Best Business Structure for Your Entrepreneurial Journey

What if there was one simple decision that could save you thousands in taxes every year AND protect your family's assets from business lawsuits? Most entrepreneurs never realize that the way they structure their business is quietly costing them money every single month while leaving their personal assets completely exposed. The solution isn't complicated, but it requires understanding the options available to you and knowing which one aligns with your specific situation. We're about to reveal exactly how to evaluate these choices so you can stop overpaying and start protecting what matters most.

Key Takeaways

-

Choosing the right business structure impacts everything from daily operations to long-term wealth building.

-

Business structure affects taxes, legal liabilities, and compliance requirements: The choice you make determines how much you pay in taxes, your personal responsibility for business debts, and the rules you must follow. This makes selecting the right structure crucial for your business’s success.

-

Start with your future in mind: Consider where you want your business to be in three to five years. The structure that works for a $50,000 side hustle might sabotage a $500,000 scaling operation.

-

Liability protection matters: Some structures expose your personal assets to business risks. Others create legal barriers that protect your family’s financial security.

-

Tax implications compound: We’re talking thousands of dollars annually that either stay in your pocket or disappear into tax payments.

-

Professional advice pays for itself: The cost of consulting with an attorney or tax professional is minimal compared to the consequences of choosing wrong.

Overview of Common Business Structures for Entrepreneurs

Think of business structures as different vehicles for your entrepreneurial journey. Some are like motorcycles—fast and efficient, but offer zero protection if you crash. Others are like armored vehicles—more complex to operate, but they’ll keep you safe when things get rough.

Quick Structure Comparison:

| Business Structure | Personal Liability | Tax Treatment | Complexity | Ideal For |

|---|---|---|---|---|

| Sole Proprietorship | Unlimited | Personal income tax | Very low | Solo ventures, low risk |

| Partnership | Unlimited (General), Limited (Limited Partners) | Pass-through | Low to moderate | Multi-owner businesses |

| LLC | Limited | Pass-through (flexible) | Moderate | Small to medium businesses seeking protection |

| S-Corporation | Limited | Pass-through | High | Small to medium businesses with U.S. citizen owners |

| C-Corporation | Limited | Corporate tax + Dividend tax | Very high | Scalable businesses seeking investment |

Other business structures, such as nonprofit corporations and benefit corporations, also exist and may be suitable for specific purposes depending on your goals.

Sole Proprietorship

A sole proprietorship is the default choice if you start earning money without formally registering any other business entity. While it offers complete control and maximum simplicity—no separate tax filing, no corporate formalities—it comes with serious drawbacks that most entrepreneurs underestimate.

The critical issue: the business owner is held personally liable for all business debts and obligations. Every business debt becomes your personal debt. Every lawsuit puts your house, car, and savings at risk. There’s no protection between your business activities and your family’s financial security.

Real-world example: Mike started a handyman business without formal structure. When shelving he installed collapsed and injured a client, his personal assets—including his family home—were exposed to the lawsuit.

While sole proprietorships might seem appealing for young entrepreneurs testing ideas, most serious business owners quickly outgrow this risky structure once they understand the liability exposure.

Partnership

Partnerships mean sharing workload, profits, and unfortunately, all the risks too. A general partnership is the default legal entity when two or more individuals conduct business together without formal registration, and all partners manage the business and share equal responsibility for debts and liabilities—meaning you’re personally liable for your partner’s business decisions. In a limited partnership, the general partner manages daily operations and holds unlimited liability, while limited partners have limited control over the business and enjoy liability protection as passive investors.

Both offer pass-through taxation, but the liability concerns remain significant.

Real-world example: Stephanie and James launched a marketing agency as general partners. When a client sued over a missed deadline, both general partners’ personal assets were equally exposed, regardless of which partner was responsible. In a limited liability partnership, individual partners are generally not liable for the actions or debts of other partners.

While partnerships can work for specific situations, most established businesses find the shared liability risk and potential for partner conflicts make LLCs a more secure choice for multi-owner operations.

Limited Liability Company (LLC)

An LLC is a hybrid business structure that combines features of partnerships and corporations, providing the game-changing protection most serious businesses need: limited liability. Your personal assets get legal protection from business debts and lawsuits. According to the U.S. Small Business Administration, “With a corporation or LLC, only the entity can be sued — not the owners or officers of the business” (SBA.gov).

