Maintaining Legal Identity Across Multiple Entities: A Complete Guide

What if a single administrative oversight—such as missing an annual report filing in a single state—led to regulatory penalties, loss of good standing, or increased litigation risk for your entire corporate group? For businesses operating a portfolio of entities, these are not far-fetched scenarios but tangible and ever-present risks. Maintaining legal identity is the foundational corporate governance discipline that ensures every LLC, corporation, subsidiary, and partnership within a corporate family retains its distinct, legally recognized, and fully compliant status. This goes beyond mere paperwork; it is the active process of preserving legal boundaries that protect assets, support corporate compliance, and enable strategic growth

As organizations expand, the complexity of multi-entity management intensifies. Each new entity, whether formed organically or through acquisition, introduces new compliance challenges—from unique filing deadlines to specific tax requirements. This guide provides a comprehensive framework for understanding the critical importance of that separation, the transformative role of modern entity management technology, and actionable strategies your organization can implement to achieve robust, defensible entity governance and mitigate risk across your enterprise.

Key Takeaways

Maintaining legal identity is a continuous strategic imperative, not a one-time task. Each entity in your portfolio requires distinct legal recognition, separate financial records, and consistent compliance with jurisdiction-specific requirements to preserve liability protection and operational clarity.

The corporate veil is only as strong as your entity governance practices. Courts can pierce the corporate veil when entities fail to observe corporate formalities, commingle funds, or blur legal boundaries through poor documentation. Meticulous separation of each entity's records, contracts, and financial accounts is essential to maintaining these protections.

Modern entity management technology transforms compliance from reactive to proactive. Centralized platforms like Entity Management System with EntityWatch® provide automated deadline tracking, secure document repositories, and real-time visibility across your entire portfolio, dramatically reducing the risk of missed filings and regulatory penalties.

Standardization and centralization are the foundation of scalable multi-entity management. Consolidating all entity data into a single source of truth and establishing uniform processes for formation, compliance, and documentation ensures consistency, reduces errors, and enables efficient expansion into new jurisdictions.

Clear accountability and regular audits prevent small oversights from becoming major problems. Assigning specific ownership for entity governance and conducting periodic compliance reviews allows organizations to identify and resolve gaps before they escalate into financial penalties, loss of good standing, or legal liability.

The Critical Importance of Maintaining Legal Identity

The deliberate and meticulous upkeep of each entity’s legal identity is not an administrative task; it is the bedrock of corporate integrity and a non-negotiable aspect of sound legal entity management. Failure to do so can unravel the very protections that the business entity structure was designed to provide As the Berkman Letter's General Counsel Guide to Entity Management notes, effective entity management helps legal teams demonstrate value while maintaining compliance across jurisdictions.

Ensuring Regulatory and Tax Compliance

Every business entity, regardless of size or operational scope, is subject to a unique web of local, state, and federal regulations. Maintaining legal identity means proactively ensuring that each entity meets its specific, ongoing compliance obligations, such as filing annual reports, paying franchise taxes, renewing business licenses, and adhering to industry-specific reporting requirements. Failure in any of these areas can trigger a cascade of consequences—including substantial financial penalties, revocation of licenses, loss of "good standing" status, and, ultimately, administrative dissolution or revocation by the state. Consistent legal compliance is an essential business objective to maintain operational continuity and protect organizational integrity.

Mitigating Financial and Legal Risk

The primary legal and financial advantage of creating separate entities is liability isolation. This "corporate veil" is designed to shield the assets of the parent company and sister entities from the debts and legal problems of any single entity. However, this veil is not impermeable. Courts can "pierce the corporate veil" if they find that the entities are not being treated as truly separate. Common reasons for this include commingling funds and assets, failing to observe corporate formalities (like holding annual meetings), and poor document management that blurs the lines between entities. A foundational step in preventing this is maintaining a clear separation in financial records, bank accounts, and contracts for each entity. Meticulous entity management ensures these protections are real in both governance and daily operations, supporting robust risk mitigation and operational continuity.

