How to Cancel a Business License Legally: A Complete Guide

Understanding how to cancel a business license might seem straightforward—until you realize each jurisdiction has its own specific requirements and procedures. The process may also differ depending on the kind of business license obtained. A business license is your local or state government’s permission to operate within their jurisdiction, and properly canceling it requires formal notification through the right channels to avoid continued renewal fees and administrative penalties.

It’s important to understand that canceling a business license—terminating your local or state operating permits—is different from closing your entire business or dissolving your LLC or corporation with the state. This guide focuses on the license cancellation process specifically, though these steps often occur alongside other closure activities.

Key Takeaways

-

Canceling a business license requires formal notification to each issuing agency—this is separate from closing your entire entity or dissolving an LLC or corporation.

-

Procedures differ by jurisdiction and license type; always check the specific requirements for local, state, and federal agencies.

-

Common reasons to cancel include closing the business, restructuring, relocating, or regulatory changes.

-

The typical steps are: file the correct forms, settle debts and taxes, notify tax agencies, and keep all cancellation proof for your records.

-

Failing to properly cancel can lead to ongoing fees, penalties, or liabilities—maintain good records and follow all deadlines.

Understanding Business License Cancellation

Canceling a business license means formally terminating your government-issued permission to operate in a specific jurisdiction. This differs from suspension (a temporary pause that keeps your license reserved) and expiration (an automatic end when you don’t renew). When you cancel a license, you’re officially notifying the issuing authority that you’re ending your business activities in their jurisdiction. For businesses that need to completely dissolve a business entity, license cancellation is typically one step in that larger process.

The requirements for cancellation cascade across multiple levels. Your city or county may have specific procedures for local business licenses, while state agencies handle professional or industry-specific licenses. Federal requirements, while not technically “licenses,” may involve closing tax accounts with the IRS. Each level requires separate notification and has its own procedures. Be sure to review all related licenses and follow the official instructions provided by each agency.

Common Reasons for Canceling a Business License

Business owners may need to cancel licenses in various situations, and understanding your specific reason helps determine which procedures apply to your situation.

Closing a Business

When shutting down operations entirely, formally canceling your business license is a critical step that signals to government agencies you’re no longer operating. This helps avoid ongoing tax obligations and compliance issues. As part of the closure process, business owners may need to liquidate assets to settle debts and distribute proceeds to creditors and shareholders. Without proper cancellation, you may continue receiving renewal notices and could face penalties for non-compliance. Failure to cancel licenses and permits can result in liability for state or local fees and reporting requirements. The IRS provides guidance on closing a business, including the importance of notifying all relevant agencies about your closure.

Changing Business Structure

Restructuring your business—such as converting from a sole proprietorship to an LLC, or from an LLC to a corporation—typically requires new licenses under the new entity structure. The old licenses issued to your previous business structure become invalid and must be canceled to avoid confusion and duplicate registrations. If your business is a corporation, you may also need to address stock as part of the restructuring and license cancellation process. If you’re also planning to change your business name during the restructuring, this will require additional updates to your licenses. States and municipalities often have different requirements for how to handle licenses during restructuring, so checking with each issuing agency is essential.

Relocation to Another State

Moving your business operations to a new state means ending your business activities in the old jurisdiction. You’ll need to cancel your current licenses and apply for new ones in your new location. Many local governments require written proof of closure—such as a license cancellation confirmation or withdrawal certificate—to confirm you’ve ended operations in their jurisdiction and avoid ongoing obligations. This may involve sending formal notifications or documents to the relevant authorities to officially dissolve or abandon your business registration.

Regulatory or Industry Changes

New laws, compliance updates, or shifts in your industry focus may require different types of licenses. For example, changing from retail to wholesale operations, adjusting to new health and safety regulations, or shifting into a more regulated service area often means your current licenses no longer apply. Industries with strict oversight—like healthcare, finance, or food services—frequently see these changes as regulations evolve.

