What Happens When a Business Closes?

The moment you realize your business isn't working can feel like watching a ship slowly sink. You've invested everything—time, money, dreams—and now you're facing the reality that it's time to close the doors. But here's what most business owners don't realize: how you close your business can either protect your future or create problems that follow you for years. The difference between a clean business closing and a messy one often comes down to understanding the legal, financial, and operational steps that must be completed properly.

AdvisorSmith notes that "approximately two-thirds of small business owners fail during their 10th year of operation—while 50 percent close after just five years of business." You're not alone in this journey, and with the right guidance, you can navigate this challenging business closing process while protecting your personal assets and financial future.

When a business closes, it's formally called "business dissolution" or "winding up operations." This involves much more than simply turning off the lights and walking away. Let's explore exactly what happens when a business closes and how to handle each step correctly.

Key Takeaways

-

Properly closing a business protects you from future legal and financial issues

-

Follow all legal, tax, and regulatory requirements to ensure a clean closure

-

Notify employees, creditors, and customers promptly and transparently

-

Settle outstanding debts and securely store important business records

-

Professional guidance can make the process smoother and safeguard your personal assets

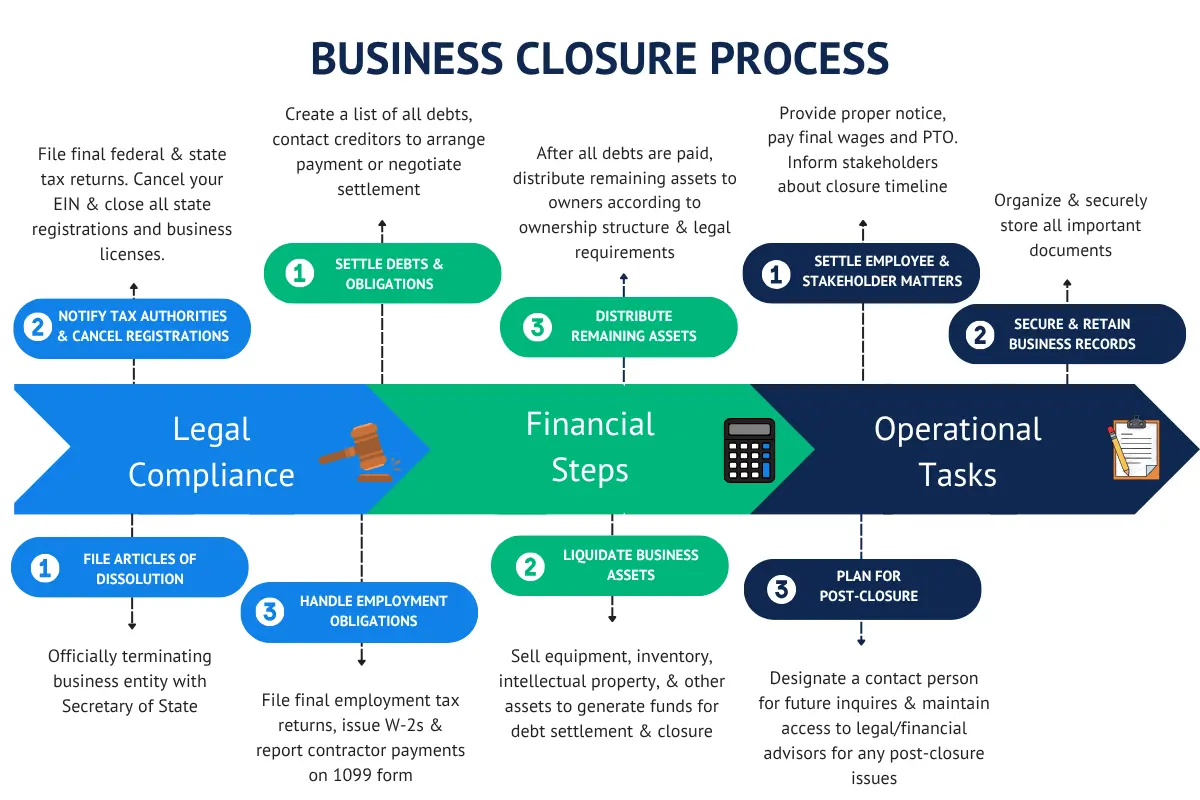

Legal Steps to Formally Close a Business

Properly closing a business starts with formal legal dissolution. This step is not optional—it's essential for protecting yourself from future legal or financial obligations and ensuring your business entity is officially and permanently terminated. Skipping this process can leave you exposed to unexpected liabilities long after your doors are closed.

