The Business Owner’s Secret Timing Tool: Should You Delay Your LLC’s Legal “Birthday”?

You’ve chosen your business name, drafted your operating agreement, and you’re ready to file your LLC paperwork. But what if filing now could mean your business does not legally start until next year—and that this timing choice could save you money, simplify your taxes, and buy you setup time?

This isn’t a loophole. It’s a standard, state‑authorized option called a delayed effective date (sometimes called a future effective date). Used intentionally, it lets you control the official start date of your LLC or corporation so your legal existence lines up better with your tax and operational plans.

Key Takeaways: Timing Your LLC’s Legal “Birthday”

-

A delayed effective date lets you file now but have your LLC or corporation legally “start” later (often up to 90 days ahead), so your entity’s legal birthday can line up with a clean tax year, a January 1 launch, or a key business milestone.

-

Using a future effective date can reduce split‑year tax complexity, postpone your first annual report and franchise tax obligations, and give you time to set up banking, systems, and contracts before ongoing state compliance deadlines begin.

-

Only some states allow you to pick a future effective date in the formation filing; others require the entity to be effective on approval, so in those jurisdictions timing is all about when you submit, not what date you select.

-

The “pre‑formation” gap is real: until the effective date, the entity does not legally exist, so you may be personally liable as a promoter for contracts and obligations, and many banks and vendors will not recognize the business or open accounts yet.

-

You can manage this gap by carefully labeling pre‑formation signatures, limiting big commitments before the entity is active, formally ratifying key contracts after formation, and coordinating with legal and tax advisors on the right effective date strategy for your state and tax classification.

What Is a Delayed Effective Date?

Think of your business’s effective date as its legal “birthday”—the day your entity officially comes into existence under state law. This date is what many states use to determine when your tax year begins, when annual reports are first due, and when ongoing state fees and obligations start.

A delayed effective date allows you to file formation documents now but specify a future date (often up to 90 days ahead, sometimes longer) for that legal birthday.

Example: You file your Articles of Organization in November 2025 but request an effective date of January 1, 2026. If the state accepts your filing, the LLC legally comes into existence on January 1, even though the paperwork was submitted and approved earlier.

Important: This is not backdating. You generally cannot choose a date in the past for a formation effective date. A delayed effective date is a forward‑looking planning tool expressly allowed by many state statutes and online filing systems.

Why Consider a Delayed Effective Date?