Step-by-Step Process to Cancel a Business License

Following a structured approach helps navigate the complexities of license cancellation and ensures you meet all requirements and avoid future complications from improper cancellation.

Review Local and State Requirements

Start by identifying every agency that issued you a license or permit. This typically includes your city clerk's office for local business licenses, county government for county-level permits, state secretary of state for entity registrations, and professional licensing boards for industry-specific credentials. Each agency has its own cancellation procedures, so check their official websites or contact them directly. Procedures and form names for cancellation vary significantly by state, so consult your state’s Secretary of State and Department of Revenue websites. State business portals often provide comprehensive guides for their specific requirements.

File the Necessary Paperwork

Formal cancellation requires submitting specific forms to each licensing agency. It is essential to ensure you are completing all required forms for each agency to properly cancel your license. Common requirements include a business license cancellation application, final information update forms, and sometimes proof of tax clearance. You’ll typically file these through online portals, mail, or in-person submission, depending on the agency. For entities like LLCs and corporations, you may also need to file separate dissolution documents with your state—for example, the Pennsylvania Department of State provides specific dissolution documents for entities registered there. Gather all necessary documents, such as the original trade license and clearance certificates, to cancel your business license.

Notify Tax Agencies

This step is critical to avoid ongoing tax obligations. You must inform both state and federal tax agencies about your license cancellation. This includes filing final returns for income tax, payroll tax, and sales tax, closing all business tax accounts, and obtaining tax clearance certificates where required. You must also report final employment taxes and make final federal tax deposits. To cancel your EIN and close your IRS business account, you must send a letter to the IRS. While an Employer Identification Number (EIN) cannot be “canceled,” the IRS will note it as inactive once you file your final returns marked as “final.” You may close various accounts such as sales tax and withholding tax accounts during closure.

Be sure to close every relevant tax account and contact the state tax department to finalize all tax obligations. Ensure that every required payment and all outstanding payments to tax agencies and contractors are made and properly documented. Accurately report all income employees receive, including final wages and compensation. If your business held a seller's permit, cancel it to prevent ongoing liabilities and potential misuse. Address any exchange of like-kind property as required by IRS procedures to complete your tax reporting responsibilities.

Settle Outstanding Obligations

Before cancellation can be processed, resolve all debts and obligations. This means paying vendor invoices, fulfilling customer orders, distributing final wages to employees, and settling any outstanding licensing fees. If you have employees, you must pay any final wages owed to them. Additionally, you must provide a Form W-2 to each employee for the calendar year of their final wages. Unresolved obligations can delay or prevent license cancellation and may result in legal challenges from creditors. When settling outstanding obligations, be sure to account for all property, including tangible assets like real estate and intangible assets such as intellectual property. To cancel a business license, close all financial obligations and pay outstanding taxes and fees.

Submit Proof of Dissolution (if applicable)

For corporations and LLCs that are also dissolving their entity (not just canceling licenses), you'll need to submit Articles of Dissolution or similar documents to your state. Once approved, this serves as legal proof that your entity no longer exists. You must file Form 966 if you adopt a resolution to dissolve the corporation. Failure to properly dissolve a business can result in continued liability for annual report fees and penalties. Some local agencies may request this dissolution proof before processing license cancellations, though not all jurisdictions require it. If you need to dissolve a business legally, this documentation becomes essential for complete closure. Sole proprietors typically do not need to file dissolution papers at the state level but may need to file a Statement of Abandonment of Use for a trade name.