File Articles of Dissolution

For corporations, limited liability companies, or any other formal business entities, filing Articles of Dissolution with your state's Secretary of State officially ends your company's legal existence. Think of this document as your business's death certificate—without it, your entity remains active in the eyes of the state, exposing you to ongoing fees, taxes, compliance requirements, and potential legal liabilities, even if you've stopped operating.

Filing Articles of Dissolution notifies the state and creditors that your business is closed, protecting you from future obligations. While sole proprietors don't need to file this document, they still must complete all tax and regulatory closure steps. Professional corporate dissolution services, like those offered by InCorp, can help ensure every piece of paperwork and all state requirements are handled correctly.

Notify Tax Authorities and Cancel Registrations

To officially close your business and avoid future problems with the IRS and state agencies, follow these steps:

File a final tax return: Use your usual business tax return for the year you close your business, and be sure to check the "final return" box on the form.

-

Sole proprietors: Schedule C with your individual tax return (Form 1040)

-

Single-member LLCs: Schedule C with your individual tax return (Form 1040)

-

Partnerships and multi-member LLCs: Form 1065 (partnership tax return)

-

C corporations: Form 1120 tax return (and Form 966 for dissolution)

-

S corporations: Form 1120-S tax return (and Form 966 for dissolution)

-

LLCs taxed as corporations: Form 1120 or 1120-S, as appropriate (and Form 966 for dissolution)

File any required additional forms: If you claimed a Section 179 deduction and closing your business means you use the property less than half the time for business, report this on Form 4797. Other forms may be required if you sell business property or assets.

Take care of employee obligations:

-

Pay final wages and compensation: Issue final paychecks, including any unused vacation or sick time, according to state laws

-

File final employment tax returns: Submit Forms 940 (Federal Unemployment), 941/944 (Quarterly/Annual Federal Tax Return), and any state employment tax forms

-

Deposit final federal tax deposits: Make all required federal tax deposits for withheld income, Social Security, and Medicare taxes

-

Provide Forms W-2: Give employees their final W-2s by the usual deadline

-

Report to state agencies: Notify state workforce and unemployment agencies as required

Report payments to contractors: If you paid any contractors $600 or more during the year, file Form 1099-NEC and send a copy to the IRS.

Cancel your Employer Identification Number (EIN): Send a letter to the IRS with your business name, EIN, address, and reason for closing. The IRS will close your EIN account after all final tax returns are filed and taxes are paid.

Notify state and local tax agencies: Close out all business licenses, permits, and sales tax accounts to officially end your tax obligations and avoid future fees or penalties.

Tip: Always check the "final return" box on your tax return and meet all tax filing due dates to avoid penalties. Keep your business and employment tax records for at least four years after closure.

Resolve Outstanding Debts and Financial Obligations

Before you can fully close your business, every outstanding debt and financial obligation must be addressed. Proper financial management is essential to avoid unnecessary risks during business closure. Many business owners make costly mistakes at this stage that can impact their personal finances for years after closure.

The SBA offers comprehensive resources on managing these closure obligations, emphasizing that proper handling of debts protects business owners from personal financial exposure. Failure to settle outstanding debts can result in legal action or even bankruptcy proceedings.

Settle Debts and Obligations

Outstanding debts don't disappear when you close your business. Creditors can still seek repayment for your business's financial obligations—including loans, payments to vendors, lease agreements, and other debt obligations. If your business cannot pay, creditors may pursue your business assets and, depending on your business structure, even your personal assets.

Start by making a comprehensive list of all financial obligations. Proactively contact each creditor to discuss debt repayment options. If your business assets don't cover everything, you may be able to negotiate a settlement agreement. In many cases, creditors will require regular payments of a certain amount as part of this agreement to satisfy outstanding debts.

For sole proprietors, this step is especially critical. Without a legal separation between business and personal assets, creditors can pursue personal assets to recover unpaid debts.

Liquidate Business Assets

Converting business assets into cash helps satisfy outstanding debts and provides funds for final expenses. This includes selling equipment, inventory, intellectual property, digital assets, and any other valuable property. In some cases, certain assets may be sold individually or transferred as part of debt settlements, and specific assets may serve as collateral for secured debts.

Be sure to document every asset sale carefully, as these transactions may have tax implications. Some business assets, including intellectual property and digital assets, may have depreciated value that affects your final return calculations.