What makes LLCs particularly attractive for established businesses is their tax flexibility—you can choose how the IRS treats your LLC as a sole proprietorship, partnership, S-Corporation, or C-Corporation. This means you can optimize your tax strategy as your business evolves without changing your underlying structure.

LLCs combine the liability protection of corporations with operational simplicity. No board meetings, shareholder resolutions, or complex governance requirements—just the protection and tax benefits most businesses need.

Real-world example: Lisa’s property management company as an LLC protected her significant personal assets when a tenant lawsuit targeted only business assets, while maintaining favorable tax treatment.

For most serious, established businesses, LLCs represent the ideal balance of protection, tax efficiency, and operational flexibility.

Corporation (C-Corp and S-Corp)

C-Corporations offer the strongest liability protection and unlimited growth potential. They can issue multiple stock classes and attract institutional investors easily, making them especially attractive to venture capitalists. However, they require regular board meetings, detailed record-keeping, and face “double taxation”—corporate taxes on profits at corporate tax rates plus personal taxes on dividends, which can significantly impact overall tax liability.

Real-world example: Horizon Software chose C-Corp status to attract venture capital, accepting higher complexity for investment access and the ability to issue multiple classes of stock.

S-Corporations aren’t a separate business entity—they’re a special tax election that LLCs and C-Corps can choose. This election is recognized by the federal government and most states for tax purposes. It allows profits and losses to pass through to owners’ personal income tax returns, avoiding corporate taxation. The biggest advantage is self-employment tax savings—owners pay themselves a reasonable salary (subject to payroll taxes) and take additional profits as distributions not subject to self-employment taxes.

Many LLCs elect S-Corp tax status to capture these tax benefits while maintaining LLC operational flexibility.

Real-world example: Sarah’s consulting LLC generates $200,000 annually. By electing S-Corp tax status, she saves approximately $12,240 in self-employment taxes annually.

C-Corp vs S-Corp Comparison:

| Feature | C-Corporation | S-Corporation Tax Election |

|---|---|---|

| Tax Treatment | Double taxation (subject to corporate tax rates) | Pass-through taxation (reported on owners personal income tax returns) |

| Number of Owners | Unlimited | Maximum 100 |

| Owner Requirements | Anyone can invest | U.S. citizens/residents only |

| Best For | Large businesses seeking investment, especially from venture capitalists | LLCs wanting tax savings |

Business Licenses and Registration

No matter which business structure you choose, obtaining the proper business licenses and completing registration requirements is a non-negotiable step for legally operating your company. The specific licenses and registrations you’ll need depend on your business activity, location, and structure, but skipping this process can expose you to fines, penalties, or even forced closure.

Sole proprietorships and partnerships often have fewer licensing and registration requirements, but that doesn’t mean you can skip them altogether. Even unincorporated businesses may need a local business license, sales tax permit, or professional certification, depending on your industry and state.

Limited liability companies and corporations face more formal requirements. These business entities must register with the state, file formation documents, and obtain any necessary federal, state, or local licenses and permits before conducting business. This process not only legitimizes your company but also helps protect your personal assets by establishing a clear separation between you and your business—an essential step in limiting personal liability.

It’s crucial to research the specific requirements for your state and industry, as regulations can vary widely. Some businesses, such as those in food service, healthcare, or construction, may require specialized permits or certifications. Keeping accurate records of all licenses and registrations is vital for maintaining compliance and avoiding legal issues down the road.

Navigating the licensing and registration process can be complex, especially for limited liability companies and corporations. Consulting with a business attorney or accountant can help ensure you meet all legal obligations and set your business up for long-term success.

