What Happens If You Don't Have a Registered Agent? A Legal & Operational Guide

Think your business is safe just because you filed the right paperwork? Think again. Missing a single, easily-overlooked requirement could slam your company with crippling fines, unexpected legal battles, or even force the state to shut your doors for good. Most business owners don't realize how one small misstep can put everything at risk. The reality is that formation documents are just the beginning—they don't guarantee full legal protection or ongoing compliance.

Without a registered agent properly fulfilling their role, your business is left vulnerable—important legal notices and government correspondence can slip through the cracks, and you may miss critical deadlines or even court summons. This oversight can lead to penalties, default judgments, or administrative dissolution, putting your company's future in jeopardy. In this guide, we'll break down exactly what can go wrong when registered agent requirements are ignored—and show you how to safeguard your business from these avoidable risks.

Key Takeaways

- Every state requires a registered agent for LLCs and corporations to maintain legal compliance and good standing

- Operating without one triggers serious consequences, including fines, default judgments, and potential business dissolution

- Missing legal documents can be devastating - you could lose lawsuits you never knew existed due to improper service

- Professional services cost $100-$300 annually - minimal compared to thousands in fines and legal fees from non-compliance

- Take immediate action if your business lacks proper registered agent coverage to avoid escalating risks

Understanding the Role of a Registered Agent

Think of a registered agent as your business's official point of contact for all government correspondence, legal notices and official documents. This person or entity receives service of process (the formal delivery of legal documents such as lawsuits or subpoenas) on your behalf during standard business hours, as well as other critical official mail from the state.

A registered agent's role is crucial to your business's legal standing. When a process server arrives to deliver service of process, your registered agent is authorized to receive service. They also ensure you never miss compliance deadlines, tax notifications, or other government correspondence—helping keep your business in good standing.

The registered agent also maintains your business's official address on file with the state, known as the registered office or agent's address, which becomes part of the public record. This ensures consistent communication channels remain open. When the state needs to contact your business about regulatory matters, compliance issues, or legal requirements, they communicate through your registered agent at this official point of contact.

The registered agent may also be called a resident agent, statutory agent, or agent for service. Many small businesses choose commercial registered agent services (third-party companies specializing in this role) due to privacy concerns, to streamline operations and to simplify compliance.

This registered agent requirement exists because there needs to be a reliable way to serve legal documents and communicate with businesses. What makes this registered agent role particularly crucial is the time-sensitive nature of many documents. These may include important documents such as annual reports and legal notices. The registered agent acts as the entity appointed to receive legal documents on the business's behalf, ensuring the business is properly served. This is part of due process and allows business owners a chance to respond to legal notices.

As JacksonWhite Law notes, "Many new business owners gloss over this seemingly minor appointment, often defaulting to themself or their spouse without much thought. Unfortunately, this can lead to challenges down the road that may jeopardize your business."

Is a Registered Agent Legally Required in Every State?

Yes, all 50 states mandate that formal business entities, such as a limited liability company or corporation, maintain a registered agent to operate legally within their jurisdiction. All states require a registered agent as part of their state statutes to conduct business legally. This isn't optional—it's a fundamental legal requirement for maintaining your business entity's existence and good standing. As the Texas Secretary of State confirms, "A domestic or foreign filing entity is required to continuously maintain a registered agent and registered office in Texas."

The registered agent must maintain a physical address (not a P.O. box) within the state where your business is registered and be available at that address during normal business hours to receive documents. This ensures that legal papers and government communications can be properly delivered when needed. If your business operates in multiple states or multiple locations, you must have a registered agent in each state; a national registered agent service can help manage this requirement.

While the core registered agent requirements remain consistent across all states, specific rules and procedures can vary. The office responsible for processing registered agent forms is often called the business entity filing office or simply the filing office. In most states, this office is part of the Secretary of State, but some states may use a different government department or title for this function.

Most states allow business owners to serve as their own registered agents if they meet certain criteria, including maintaining a physical address in the state and being available during business hours. However, this approach carries significant risks that many business owners underestimate, including privacy exposure and missed documents.