Achieving Operational and Strategic Clarity

Clear legal boundaries between entities are a prerequisite for operational efficiency in a multi-entity business structure. When each entity maintains a distinct legal identity, it can open its own bank accounts, secure financing based on its individual credit, enter into contracts in its own name, and manage its profits and losses independently. This separation supports accurate financial consolidation, transparent internal and external audits, and enables informed, strategic decisions about the performance, viability, and future of each business unit. Clean, reliable legal entity data is essential for effective strategic decision-making and risk management across the organization.

The Transformative Role of Technology in Legal Identity Management

As the number of entities grows, manual tracking methods like spreadsheets and calendar reminders become a significant burden. They are prone to human error, difficult to scale, and fail to provide a holistic view. Modern entity management technology is no longer a luxury but a necessity, offering the precision, automation, and scalability required for effective modern governance.

Centralized Legal Entity Management Software

Specialized platforms provide a single, centralized dashboard offering a real-time overview of the status and obligations of every entity in your portfolio. A prime example is InCorp's Entity Management System with EntityWatch®, a system that tracks vital details like entity filing status, registered agent information, officer and director lists, and compliance due dates.

Automation for Compliance Tracking and Reporting

Compliance automation is a core benefit of these platforms. Systems like Entity Management System with EntityWatch® can send automated, proactive alerts for upcoming filing deadlines, changes in entity status, or missed filings. This functionality drastically reduces the risk of human oversight, helps ensure that every entity meets its obligations on time, and maintain good standing. Furthermore, this technology can streamline the generation of required regulatory filings and provide instant, customizable reports to meet internal reporting requirements for board meetings, audits, or internal reviews.

Secure Document Management and Audit Trail

Robust document management is a critical component of legal compliance. Entity management platforms provide secure, cloud-based repositories for all critical entity documentation, from articles of incorporation and bylaws to board minutes, stock ledgers, and intellectual property assignments. These systems often include features like encryption, access controls, and version history, maintaining a complete and immutable audit trail. This is valuable for internal organization and can serve as critical supporting documentation of proper entity governance in the event of a legal or regulatory challenge.

Integration and Scalability for Growth

The true power of this entity management technology is unlocked when it integrates seamlessly with other enterprise systems, such as ERP, HR, and finance software. This breaks down information silos, ensures data consistency across the organization, and provides a holistic view of how legal structures impact overall business performance. Moreover, these digital solutions are inherently scalable, allowing organizations to add new subsidiaries or enter new jurisdictions without a proportional increase in administrative overhead or complexity.

Actionable Strategies for Effective Multi-Entity Management

Technology is a powerful enabler, but its effectiveness is maximized when deployed within a framework of sound strategy and disciplined execution. The following strategies are essential for mastering the compliance challenges of a complex structure.

Centralize All Entity-Related Data

The first and most critical step is to eliminate data silos. Consolidate all information—including incorporation documents, amendments, officer details, governing agreements, and filing histories—into a single, centralized system. This creates a centralized, reliable source, eliminates duplication and contradiction, and helps ensure that everyone in the organization is working from consistent and accurate legal entity data.

Standardize Compliance Processes and Documentation

Create uniform policies, procedures, and checklists for managing the lifecycle of every entity, regardless of its jurisdiction. Standardizing processes for entity formation, dissolution, annual tax compliance, and regulatory filings reduces errors, ensures consistent corporate compliance across the portfolio, and makes the process more efficient. Adhering to consistent document retention guidelines for all entities is a key part of this standardization.

Conduct Regular Audits and Proactive Compliance Reviews

Do not wait for a problem to arise. Schedule periodic, proactive internal audits of each entity’s legal health. These reviews should verify that all entity documentation is current, all filings are up-to-date, and all records are accurate. This practice helps identify gaps, outdated information, or potential compliance risks long before they escalate into emergencies, allowing for calm and deliberate corrective action.

Leverage Technology and Embrace Automation

Strategically invest in a robust entity management system and commit to its full utilization. Leverage its compliance automation capabilities to track deadlines, manage documents, and generate alerts. This minimizes manual, repetitive tasks, freeing up legal and compliance teams to focus on higher-value strategic work rather than administrative tracking.