Asset Distribution Process for Remaining Assets

Asset distribution must follow legal priorities—creditors get paid first, then owners receive what's left. After all debts are settled, any remaining assets can be distributed according to your business ownership structure. In a corporation, remaining assets may be distributed to shareholders in proportion to their stock ownership. For LLCs, assets are typically distributed to members based on their ownership percentages or as outlined in the operating agreement.

For corporations and LLCs, this process may require amendments to articles of incorporation or operating agreements to properly document the final asset distribution.

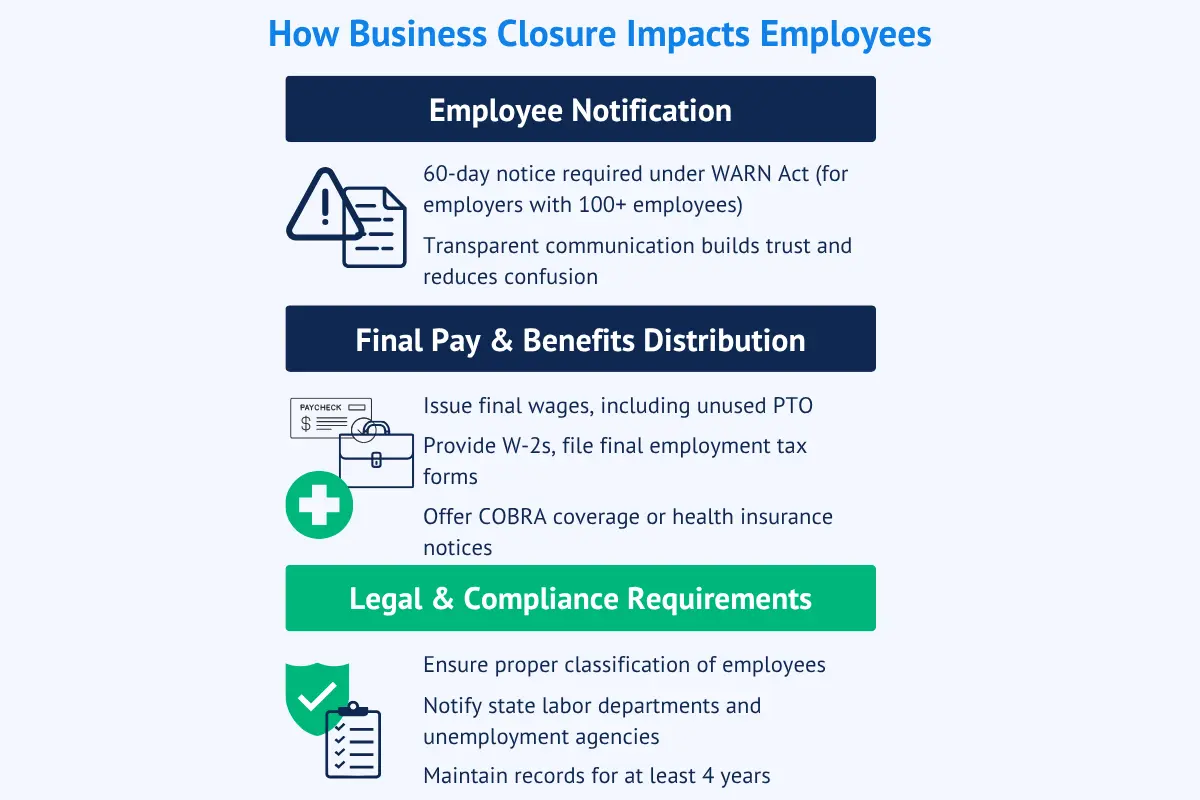

Impact on Employees and Benefits

Your responsibilities to employees don't end when the business closes. State laws require specific procedures for layoffs, payment of final wages, and continuation or termination of employee benefits.

Employee Rights and Final Pay

Employees must receive final wages promptly, including compensation owed for unused vacation time or sick leave, as required by state law. Most states require final paychecks within days of termination, though deadlines vary.

Large employers may need to comply with the WARN Act, which requires 60 days' advance notice for mass layoffs. Correct employee classification is crucial—refer to resources comparing 1099 vs. W2 classifications to ensure proper final payment handling.

Benefits and Retirement Plans

Health insurance typically ends with employment, but employees may be eligible for COBRA continuation coverage. You'll need to provide proper notifications about these options.