State-by-State Variations in Business License Cancellation

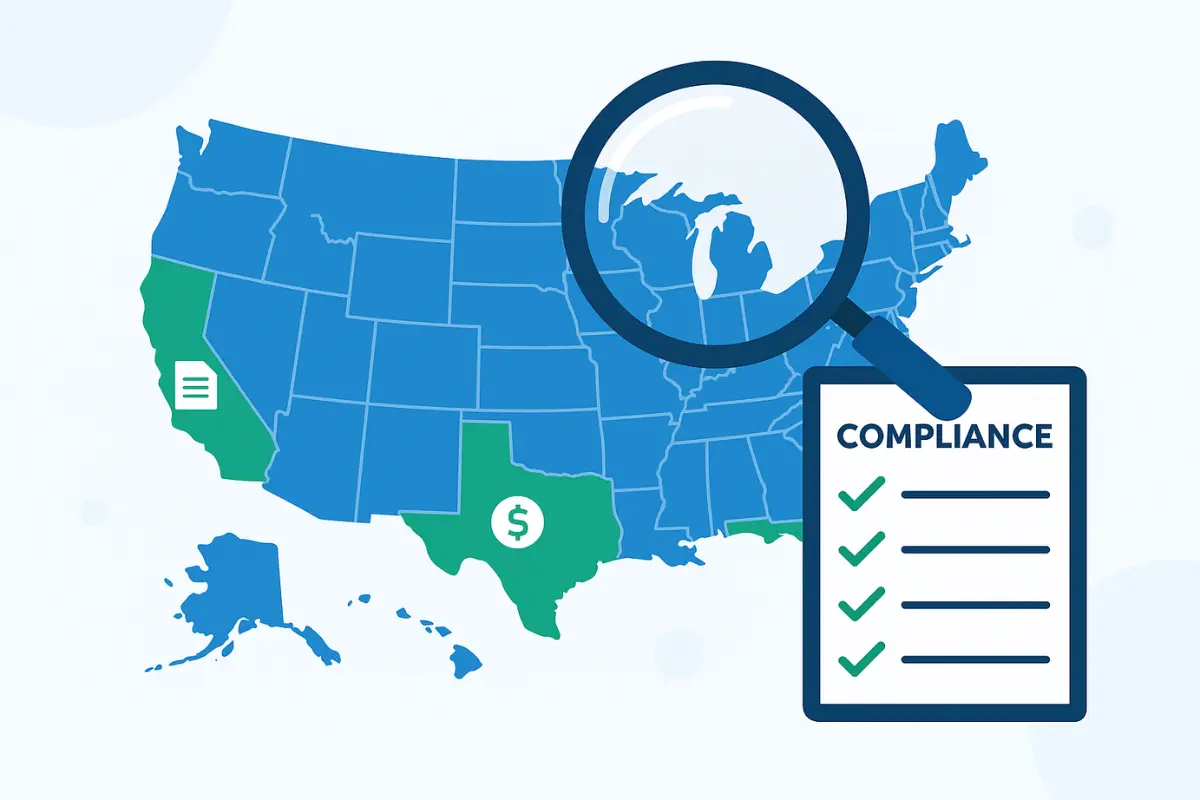

Cancellation procedures differ dramatically across state lines, making it essential to verify specific requirements for your jurisdiction.

California requires LLCs and corporations to be in "good standing" with all fees and taxes paid before processing cancellations. Many cities also require a final business tax return.

Texas requires a Certificate of Account Status from the state comptroller proving all taxes are paid before allowing entity dissolution, which may be needed for some license cancellations.

Florida has a relatively simple process for sole proprietors but requires more documentation for incorporated entities canceling licenses.

New York has specific requirements for New York City businesses, including particular forms for discontinuing operations, while state-level professional licenses have their own cancellation procedures.

Always check your state's official business portal for exact requirements, as these examples illustrate the wide variation in procedures.

What Happens After You Cancel a Business License?

Understanding the consequences of cancellation helps ensure you’ve properly completed the process and know what to expect. For a comprehensive overview of what happens when a business closes, including both license and entity considerations, InCorp provides detailed guidance.

Business owners should also review all taxation implications that may arise after canceling a business license.

Tax Implications

License cancellation often triggers final tax filing requirements. You must report all income and expenses through your closure date, file final sales tax returns if applicable, and potentially obtain tax clearance certificates. Some states require proof that all tax obligations are satisfied before finalizing license cancellation. If your business has multiple locations, you need to cancel licenses for each location individually. Retain business records for at least three to seven years for potential future inquiries after cancellation. Keep all cancellation confirmations for tax records.