Factors to Consider When Choosing a Business Structure

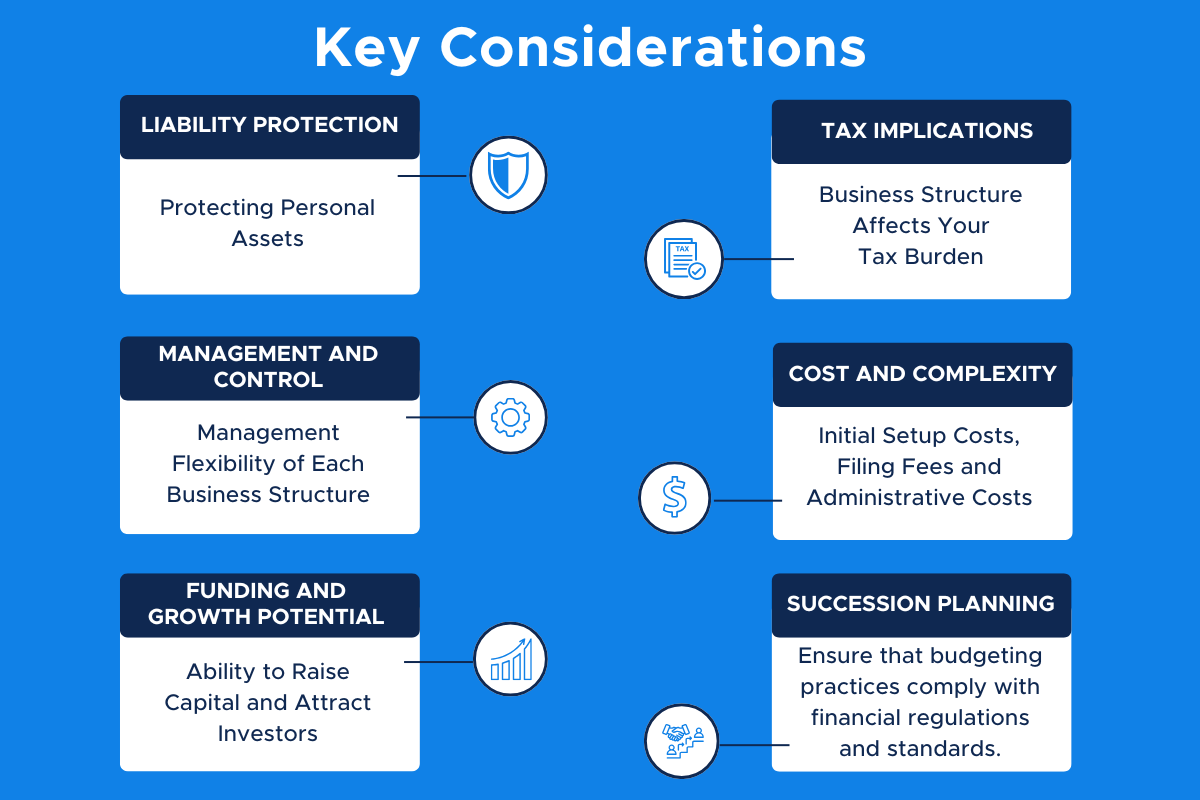

Liability Protection

Protecting personal assets is the top priority for most entrepreneurs. In sole proprietorships and general partnerships, you’re personally responsible for every business liability—client lawsuits, unpaid vendors, or the business's debts can directly impact both your personal and business assets, as there is no separation between them.

Limited liability entities (LLCs, corporations, and Limited Liability Partnerships) create a legal barrier between business and personal assets. These structures help shield your personal and business assets from business liabilities and the business's debts. LLPs are particularly common in professional services like law firms, providing liability protection while allowing professional licensing compliance.

According to business attorneys at Bellas & Wachowski, “The primary purpose of setting up an LLC is to protect the members and investors from personal liability from the claims of creditors of the business” (Bellas & Wachowski).

Tax Implications

Your business structure dramatically affects your tax burden. A pass through entity—such as a sole proprietorship, partnership, LLC, or S-Corp—allows owners to pay taxes on business income via their personal returns. Profits and losses from these entities are reported directly on the owners’ or partners personal tax returns, avoiding double taxation. However, partners in partnerships and LLCs may need to pay self employment taxes on their share of the profits. Limited partnerships also report profits and losses on the partners personal tax returns.

C-Corporations face double taxation but can sometimes result in lower overall rates for high-income businesses. S-Corp elections can save thousands annually by allowing owners to take income as distributions rather than salary.

As attorney Bob Zeglarski explains, “I recommend the LLC for most companies and clients simply because it has the best tax treatment” (TechInsurance, 2022).

For personalized guidance, consult the IRS website or a tax professional.

Management and Control

Sole proprietorships offer complete autonomy. Partnerships require coordination between partners. According to Thomson Reuters, "LLC owners can make their own business decisions, whereas corporations have boards of directors and shareholders who participate in business decisions" (Thomson Reuters, 2025).

Cost and Complexity

Sole proprietorships have no formation costs but sacrifice protection. LLCs require state filing fees ($50-$500) plus annual reports. Corporations have the highest costs with articles of incorporation, bylaws, and ongoing compliance requirements.