Different states also have varying procedures for appointing or changing registered agents, different filing requirements, and different penalties for non-compliance. For detailed information about registered agent requirements by state, business owners should research their specific state's regulations.

Even inactive LLCs must maintain a registered agent. Simply because your business isn't actively operating doesn't exempt you from state requirements. Inactive businesses still receive government notices, annual report requirements, and potential legal documents that require proper service through a registered agent.

The Bottom Line: No matter what state you live in, if you have or plan to have a legally recognized formal business entity, you will need a registered agent to conduct business in compliance with state statutes.

Legal Consequences of Not Having a Registered Agent

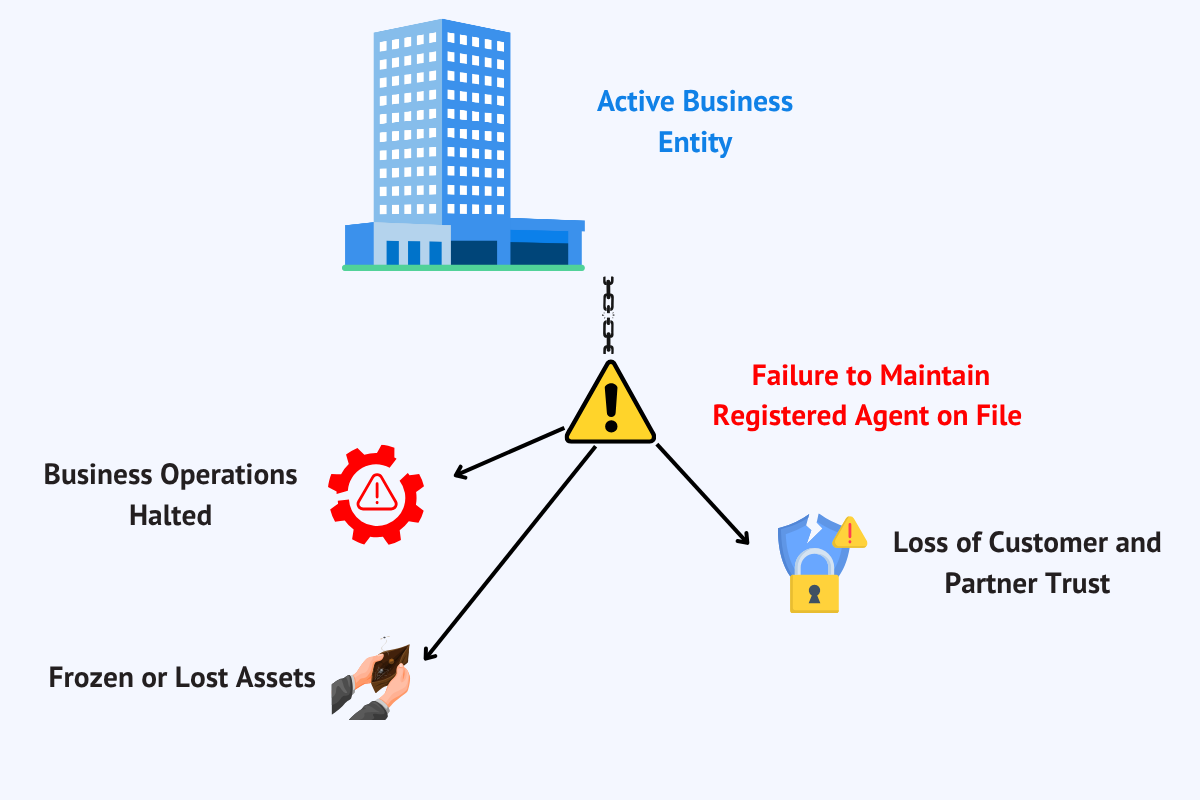

Operating without registered agent services violates fundamental state law requirements and triggers a cascade of serious legal consequences that can threaten your business's very existence. States don't treat this as a minor oversight. They consider it a critical compliance failure that undermines the legal framework supporting business operations. Without someone providing registered agent services to reliably receive legal notices on your business's behalf, you are officially out of compliance with state requirements.