1. Tax Simplification

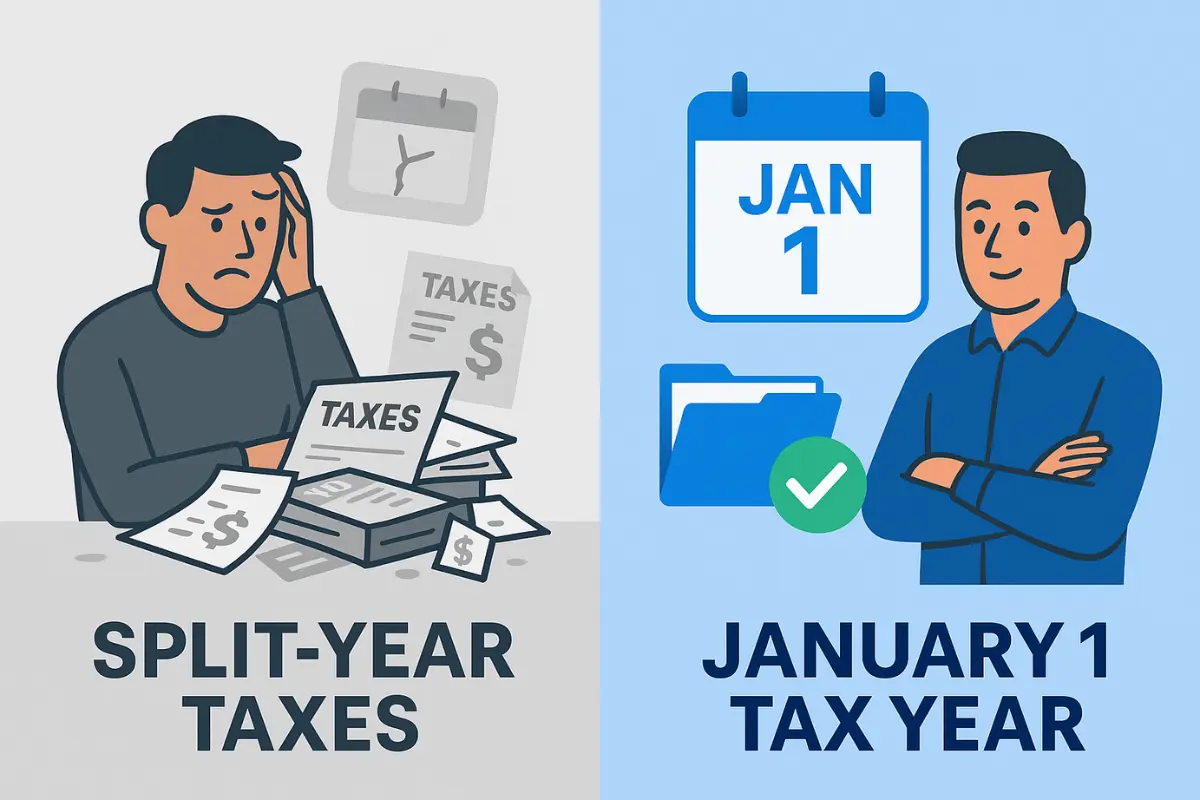

Forming mid‑year can create a “split‑year” situation. If you’re changing from a sole proprietorship or partnership into an LLC taxed differently (for example, electing S‑corp status), you may end up with separate reporting for the pre‑formation part of the year and for the new entity.

Choosing a January 1 effective date often gives your new LLC or corporation a clean first tax year, which can make planning and compliance easier. For instance, if you transition a sole proprietorship to an LLC in December 2025 and set a January 1, 2026 effective date, your entity’s first tax year is the full calendar year 2026, rather than splitting activity between 2025 and 2026. Exact results depend on how your LLC is classified for federal tax purposes (disregarded entity, partnership, S‑Corp, or C‑Corp) and on IRS election deadlines, so customized advice is key.

2. Delaying Your First Annual Report and State Fees

Many states use your formation or effective date to determine when your first annual (or biennial) report is due and when recurring state fees begin. By pushing your effective date into the next year, you can often defer those costs.

Conceptual examples based on current rules:

California LLCs: California generally imposes an annual 800 USD franchise tax on most LLCs doing business in the state, with the first payment due by the 15th day of the fourth month after the LLC is formed or starts doing business, and then annually (commonly around April 15 for calendar‑year entities). A late‑year formation can effectively trigger an 800800 USD obligation for a short initial period and then another 800800 USD soon after, whereas timing your effective date for early January can usually avoid that partial‑year obligation and push your first payment to the following April instead.

Florida LLCs: Florida requires LLCs to file an annual report (approximately 138.75 USD for LLCs) by May 1 each year to maintain active status, with a significant late fee if missed. If your Florida LLC is effective late in the year, you may have to file a report in the very next calendar year; if instead your entity’s effective date is January 1 of the following year, your first report may not be due until the year after that.

The exact timing and amounts differ by state, but the pattern is the same: pushing your effective date forward can delay when your first state‑level obligations hit.

3. Operational Runway

A delayed effective date also buys you time to get organized before your state compliance obligations begin. The gap between filing and effectiveness can be used to:

-

Open a business bank account once your paperwork is accepted and you have an EIN.

-

Implement accounting software and set up payroll systems.

-

Finalize contracts, leases, licenses, and branding.

-

Recruit team members and vendors so you can hit the ground running on day one.

You lock in your name and structure early, but your legal “start clock” begins on the date that best matches your rollout.

State Rules: Where and How It Works (2025–2026)

Not all states handle delayed effective dates the same way, and a few do not permit them for formation filings at all. Always verify the rules with your specific Secretary of State or Corporations Division.

States That Allow Future Effective Dates

-

Alabama – Allows LLCs and corporations to specify a future effective date, often up to 90 days forward, in the formation document.

-

California – Permits a future effective date (commonly up to 90 days) on many online corporation and LLC filings; the Secretary of State guidance explains that if no date is listed, the default effective date is the filing date.

-

Delaware – Under Delaware law, corporations can specify a future effective date up to 90 days after filing, while LLCs can do so up to 180 days after filing; if no future date is specified, the entity is effective on the filing date.

