your business's growth.

Before making your final decision, use this simple checklist:

-

Does the formation service offer compliance support after formation?

-

Are registered agent services long-term and reliable?

-

Is the pricing transparent and easy to understand?

-

Can you get help from a real person when you need it?

Choosing the right formation service is an investment in your business journey. Professional providers who understand the formation process can save you from unnecessary regulatory violations, provide security, and help you avoid costly tax mistakes.

FAQs

Are business formation services only for new businesses?

No. Many formation services also assist existing businesses with services such as changing a business name, converting to a different structure, filing annual reports, or expanding into other states through foreign qualification. They can also help dissolve or reinstate a company, and often provide ongoing compliance support for established businesses needing structural changes or regulatory assistance.

Can I switch to another formation service after my business is already formed?

Yes, you can change service providers for your ongoing business needs, such as registered agent service, compliance reminders, and annual report filings. This won't affect your business registration; it just changes who manages those services. Many small business owners switch providers when they need more comprehensive support services. Top LLC services should provide a wide variety of business solutions to support your company's needs over time. Consider long-term support capabilities when choosing providers.

Do I still need a lawyer if I use a formation service?

Not always, but it depends on your situation. Formation services handle standard filings and provide legal forms, but they don't give legal advice. If you have a complex ownership structure, industry-specific regulations, or investor requirements, it's wise to consult a business attorney alongside the formation service.

What are some red flags to watch for in formation service providers?

Watch for vague pricing, no live customer support, aggressive upsells, lack of verified reviews, or poor BBB ratings. Other warning signs include requiring full payment upfront without a clear refund policy, failing to explain differences between business structures or tax payments, and omitting details on state filing fees. Be wary of services that promise "instant approvals" without explaining state processing timelines. When reviewing a provider's official website, compare it to what you would want on your own website. If basic company info, clear pricing, or contact details (phone and email) are missing, that's a red flag. Quality LLC service providers should be transparent and provide comprehensive, accessible information.

What is the best LLC formation service?

The best LLC service depends on your unique business needs. Different providers specialize and excel in different areas. For example, InCorp is known for strong customer support and affordable prices, Northwest Registered Agent for privacy and personalized service, and LegalZoom for its broad legal resources. Read customer reviews, compare prices and features, and speak with representatives before making your choice. A quality provider will help you avoid costly LLC mistakes and is a great investment for the long-term health of your business.

What are the most common business entity types?

Sole proprietorships – Easy to start, but offer no personal liability protection. Owners pay self‑employment taxes on all income. Partnerships – Two or more owners share profits, offer no personal liability protection, and pay self‑employment taxes on all income. LLCs – Offer personal liability protection, tax flexibility, and potential tax savings by avoiding double taxation, though members still pay self‑employment taxes. C corporations – Offer strong personal liability protection, but are subject to double taxation. S corporations – Offer personal liability protection and avoid double taxation by passing income through to shareholders; some earnings may still be subject to self‑employment taxes.

What is required to start an LLC?

To start an LLC, you typically need to choose a unique business name, designate a registered agent, file Articles of Organization with your state, pay the required filing fees, and obtain an Employer Identification Number (EIN) from the IRS. Some states may also require an operating agreement and business licenses.

Launch Your Business with InCorp

Do you want to launch your business with confidence? InCorp's dedicated customer service team offers personalized support, backed by in‑depth knowledge and experience, to help you get started quickly and efficiently. From business formation and registered agent services to trademark assistance and other essential solutions, we're committed to supporting your company over the long term as your needs evolve. Contact InCorp today to start the formation process and ensure your business is built for lasting success.

Share This Article:

Stay in the know!

Join our newsletter for special offers.