Establish Clear Governance Structures and Accountability

Ambiguity is the enemy of compliance. Assign clear ownership and accountability for entity governance. Designate whether responsibility lies with the legal department, a dedicated compliance team, or the corporate secretarial function. Forbes Insights notes that clear roles and responsibilities strengthen compliance by aligning oversight with accountability. A core part of this is understanding and fulfilling the responsibilities of a registered agent, a crucial role for maintaining communication with state authorities.

Engage External Expertise for Complex Challenges

For navigating complex, unfamiliar, or rapidly changing jurisdictions, partnering with external experts is a prudent strategy. Local registered agents, legal counsel, and compliance professionals can provide invaluable, specialized guidance and help ensure legal compliance in areas where internal knowledge may be limited, thereby strengthening your overall entity governance framework.

Conclusion: Fortify Your Foundation for Sustainable Growth

Maintaining legal identity across a portfolio of entities is not a one-time project but a continuous, strategic imperative. It demands focus, discipline, and the right technological tools. This ongoing commitment helps protect your corporate assets and supports unwavering legal compliance, and provides the clear, operational structure necessary for sustainable and confident growth.

Navigating the intricate landscape of multi-entity management is a core function of modern corporate oversight. Managing multiple entities, with a system like Entity Management System with EntityWatch®—is where InCorp provides expert support. Our system is designed to help you organize your entity-related data, streamline your filing deadlines, and maintain the secure document management that supports the integrity of every entity in your structure.

FAQs

What is the difference between a legal identity and a brand identity?

A legal identity refers to the official, government-recognized existence of a business entity, defined by its registration number, tax ID, and incorporation documents. It is a matter of public record and legal compliance. A brand identity, in contrast, is how the business presents itself to the market through its name, logo, and messaging, shaping customer perception. The two must align but serve fundamentally different purposes.