-

Florida – Florida’s LLC and corporate statutes and Sunbiz instructions allow you to specify an effective date in the Articles that is no more than five business days before, or up to 90 days after, the date the filing is received by the Division of Corporations.

-

Illinois – Illinois allows you to specify a future effective date in the LLC Articles of Organization, but it cannot be more than 60 days after the filing date.

-

Maine – Under Title 31, §1674 of the Maine Revised Statutes, a filed record (including a Certificate of Formation) may specify a delayed effective date, and if no date is specified it becomes effective on the date and time shown by the Secretary of State’s filing stamp; the statute allows a future date but caps it at no more than 90 days after filing.

-

Nebraska – Nebraska’s LLC act (Nebraska Uniform Limited Liability Company Act, Neb. Rev. Stat. § 21‑121) provides that a filed record becomes effective on the filing date unless a delayed effective date is stated, and the delayed date may not be more than 90 days after the date the record is filed.

-

New Jersey – For New Jersey LLCs, you can choose a future effective date rather than using only the approval date, and state law does not set a specific maximum number of days so long as the delayed effective date is clearly stated in the certificate and complies with the Revised Uniform Limited Liability Company Act.

-

Texas – The Texas Secretary of State permits a delayed effective date for formation filings, but it cannot be more than 90 days after the date the instrument is signed, and this option is built into the standard formation forms and filing instructions.

-

Virginia – Allows a future effective date up to 15 days after filing approval. The delayed date must be clearly requested (for LLCs, typically in the cover letter for mailed filings; for corporations, within the articles). No backdating is permitted.

-

New York – Under New York Limited Liability Company Law § 203(d), an LLC is formed upon filing of the Articles of Organization or on a later effective date stated in the Articles, so long as that date is not more than 60 days after the filing date.

-

Pennsylvania – Under Title 15 of the Pennsylvania Consolidated Statutes, formation documents filed with the Department of State may specify a future effective date rather than the filing date, and the statute does not set a fixed outer limit on how far in the future that date may be.

-

South Dakota – South Dakota Codified Laws, LLC Article 12 (e.g., § 47‑34A‑1201 and related sections) authorize a delayed effective date for articles of organization and other records; if a delayed effective date (but no time) is specified, the record takes effect on that date, which may be set up to 90 days after filing.

States That Do Not Allow Delayed Effective Dates

Some states treat the approval date as the only effective date for formations (unless very narrow exceptions apply). These include:

-

Alaska – Alaska’s LLC statute ties organization to the filing of conforming Articles of Organization with the Corporations Section; there is no statutory provision that lets you name a later effective date, so the LLC is organized as of the filing/approval date.

-

Connecticut – Under the Connecticut Uniform Limited Liability Company Act, a record filed with the Secretary of the State becomes effective as provided in the general filing rules, and there is no section that authorizes a delayed effective date for initial LLC formation, so approval date is effectively the start date.

-

Hawaii – Hawaii’s LLC chapter and the Business Registration Division’s information sheet indicate that a filing becomes effective when filed by the Director; the domestic LLC formation instructions do not provide any field or authority for a future effective date in the Articles of Organization.

-

Idaho – Idaho Code § 30‑1‑123 states that a filed document is effective on the date and time of filing unless a delayed effective date is specified and permitted, but the LLC provisions do not create a delayed‑date mechanism for articles of organization, so an Idaho LLC is ordinarily effective when the filing is accepted.

-

Louisiana – Louisiana’s LLC law treats an LLC as organized when articles of organization that comply with the statute are filed with the Secretary of State; there is no authority in the LLC chapter to state a later effective date in those articles, so the approval date controls.

-

Maryland – Maryland’s LLC statute provides that a limited liability company is formed when the Department of Assessments and Taxation accepts its articles of organization for record, and neither the statute nor the standard state forms allow filers to choose a delayed effective date for formation.

-

Minnesota – Minnesota Statutes chapter 322C (Revised Uniform LLC Act) ties the effectiveness of filed records to the time of filing, and for articles of organization there is no separate “delayed effective date” option, so the LLC comes into existence when the filing is accepted by the Secretary of State.

-

Nevada – Nevada’s LLC chapter makes filed certificates effective at the time of filing unless otherwise specified, but in practice the standard LLC formation provisions and Secretary of State materials do not offer a forward‑dating choice for the initial formation filing, so a Nevada LLC is generally effective on the approval date.