Funding and Growth Potential

Sole proprietorships rely on personal funds and business loans. LLCs can attract investors through membership interests. C-Corporations offer the greatest fundraising advantages with unlimited investors and multiple stock classes.

Succession Planning

Sole proprietorships die with the owner—when you retire, the business legally ceases. Partnerships face complications when partners leave. LLCs and corporations enable smooth transitions through ownership transfers that keep the business intact.

Business Operations

Business operations encompass the daily activities that keep your company running—everything from management and marketing to finance and customer service. The business structure you choose will shape how these operations are managed, who has decision-making authority, and how much personal liability you face.

Sole proprietorships and partnerships typically feature a straightforward management structure, with owners making decisions directly and enjoying complete control over business operations. However, this simplicity comes at the cost of personal liability, as owners are personally responsible for business debts and legal obligations.

Limited liability companies and corporations introduce more formal management structures. LLCs can be managed by members or appointed managers, offering flexibility while still providing personal liability protection. Corporations, on the other hand, are required to have a board of directors and officers, which can add complexity but also brings structure and accountability—especially important as your business grows.

Your business structure also affects your ability to raise capital. Corporations can issue stock to attract investors and fuel expansion, while LLCs can bring in new members. Pass-through entities like sole proprietorships and partnerships may find it more challenging to secure outside investment, relying instead on personal funds or loans.

Tax status is another operational consideration. Pass-through entities have different tax implications than C corporations, which pay corporate taxes and face stricter regulatory requirements. Corporations are also subject to more rigorous compliance standards, including annual reports and shareholder meetings.

Ultimately, the best business structure for your operations depends on your company’s size, growth ambitions, desired level of control, and appetite for regulatory compliance. Consulting with a business attorney or accountant can help you evaluate your options and choose a structure that supports your operational needs while providing the right balance of liability protection and flexibility.

When to Consider Each Type of Business Structure

Starting Small

While sole proprietorships and partnerships might seem appealing when testing a business concept due to their simplicity, they expose entrepreneurs to significant personal liability risks that often outweigh their convenience.

Many businesses, including affiliate marketing ventures, initially start as sole proprietorships but quickly transition to LLCs once owners understand the liability protection benefits and realize the formation costs are minimal compared to the security gained.

Even when starting small, most serious entrepreneurs find that forming an LLC from the beginning provides crucial asset protection without significantly increasing complexity or costs.

Growing or Scaling

LLCs become essential when you have consistent revenue, growing business assets, larger contracts, plans to hire employees, or need enhanced business credibility. The liability protection and tax flexibility make LLCs the preferred choice for most established businesses.

S-Corporation elections can provide additional tax benefits for profitable LLCs, offering the best of both worlds—LLC flexibility with potential tax savings.

Seeking Investment

C-Corporations become necessary when pursuing venture capital, offering equity compensation, considering an IPO, or building for rapid scaling and acquisition. However, many businesses can operate successfully as LLCs with S-Corp tax elections until they reach this investment stage.

Common Mistakes to Avoid When Choosing a Business Structure

Mistake #1: Ignoring Long-Term Business Goals

Many entrepreneurs choose structures based solely on immediate concerns like setup costs or simplicity. They pick sole proprietorships because they're free and easy, then face expensive transitions when they need liability protection or tax optimization.

Before choosing, map out your business plan for three to five years. Consider whether you'll bring in partners, need liability protection, plan for eventual sale, or require tax optimization strategies.

Mistake #2: Overlooking Legal and Tax Implications

Sole proprietors often don't realize they're personally liable until facing a lawsuit. LLC owners miss self-employment tax savings through S-Corp elections. Others choose S-Corp status without understanding administrative requirements.

Tax implications alone can mean thousands annually. A business generating $100,000 might pay $15,300 in self-employment taxes as a sole proprietorship, but only $7,650 with S-Corp structuring—a $7,650 annual difference.

Mistake #3: Choosing Without Professional Guidance

The most expensive mistake is navigating complex requirements without professional help. Online articles can't replace personalized guidance from attorneys and tax professionals who understand your specific situation.

Professional consultation costs a few hundred to a few thousand dollars—minimal compared to choosing wrongly. A qualified professional helps you understand legal implications, optimize tax strategy, ensure compliance, and plan for future transitions.

Take the Next Step: Choose the Right Business Structure for Your Success!

You now understand the landscape of business structures and how each one impacts your taxes, liability, and growth potential. The question isn't which structure is "best"—it's which structure is best for your specific situation and goals.