Impact on Business Records

Canceling a business license does not automatically change the legal status of your business entity with the Secretary of State or other state agencies. The entity (such as an LLC or corporation) will remain active and continue to exist as a legal structure unless you separately file formal dissolution or withdrawal paperwork with the appropriate government office.

When a business license is canceled, the public record will show that the license has been terminated in that jurisdiction, but your entity will still appear as "active" or "in good standing" in state databases unless you take additional steps to dissolve or withdraw the entity. This means you may still be responsible for annual reports, franchise taxes, and other compliance obligations until the entity is formally dissolved or withdrawn.

If you wish to fully close your business, you must file dissolution documents (such as Articles of Dissolution or Certificate of Cancellation) with the Secretary of State. Only after this process is complete will your entity’s status be updated to "dissolved," "terminated," or "withdrawn" in official records.

Maintaining copies of all license cancellation confirmations and entity dissolution filings is essential for future reference, tax compliance, and legal protection. Failure to properly dissolve or withdraw your entity can result in ongoing fees, penalties, and potential liability, even if you are no longer operating.

Protecting Your Liability

Properly canceling a business license helps establish a clear end date for your license-related obligations in that jurisdiction and can reduce the risk of future license fees, renewal notices, or penalties tied to that license. However, canceling a license does not, by itself, end the legal existence of an LLC or corporation or eliminate outstanding debts, contracts, or other legal obligations. For stronger long‑term protection, businesses that are no longer operating typically need to both cancel applicable licenses and formally dissolve or withdraw their entity, which helps maintain the separation between business and personal assets when combined with proper record-keeping and compliance practices.

Common Mistakes to Avoid When Canceling a Business License

Business license cancellation often goes wrong when owners make these common errors. It is crucial to follow all official procedures and deadlines to avoid these mistakes:

-

Assuming closure is automatic: Simply stopping operations doesn’t cancel your licenses or notify agencies

-

Ignoring tax agencies: Failing to file final returns and close tax accounts guarantees future penalties

-

Forgetting local licenses: Canceling state registration doesn’t automatically cancel city or county licenses

-

Missing deadlines: States often impose strict timelines for filing cancellation documents after ceasing operations

-

Poor record keeping: Always maintain copies of all cancellation confirmations, tax clearance letters, and final returns indefinitely

Alternatives to Canceling a Business License

Before proceeding with full cancellation, consider whether these alternatives better suit your situation.

Suspending Operations

If you plan to resume business later, many jurisdictions allow you to suspend or place licenses in "dormant" status. This maintains your business name and license rights while potentially reducing or eliminating fees during the suspension period. This option works well for seasonal businesses or temporary financial pauses.

Selling or Transferring the Business

When ownership changes hands, licenses can often be transferred or amended rather than canceled. This preserves the business's established history and may be valuable to buyers. The legal process varies by jurisdiction but typically involves filing transfer applications with each licensing agency.

Restructuring the Business

Converting your business structure (such as from sole proprietorship to LLC) while continuing operations may allow you to amend existing licenses rather than canceling and reapplying. This can save time and maintain business continuity, though the availability of this option varies by jurisdiction and the extent of changes.

FAQs

Do I need to cancel my business license if I'm closing my company?

Yes, in most states, you're legally required to cancel your business license when closing to avoid ongoing tax or compliance obligations. This is separate from dissolving your entity, which requires additional steps with the state.

How much does it cost to cancel a business license?

The cost varies by state and city. Some jurisdictions charge no fee, while others may require a small filing fee ranging from $10 to $100. Entity dissolution fees are typically separate and higher.

Can I transfer my business license instead of canceling it?

In some cases, yes. Depending on local laws, you may be able to transfer or amend your license if you're restructuring or selling your business instead of shutting it down. Contact your licensing agency to confirm options.