In all of these states, the practical timing tool is when you submit the filing (for example, waiting until early January if you want activity and obligations to start in the new year), rather than relying on a delayed effective date field in the formation document.In those states, your entity is generally effective on the date the filing is accepted, so the main timing tool is when you submit (for example, waiting until early January).

If your state does not permit a delayed effective date, you essentially have three choices:

-

File now and accept the approval date as your effective date.

-

Wait and file closer to your desired “start” date (such as early January for a January‑1‑style launch).

-

Use a professional filing provider, such as InCorp, to prepare your formation documents in advance and then submit them to the state on a specific date you select, so your approval date will closely align with your planned start date.

When a Delayed Effective Date Makes Practical Sense

A delayed effective date gives you control over when your business entity legally begins. By choosing a specific date in the future, you can manage the start of tax, compliance, and legal obligations, making it easier to align these with your operations or calendar. This tool can ease administrative burdens, but it must be used with awareness of the risks and limitations.

When a Delayed Effective Date Can Help

A delayed effective date can be valuable in several situations:

-

You’re forming your entity late in the year and want it to start on January 1, keeping all activity in one tax year.

-

You’re converting from a sole proprietorship or partnership and want to avoid overlap or confusion in your tax filings for the year.

-

You want to defer annual reports, franchise tax, or minimum tax obligations until the next year, since most state requirements are based on the entity’s effective date.

-

You’ve secured your business name and structure but still need time to prepare banks, systems, or operations before accepting new compliance responsibilities.

-

You want to coordinate the start of your business with a milestone, like a contract, funding round, or lease, so liability protection begins exactly when needed.

When a Delayed Effective Date May Not Be Ideal

There are circumstances where a delayed effective date might not serve your needs:

-

Your state doesn’t permit delayed effective dates, so your only option is to time your filing as needed.

-

You need to execute contracts, hire, lease property, or open bank accounts right away; until your effective date, the entity is not legally active.

-

State fees or taxes are minimal, so delaying the start date only adds complexity for vendors, customers, or investors.

-

You are already operating and need liability protection as soon as possible; delaying leaves you personally exposed for longer.

-

You plan to earn revenue immediately and want clarity for tax, accounting, or investor documentation from day one

Critical Caution: The “Pre‑Formation” Gap

Until the effective date, the LLC or corporation does not legally exist as a separate entity. That gap creates both liability and practical risk that many founders underestimate.

What can go wrong in the gap

-

Contracts signed only in the LLC’s or corporation’s name before it exists may not bind the entity at all, and counterparties may argue the agreement is unenforceable or instead enforceable only against the individual who signed.

-

The person acting for the not‑yet‑formed entity is typically treated as a “promoter” and can be personally liable for pre‑formation debts and obligations, even if the entity later adopts the contract, unless the other party clearly agrees to a novation releasing the individual.

-

Banks, payment processors, landlords, and many vendors will not treat the entity as real until you can provide filed formation documents or a certificate of existence, so you may not be able to open accounts or sign key agreements in the entity’s name during this period.

Practical ways to manage pre‑formation risk

-

Where immediate commitments are unavoidable, sign as something like: “[YourName], on behalf of [LLCName], a proposed limited liability company,” rather than pretending the entity already exists.

-

Once the entity is formed and effective, have the LLC or corporation formally adopt or ratify important pre‑formation contracts by written member/manager or board consent, and, where stakes are high, obtain a short amendment or acknowledgement from the counterparty confirming that the entity (not you personally) is now the primary obligor.

-

Avoid taking on significant obligations (long‑term leases, large purchase orders, major service contracts) in the “gap” if you can reasonably wait until after the effective date, or structure them so they are expressly contingent on the entity being formed and approved.

-

Coordinate with legal and tax counsel when you expect heavy pre‑formation activity (e.g., fundraising commitments, major asset transfers) so your documents clearly address promoter liability, ratification, and the intended effective date of key transactions.

How a Registered Agent Completes Your Compliance Strategy

A delayed effective date helps you manage your start line; a registered agent helps you manage the entire race. Every LLC and corporation must maintain a registered agent in each state where it is registered or qualified to do business.

A professional registered agent service can:

-

Track deadlines tied to your effective date. Annual report and franchise tax obligations often key off your formation/effective date or anniversary month, and a registered agent can send reminders so you do not miss those filings.