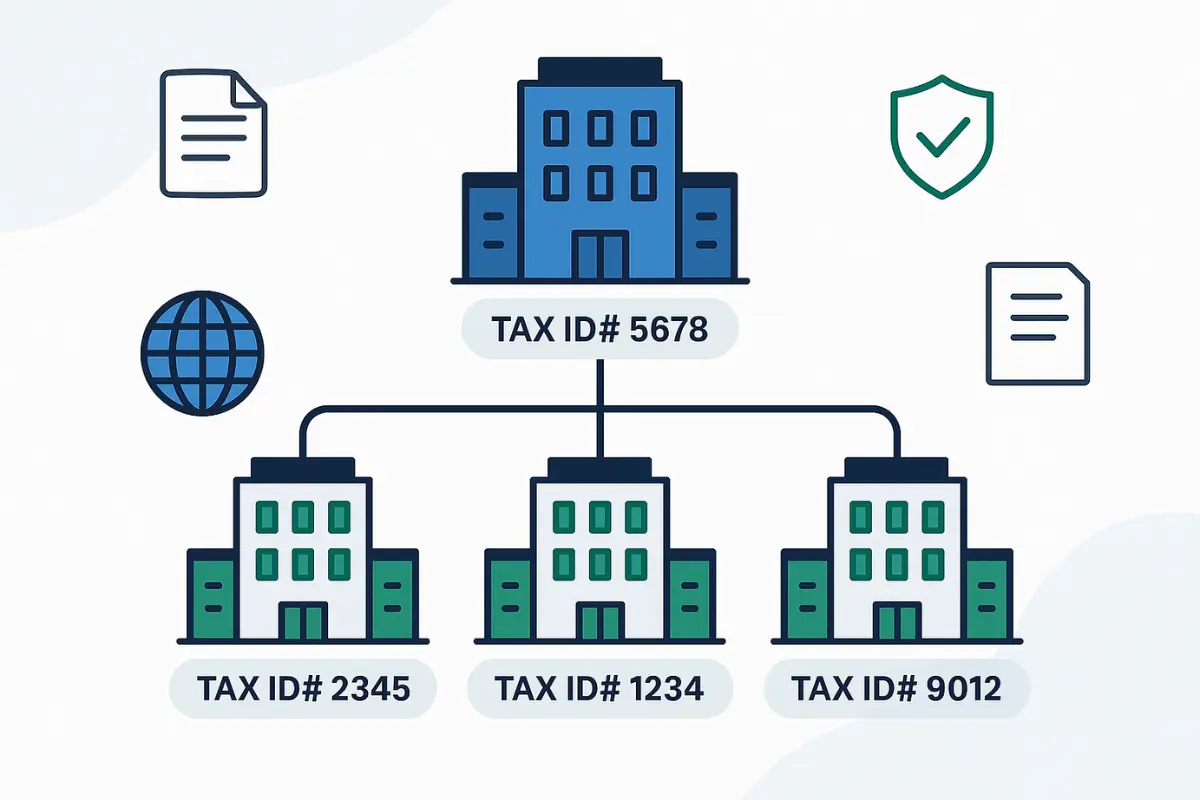

Can multiple entities share the same legal identity?

No. By definition, each entity must have its own distinct legal identity. This includes a unique legal name, registration number, and tax identification number. Attempting to share a legal identity would completely negate the liability protection and operational clarity that forming separate entities is designed to provide.

How does maintaining legal identity affect business expansion?

A well-managed and compliant portfolio of entities makes expansion significantly smoother and less risky. It streamlines the process of forming new subsidiaries, qualifying to do business in new states (foreign qualification), and securing the necessary licenses and permits, as each new entity is built upon a foundation of proven, efficient, and scalable compliance processes.

What are the consequences of neglecting legal identity maintenance?

The consequences are severe and multifaceted. They can include accumulating state fines and penalties, losing good standing (which can prevent you from expanding or enforcing contracts in court), facing difficulties in obtaining financing, suffering reputational damage with partners and customers, and, in the worst cases, having a court pierce the corporate veil (holding owners personally liable) or the state administratively dissolving the entity.

How is legal entity management different from "just doing annual filings"?

Legal entity management is an ongoing governance discipline that centralizes entity data, tracks regulatory requirements across multiple jurisdictions, and coordinates legal, tax, and finance teams to keep every entity in good standing. Annual filings are only one part of that program; effective legal entity management also covers corporate records, intercompany agreements, director information, and real‑time visibility into compliance status for all legal entities.

Why do organizations with multiple entities need entity management software?

As organizations add multiple entities and business units, manual entity management processes become error‑prone, time‑consuming, and difficult to scale. Entity management software centralizes corporate data into a single source of truth, automates regulatory filings and annual filings, and gives legal teams and compliance professionals real‑time visibility into good standing and risk across the portfolio.

How does entity management software reduce financial penalties and associated costs?

By automating reminders for regulatory filings, licenses, and renewals, entity management software helps ensure timely compliance and reduces the chance of missed deadlines that trigger financial penalties. Centralized, accurate entity data and audit‑ready corporate records also cut down on remediation work, rush filings, and professional fees when regulators or auditors request proof of compliance.

How does strong entity governance improve risk management and operational efficiency?

A robust entity governance framework sets standardized processes for corporate records, director and officer approvals, and regulatory compliance across all legal entities. This consistency improves data accuracy, reduces legal and reputational damage risk, and allows legal departments and compliance teams to act quickly and make informed decisions based on up‑to‑date entity data.

What is a "single source of truth" for entity data, and why does it matter?

A single source of truth is a centralized repository where all corporate data—corporate names, registrations, ownership, director information, and key regulatory filings—is maintained and governed. When multiple departments rely on the same, up‑to‑date system, organizations avoid inconsistencies, enhance visibility across multiple entities, and collaborate seamlessly on legal obligations and reporting requirements.

Should legal teams manage entity governance in‑house, outsource it, or use a hybrid model?

In‑house legal operations offer greater control over entity management processes but require sufficient resources to keep up with stringent compliance requirements and changing regulations. A hybrid model, where core governance stays with legal teams and selected compliance tasks are handled by external providers or third‑party systems, can reduce administrative overhead while preserving adequate governance and oversight for specific entities and multiple jurisdictions.

Share This Article:

Stay in the know!

Join our newsletter for special offers.