Retirement plans require special handling during business closing. Employees need information about rolling over their 401(k) accounts or accessing other retirement benefits, and plan administrators must be notified about the business termination. For more detailed information, refer to the IRS 401(k) Resource Guide.

Tax and Regulatory Compliance

Tax compliance during business closing is non-negotiable. Mistakes here can result in personal liability for business taxes, even after the entity is dissolved. Maintaining proper business records throughout this process is essential for meeting ongoing compliance requirements.

Final Tax Filings

Your final return must include all business income through the closure date. File any required payroll and sales tax returns and report employee wages on W-2 forms and contractor payments on 1099 forms. Different business types have different requirements—S corporations, C corporations, partnerships, and sole proprietorship structures each have specific final return obligations.

Be prepared to pay any additional tax owed or receive refunds for overpayments. Keep detailed tax records for at least four years after filing your final return.

For a detailed, step-by-step checklist of all required tax filings and account closures, see the "Notify Tax Authorities and Cancel Registrations" section above.

Cancel Business Numbers and Accounts

To fully close your business, you must deactivate your Employer Identification Number (EIN) with the IRS by mailing a letter that includes your business name, EIN, address, and reason for closure. Attach your EIN assignment notice if available. Make sure all final tax returns are filed and taxes paid before sending your request.

Also, close all state tax registrations and business tax accounts to avoid future notices or fees. Don't forget to shut down business bank accounts, credit lines, and any other financial accounts tied to your business entity.

Communication with Stakeholders

Professional communication during a business closing protects your reputation and helps ensure a smooth transition for employees, customers, vendors, and other key parties. Timely, transparent updates reduce confusion and maintain goodwill as you wind down operations.

Notify Customers and Clients

Inform customers and clients as early as possible about your closure plans, especially regarding pending orders, warranties, refunds, or ongoing service commitments. Use clear, professional communication—such as email announcements, website notices, and physical signage—to reach all affected parties.

Be transparent about final order deadlines, explain how outstanding issues will be handled, and provide contact information for questions. A courteous, reassuring tone helps maintain trust and protects your brand reputation.

Inform Creditors and Suppliers

Proactively notify creditors and suppliers about your business closure to set clear expectations and avoid misunderstandings. Send formal written notices—by email or mail—outlining the closure date, payment timelines, and procedures for settling outstanding balances or closing accounts.

Include direct contact information for follow-up and offer a reasonable window for final transactions. Clear, timely communication helps maintain professionalism and reduces the risk of disputes during the wind-down process.