Penalties and Fines

States impose substantial financial penalties on businesses operating without registered agents, and these fines can accumulate quickly. Penalty amounts vary by state, typically ranging from $50 to $500 or more, and in some cases, states may impose monthly penalties that compound over time.

These penalties and fines can accumulate rapidly, creating significant financial burdens for businesses that fail to maintain compliance. Beyond direct fines, businesses face additional costs when they attempt to reinstate good standing after operating without a registered agent. Reinstatement fees often exceed the original penalties and require businesses to pay all accumulated fines before resuming normal operations.

Legal Liabilities and Default Judgment Risks

Perhaps the most devastating consequence of operating without a registered agent is the risk of default judgments in legal proceedings. If your business cannot accept service of legal documents because you lack a registered agent, you may never learn about a lawsuit until it's too late. Courts can allow alternative service methods that may not reach you in time, increasing the likelihood of losing the case by default and facing severe financial and legal consequences.

This creates a scenario where you might face a lawsuit without knowing it exists. If you fail to respond to legal papers you never received, courts can issue default judgments against your business. These judgments assume you've admitted guilt or liability, potentially resulting in substantial financial awards against your company.

Default judgments can be extremely difficult and expensive to overturn, even when you can prove you never received the original documents. You won't be able to respond to a lawsuit or defend your business in court—simply because you never received the documents in the first place. The Colorado Secretary of State warns that "If your entity is sued and there is no registered agent to receive the summons, the plaintiff can serve your entity in another way — one that may not result in your entity responding to the summons in time. The plaintiff can then proceed with the lawsuit — without your entity. A default judgment can be entered against your entity even if the lawsuit was frivolous, and you could easily have won the case."

Unable to Register Your LLC

States require registered agent information as part of the initial LLC formation process. To legally establish your entity, you must complete the required form—the Articles of Organization—which requires you to appoint a registered agent before your registration will be accepted. This ensures every business has a reliable point of contact for legal and official documents, preventing companies from operating in legal gray areas without proper state recognition.

Many entrepreneurs, upon discovering this requirement, choose to act as their own registered agent. However, it's important to understand the risks of serving as your own registered agent, including privacy exposure and the possibility of missing critical documents.

Loss of Good Standing

Operating without a registered agent automatically places your business at risk of losing good standing with the state. Good standing represents your business's compliance with all state requirements and its legal authorization to operate within the jurisdiction.

Loss of good standing triggers serious consequences that extend far beyond regulatory penalties. Banks may freeze business accounts or refuse to process transactions for companies not in good standing. Businesses lose their ability to enter into contracts, apply for loans, pursue grants, or engage in normal commercial activities.

Dissolution

The ultimate consequence of operating without a registered agent is administrative dissolution by the state. When businesses fail to maintain basic compliance requirements, including registered agent services, states can dissolve the business entity and terminate its legal existence.

Administrative dissolution effectively ends your business's legal recognition and protection. Your LLC or corporation ceases to exist in the eyes of the law, eliminating liability protection and potentially exposing owners to personal liability for business debts and obligations.

How Missing a Registered Agent Affects Business Operations

Beyond legal consequences, operating without a registered agent can create significant operational disruptions that may paralyze normal business activities. When your business fails to receive critical communications, time-sensitive materials, annual reports, and other important documents, you risk missing deadlines and falling out of compliance. Over time, these issues often compound, creating administrative chaos that diverts valuable resources from productive business operations.

Impact on Business Compliance

Business Compliance requires consistent attention to deadlines, regulatory changes, and administrative requirements. Without a registered agent, businesses lose their primary communication channel for receiving compliance-related information. A registered agent helps your business stay compliant by managing annual reports and other regulatory filings, ensuring you meet all state requirements.