-

Provide a reliable legal address. The registered agent receives service of process, tax notices, and official state mail at a public address, protecting your privacy and ensuring critical documents do not go to an unused or changing location.

-

Support ongoing good standing. Good standing is essential for financing, licensing, and expansion. A registered agent helps you avoid administrative dissolution or revocation caused by missed notices or late reports.

How InCorp Can Help You Execute This Strategy

At InCorp, the goal is to turn timing strategy into reliable execution across all 50 states.

InCorp can help you:

-

Form your entity with precision. Guidance on when and how to request a delayed effective date (in states that allow it), ensuring filings meet each state’s specific form and timing requirements.

-

Maintain nationwide registered agent coverage. InCorp provides registered agent services in every state, with a stable legal address, deadline reminders, and a secure online portal to manage notices and documents.

-

Handle ongoing compliance. Services include annual report filings, support with franchise tax‑related filings in many jurisdictions, and tools that map your obligations to your formation/effective dates so you stay in good standing over time.

Final Verdict: Is a Delayed Effective Date Right for You?

For many businesses forming in Q4, a delayed effective date—often targeting January 1—is a smart move. It can simplify tax reporting, push back your first annual fees, and give you a realistic on‑ramp to launch operations. It is a classic example of working with the rules, not around them.

Your next step is to evaluate your timeline, confirm your state’s specific rules on effective dates using official Secretary of State or Corporations Division resources, and discuss tax impacts with a professional advisor. If aligning your legal “birthday” with your business plan makes sense, partnering with a provider like InCorp for formation, registered agent service, and compliance support can help ensure it is executed correctly from day one.

FAQs

What is a delayed effective date, and how is it different from a delayed filing?

A delayed effective date is when your LLC or corporation's legal "birthday" is set to a future date (for example, up to 90 days later) even though you submit the formation filing today. A delayed filing is when you simply wait and submit your paperwork closer to your desired start date, so the effective date and filing date are the same.

With a delayed effective date, the state's office may approve your company now but treat your official effective date as a later business day, which can change when your tax year, annual reports, and state fees begin. With a delayed filing, you control timing only by when you submit—not by selecting a special date on the form.

How can a delayed effective date affect my federal income tax return and estimated tax payments?

For federal income tax, the IRS looks at when your entity legally exists and how it is classified (disregarded entity, partnership, S‑corporation, or C‑corporation). If you choose a January 1 effective date instead of a late‑year date, you often avoid split‑year income tax returns and can report the first year's income and expenses on a single federal income tax return for that tax year.

Your estimated tax payments and payroll taxes should match the actual period you are doing business through the entity, so a well‑timed effective date can simplify calculations and financial reporting. Because rules differ, especially for S‑Corp elections and partnerships, business owners and passionate entrepreneurs should coordinate with a tax professional before relying on delayed effective dates or delayed filings for IRS planning.

Can a delayed effective date lower my tax bill or help avoid late payment penalties and interest charges?

A delayed effective date does not change what you ultimately owe in federal income tax, but it can help you avoid short "stub‑period" returns and some state‑level fees that increase your overall tax bill. In states where annual reports, franchise tax, or minimum fees are tied to the effective date, starting on January 1 instead of December can defer those obligations to the following year and reduce extra charges.

However, a delayed effective date does not excuse late filing or late payment penalties if you miss IRS or state tax return due dates once the entity is active; tax agencies will still charge interest and additional penalties on any unpaid full amount. If you are unable to pay in full, you may request a payment plan or installment agreement with the IRS or state agency, but interest and some fees usually continue to accrue.

How do state rules on delayed effective dates vary, and do all states allow them?

Not all states allow a delayed effective date for entity formation; some require your company to be effective on the date the filing is accepted. For example, states such as Alaska, Connecticut, Hawaii, Idaho, Louisiana, Maryland, Minnesota, and Nevada generally treat the filing approval date as the only effective date, so timing is about when you submit, not what future date you request.

Other states—like California, Florida, Texas, New York, Pennsylvania, Maine, Nebraska, and South Dakota—expressly allow a delayed effective date in the formation form, often up to 60–90 days (or, in Delaware's case for LLCs, up to 180 days). Because not all states follow the same process, always confirm with your state's office (Secretary of State, Corporations Division, or equivalent) before assuming you qualify for a delayed effective date or delayed filings strategy.