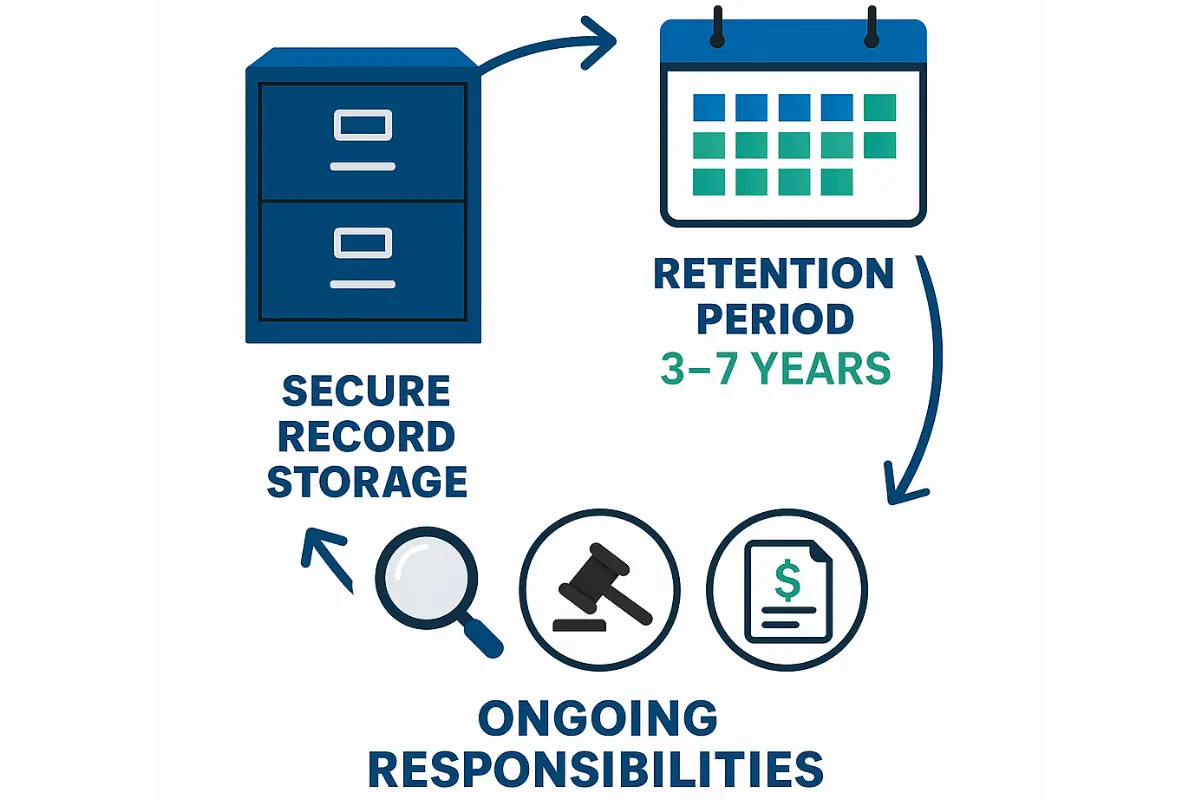

Record Keeping and Post-Closure Obligations

Closing your business doesn't end your responsibilities—secure recordkeeping is essential to protect yourself from future audits, legal claims, or tax inquiries.

Maintain Business Records

Retain key documents—including tax filings, employee records, contracts, and financial statements—for at least three to seven years or as required by law and local regulations. Store them securely, preferably in digital formats with reliable backups, and limit access to trusted individuals.

Address Any Post-Closure Issues

Be prepared for unexpected bills, tax inquiries, or legal claims that may arise after closure. Set up a process or designate a point of contact (such as yourself or a trusted advisor) to handle these matters, and maintain relationships with legal and financial professionals for support if needed.

Final Thoughts on Closing Your Business Successfully

Closing your business doesn't have to be a disaster. With careful consideration of your legal requirements, financial obligations, and responsibilities to your employees, you can wind up operations cleanly while protecting your personal assets and future opportunities.

You're not alone in this journey. According to Business Insider, "UBS analysts last year estimated US retail closures could reach 45,000 stores by 2029, led largely by smaller stores going out of business." Whether you're part of this trend or facing closure for other reasons, following proper procedures ensures you can move forward without lingering business complications.

While closing a business marks the end of one chapter, it can also open the door to new opportunities, fresh perspectives, and future success.

Key steps for a successful closure:

-

Review and fulfill all legal and regulatory requirements

-

Communicate transparently with employees, customers, creditors, and suppliers

-

Settle outstanding debts and financial obligations

-

Maintain and securely store important business records

-

Seek professional legal and financial advice as needed

-

Plan for any post-closure issues and designate a point of contact

By planning ahead and tying up all loose ends, you'll protect your reputation, minimize risk, and set yourself up for whatever comes next.

FAQs

What is the first step to take when closing my business?

The first step is to formally dissolve your business by filing Articles of Dissolution with your state and notifying relevant government agencies, including the IRS.

What is it called when a business closes?

When a business closes, it's formally called "business dissolution" or "winding up operations." This legal process officially ends the business entity's existence.

Do I need to notify my employees when closing the business?

Yes, you must notify your employees in advance and ensure they receive their final paychecks—including any unused vacation or sick leave—in compliance with local labor laws.

How do I handle business debts when closing?

Settle outstanding debts by liquidating business assets and negotiating with creditors if needed. Make sure all financial obligations are met before distributing any remaining assets.

Are there any taxes I need to pay when closing my business?

Yes, you must file final tax returns, including income and employment taxes, and cancel your business's tax registrations. Address any outstanding tax liabilities before closing.

Do I need to cancel my EIN if I close my business?

Yes, if you're completely shutting down and won't need the EIN for future business activities, you should cancel it with the IRS. However, in some cases, you may need to keep the EIN active.

Close Your Business the Right Way with Confidence

Don't let closing your business become a source of ongoing problems. Professional guidance ensures every step is completed correctly, protecting your personal assets and financial future.

InCorp's experienced team handles the complex legal requirements—from preparing and filing Articles of Dissolution to assisting with other essential steps to properly close your business entity. We help business owners navigate this process with confidence, making sure all loose ends are tied up.

Protect yourself from future liabilities. Contact InCorp today for a free consultation and expert guidance tailored to your specific closure needs.

Share This Article:

Stay in the know!

Join our newsletter for special offers.