Here's your action plan:

Evaluate your needs - Review each structure against your current situation, risk tolerance, and three-to-five-year growth plans. Consider both where you are today and where you want to be.

Gather essential information - Choose your business name, determine your ownership structure, and identify your registered agent requirements for your state.

Get professional guidance - Consult with a business attorney and tax professional who can provide personalized advice based on your specific circumstances, industry, and location.

Complete the formation process - File the necessary documents with your state, obtain your Employer Identification Number (EIN), and secure any required business licenses and permits.

The structure you choose today becomes the foundation for everything you build tomorrow. Take the time to choose wisely, and you'll save thousands in taxes while protecting your family's financial security for years to come.

FAQs

Can I change my business structure later if my needs evolve?

Yes, business structures can be changed as your needs evolve, and many entrepreneurs do exactly that. You might start as a sole proprietor to test your concept, transition to an LLC for liability protection, and eventually elect S-Corp status for tax savings or convert to a C-Corp for investment funding. However, structural changes involve administrative complexity including re-registering with your state, updating tax information, revising contracts, and potentially restructuring ownership arrangements. These transitions also have tax implications and costs that should be considered carefully. The key is working with professional guidance to ensure transitions are handled properly and timing aligns with your business goals. While changes are possible, starting with the right structure saves time and money in the long run.

Do different industries favor different business structures?

Absolutely. Industry norms often reflect the unique risks, funding requirements, and operational needs of different business types. Tech startups typically choose C-Corps because they need to attract venture capital and offer stock options to employees. Professional services like law firms often use Limited Liability Partnerships (LLPs) that provide liability protection while allowing professional licensing compliance. Freelance services, consulting, and small retail operations frequently operate as sole proprietorships or LLCs due to their simplicity and adequate protection for lower-risk activities. Real estate investors often prefer LLCs for liability protection and tax flexibility, while businesses planning rapid scaling or eventual public offerings lean toward C-Corp structures. Research common practices in your industry, but remember that your specific situation and goals matter more than industry trends.

How does a business structure affect branding or public perception?

Your business structure can significantly influence how clients, vendors, and partners perceive your operation. Including "LLC" or "Inc." in your business name often enhances credibility and suggests a more established, professional operation. Many clients prefer working with incorporated businesses because it indicates stability and proper business practices. Some structures also signal specific intentions. C-Corporations suggest growth ambitions and investment readiness, while benefit corporations demonstrate commitment to social and environmental responsibility alongside profit-making. However, your business structure shouldn't be chosen primarily for perception. Focus on the legal, tax, and operational benefits that align with your goals, and let enhanced credibility be a welcome bonus.

Can I operate without a formal structure at all?

Technically yes, but you're automatically operating as a sole proprietorship by default if you earn business income without registering a formal entity. This approach offers maximum simplicity—no registration fees, no separate tax filings, and minimal administrative requirements. You report business income and expenses directly on your personal tax return. However, operating without formal structure means accepting unlimited personal liability for all business debts and obligations. Your personal assets including your home, savings, and other property remain completely exposed to business risks. For many entrepreneurs, the simplicity isn't worth the risk exposure, especially as the business grows and generates significant income or assets.

What happens if I choose the wrong structure?

Choosing the wrong structure typically isn't catastrophic, but it can create significant inefficiencies and missed opportunities. Common consequences include paying unnecessary taxes, facing unexpected liability exposure, difficulty raising capital, or hitting roadblocks during scaling. You might also face administrative complexity that doesn't match your business needs or miss out on tax savings available through other structures. For example, remaining a sole proprietor when you could save thousands through S-Corp election, or choosing S-Corp status when your income doesn't justify the administrative burden. The good news is that most structural problems can be corrected through transitions to more appropriate entities. However, these changes involve time, money, and complexity that could be avoided with better initial planning. Regular reviews of your business structure—especially after major milestones or changes in income—help ensure your foundation continues supporting your goals.

Get Personalized Guidance for Your Business Structure

Choosing the right business structure is too important to leave to chance. InCorp's experienced professionals handle the complex legal requirements and paperwork, so you can focus on building your business with confidence.

Our comprehensive services include business formation, registered agent services, and ongoing compliance support to keep your business in good standing. Don't let uncertainty about business structures delay your success.

Contact InCorp today to get expert guidance tailored to your specific situation and start protecting your assets while optimizing your taxes.

Share This Article:

Stay in the know!

Join our newsletter for special offers.