Missing annual report deadlines, tax notifications, or regulatory updates can trigger penalties that go far beyond simple late fees. These compliance failures often create cascading effects, disrupting multiple aspects of business operations—from banking relationships to contract negotiations and even jeopardizing your ability to renew business licenses.

Compliance failures also undermine your business's ability to make strategic decisions. When you're unaware of regulatory changes or new requirements, you cannot adapt your business practices accordingly, potentially leading to ongoing violations that accumulate over time. Understanding and avoiding new business financial mistakes becomes crucial for maintaining operational stability.

Privacy Risks and Public Disclosure

Business owners who try to avoid registered agent requirements often encounter significant privacy risks. Without proper registered agent services, businesses may be forced to use a home address for official business communications. This practice exposes personal info to public records, making sensitive details available on the public record and potentially attracting unwanted attention.

By contrast, using professional registered agent services allows your business to list a business address instead of a personal address. These registered agent services use their business addresses for all official correspondence, ensuring important documents reach you promptly while keeping your personal information private. This approach not only protects your privacy but also keeps your business in full compliance with state requirements.

How to Avoid These Consequences: What You Should Do Next

Protecting your business from registered agent-related consequences requires immediate action and ongoing attention to compliance requirements. Here's your action plan:

- Evaluate your current situation: Review your business records to confirm you have a registered agent in place and that their information is up to date with the state

- Choose between self-service or professional service: Decide whether to serve as your own registered agent or hire a professional service, considering the risks and benefits of each approach

- Update your business records: File any necessary paperwork with the state to appoint or change your registered agent, ensuring all information is accurate

- Establish ongoing compliance procedures: Create systems to keep your registered agent information current and to ensure you promptly receive and respond to all official communications

The key is to take action quickly, especially if your business currently lacks proper registered agent coverage. Every day without proper registered agent service increases your risk exposure and the potential for serious consequences.

Final Thoughts: Protecting Your Business with a Registered Agent

Operating without a registered agent isn't just a compliance oversight—it's a critical vulnerability that exposes your business to legal, financial, and operational risks that can destroy everything you've built. The consequences range from substantial fines and default judgments to complete business dissolution, making registered agent services one of the most important investments in your business's legal foundation.

According to the National Business Association, over 60% of small businesses operating in the US use commercial registered agent services for efficient and timely handling of their legal documents.

Professional registered agent services typically cost $100 to $300 annually, a minimal investment compared to the thousands in fines, legal fees, and operational disruptions that result from non-compliance. Your business deserves protection from preventable legal and administrative disasters.

FAQs

What are the risks if I don't have a registered agent?

The risks include missing important legal documents like lawsuits or government notices, which can lead to fines, default judgments, and loss of good standing with the state. You also face potential business dissolution and inability to maintain legal operations.

How much does it cost to hire a registered agent?

Registered agent services typically cost between $100 to $300 per year, depending on the provider and any additional services offered. This minimal cost provides significant protection against much larger penalties and legal consequences.

What happens if I miss the deadline to appoint a registered agent?

Missing the deadline to appoint or maintain a registered agent may result in your business losing good standing with the state, leading to fines, penalties, and the inability to file necessary business documents. Some states begin imposing monthly penalties immediately.

Can I change my registered agent after my business is formed?

Yes, businesses can change their registered agent by filing the appropriate paperwork with the state. It's essential to update your registered agent information promptly to ensure continued compliance and avoid legal issues during the transition period.

Get Reliable Registered Agent Protection

Don't let registered agent requirements become the vulnerability that destroys your business. InCorp provides professional registered agent services that keep your business compliant, protect your privacy, and ensure you never miss critical legal notices or government communications.

Our registered agent services eliminate the risks of operating without proper coverage while providing the peace of mind that comes from knowing your business maintains full legal compliance. We handle all official communications professionally and ensure you receive timely notification of any documents requiring your attention.

Take action now to protect your business from costly penalties, legal risks, and administrative dissolution. Contact InCorp today to secure reliable registered agent protection and maintain the legal foundation your business needs to thrive.

Share This Article:

Stay in the know!

Join our newsletter for special offers.