What happens if I don't cancel my business license properly?

Failing to cancel a license can lead to penalties, tax liabilities, and continued legal responsibilities in your name—even if your business is no longer operating. You may continue receiving renewal notices and could be sent to collections for unpaid fees.

Who can help me with the business license cancellation process?

You can handle it yourself, but professional services simplify the process, help with state requirements, and reduce the risk of mistakes that could cause future liabilities.

Can I cancel my business license by email?

Some agencies allow you to cancel or surrender your business license by email. Check with your local or state authority to find out if they accept email requests and to learn about their specific process.

Is canceling a business license legally required when closing a business?

In many jurisdictions, canceling your business license is legally required when you are closing your business to prevent ongoing tax obligations, renewal fees, and late fees that can accrue even after operations stop. This step is separate from filing dissolution documents with the state's office and helps show agencies that you no longer operate or use the license for business purposes.

How does canceling a business license affect my tax obligations?

Canceling a business license usually goes hand in hand with filing final tax returns and closing tax accounts related to income tax, sales tax, and payroll taxes owed for the period you operated. Small business owners typically must report all business income, pay remaining taxes, and keep tax records and business records for several years after the business closing.

Do I need to close my tax accounts when I cancel my business license?

Yes, most agencies expect you to close all related tax accounts—such as sales tax permits, withholding accounts, and any seller's permit—when closing your business or canceling licenses. If you had an employer identification number, the Internal Revenue Service will mark the business account inactive after you file final returns, even though the EIN itself is not canceled.

What is the difference between canceling a business license and business dissolution?

Canceling a business license ends your permission to operate under that specific license, while business dissolution is the formal legal process of ending the existence of a corporation or limited liability company. Dissolution usually requires filing articles or other dissolution documents, satisfying tax obligations, and sometimes distributing remaining assets to owners or creditors under your operating agreement or corporate bylaws.

Does canceling my business license change my business structure or entity type?

No. Canceling business licenses does not change your business structure or entity type—such as sole proprietorship, corporation, or limited liability company—which is governed by state entity filings. To change or end a legal entity, you must follow the state's dissolution process or file amendments, which is separate from license or registration cancellation.

How does license cancellation work for sole proprietors compared to corporations or LLCs?

Sole proprietors often only need to cancel local and state business licenses, permits, and relevant tax registrations because there is no separate legal entity filed with the Secretary of State. Corporations and LLCs, by contrast, usually must cancel business licenses and also file dissolution documents and final returns to properly close the legal entity and stop annual reports and franchise taxes.

What should small business owners do with business property and remaining assets when closing?

Before submitting any cancellation form or dissolution paperwork, businesses generally need a plan to pay creditors, sell or dispose of eligible property and business equipment, and distribute remaining assets according to state law and organizational documents. Properly documenting how business property is sold or converted to personal use helps when preparing the final return and maintaining clean tax records.

How long does it take to complete the process of canceling licenses and closing your business?

The full process can take several weeks or longer, depending on how quickly you file required forms, pay taxes, and resolve any outstanding issues with agencies. Some states will not finalize dissolution or administrative dissolution relief until all required forms, final returns, and taxes are processed, so starting early helps you properly close your business.

Are there special considerations for certain business types, like liquor licenses or highly regulated industries?

Yes. Certain business licenses—such as a liquor license or other highly regulated permits—often have extra rules for surrender, transfer, or cancellation that go beyond standard business licenses. These licenses may require additional approvals, background checks for buyers, or specific notice to regulators before the business can officially close under that license.

What records should I keep after canceling a business license and filing final returns?

You should keep copies of all cancellation confirmations, dissolution documents, tax return filings, and important business records for at least three to seven years, and sometimes longer depending on your state and industry. These records help prove that you properly closed your business, satisfied tax obligations, and no longer operate under that business name or license.

Share This Article:

Stay in the know!

Join our newsletter for special offers.