How do delayed effective dates interact with financial statements, bank accounts, and investor confidence?

Your effective date influences when your entity appears in official records, which in turn affects financial reporting and investor confidence. If your company's effective date is January 1, you can prepare financial statements that neatly match the calendar year, which often makes income, expenses, and tax disclosures easier for lenders and investors to review.

Banks usually require proof of filing (such as stamped articles or a certificate of existence) before opening a business bank account, and public companies and larger private corporations must ensure their corporate records and financial reporting match the legal effective date to avoid enforcement actions or audit issues. A clear, well‑timed effective date supports accurate financial statements and can lead to greater investor confidence in how you manage compliance.

Do delayed effective dates change my filing deadline for income tax returns or annual reports?

A delayed effective date can shift when your first annual report or state income‑based fee is due, because many states key those obligations to your effective date or anniversary month. For example, forming on January 1 instead of December may mean your first state report is due a year later, rather than just a few months after formation.

For federal income tax returns, your filing deadline is based on your tax year and entity type (e.g., March 15 or April 15), regardless of whether your business existed the entire prior year; a short year may still require an income tax return even if revenue was low. Delayed effective dates do not remove the obligation to submit returns on time; failing to file can trigger late filing penalties, interest charges, and, for public companies or multi‑state corporations, possible enforcement actions.

How do I actually request a delayed effective date or manage delayed filings with the state?

In states that permit delayed effective dates, the formation form usually includes a field labeled "effective date" or "delayed effective date," where you enter a specific date (for example, January 1 of the new year). Some states, like Texas and Florida, limit how far forward you can delay (often no more than 90 days from the date you sign or the business day the filing is received), and they will reject forms that try to backdate or exceed those limits.

If your state does not allow a delayed effective date, your only timing lever is when you submit—either electronically, by mail, in person, or by a service using check or money order. In either case, business owners should be aware that once a filing is accepted, fees are rarely refunded even if you mis‑timed the date, so it is wise to prepare in advance and, when needed, contact a business expert or attorney before you hit "submit."

What happens if my company files late, pays late, or cannot pay the full amount due?

If your corporation, LLC, or partnership files an income tax return or annual report after the due date, the IRS and many states will charge interest and late filing penalties on any unpaid tax or fee. Late payment penalties and interest charges can add up quickly, especially if you owe payroll taxes, franchise tax, or state income tax and do not address the bill promptly.

If you are unable to pay the full amount, you can often request an installment agreement or payment plan online or by form; in many cases, the tax agency will continue to charge interest and possibly a reduced penalty while you pay over time. Ignoring a balance due can lead to liens, levies on a bank account, or other enforcement actions, which may also affect your ability to obtain credit or a loan for the business.

Does using a delayed effective date help with prior year problems, refunds, or credits?

A delayed effective date mainly affects your new entity's future tax year and obligations; it does not erase prior year issues for an existing sole proprietorship, partnership, or corporation. If you have unpaid prior year income tax, payroll taxes, or late filing penalties, those remain due even if you form a new company with a clean legal birthday and hope for a refund or credit.

The advantage of timing your effective date near year end is that you can draw a clean line in your financial statements between prior year activity and the new entity's activity, which can simplify financial reporting and future income tax filings. For any open tax periods, you still need to complete required returns, address interest and penalties, and, if needed, work with the IRS or state to set up a payment plan on amounts you owe.

How should I decide between forming now, using a delayed effective date, or waiting until the new year?

Your choice depends on when you need liability protection, your expected income, and the cost of state and federal compliance. If you expect to sign contracts, open a bank account, or generate income immediately, you may not want to delay the effective date, because the entity does not exist until that date and you could be personally exposed in the gap.

If you primarily want to align with the new year, avoid split‑period income tax returns, and defer annual reports and state fees, a January 1 effective date or a delayed filing to early January can be an advantage. Because not all states—including some like Louisiana and Maryland—allow delayed effective dates, and because every business has different income, cash flow, and tax goals, it is best to prepare a simple forecast, review your state's rules, and speak with a tax professional before locking in your strategy.

Disclaimer: This article is for informational purposes only and is not legal or tax advice. Always confirm your plan with your attorney or tax professional.

Share This Article:

Stay in the know!

Join our newsletter for special offers.