How to Know If Your Business Needs a Fictitious Business Name

A sole proprietor wants to market services under a professional brand rather than her personal name. An LLC plans to launch a retail division under a simpler name. A partnership needs to open a bank account, but requires proof of a registered name. Each scenario raises the question of whether a Fictitious Business Name registration is necessary.

Understanding when businesses need a Fictitious Business Name helps entrepreneurs comply with requirements while establishing clear brand identities. Also known as Doing Business As (DBA), Assumed business name, or Trade name registrations, these filings serve specific legal and operational purposes.

This guide explains when a Fictitious Business Name registration is required, how to register a fictitious business name, and how businesses use alternate names.

Key Takeaways

-

A Fictitious Business Name (also called a DBA, assumed name, or trade name) lets a business operate under a brand that is different from its legal name without creating a new legal entity or adding liability protection.

-

Sole proprietors and partnerships often need a fictitious name filing when they do business under anything other than the owner’s full legal name, including when they want to brand services or avoid using a personal name in public-facing materials.

-

LLCs and corporations may register one or more fictitious names to simplify long legal names, run multiple brands or divisions under a single entity, or test new markets without forming additional entities.

-

Many states and local jurisdictions require a fictitious name filing before or shortly after using an alternate name, and banks commonly request proof of registration before opening accounts or processing payments in that name.

-

Filing typically involves checking name availability, completing a state or county form, and paying a fee that often ranges from about $10 to $100, with some jurisdictions also requiring newspaper publication for several consecutive weeks.

-

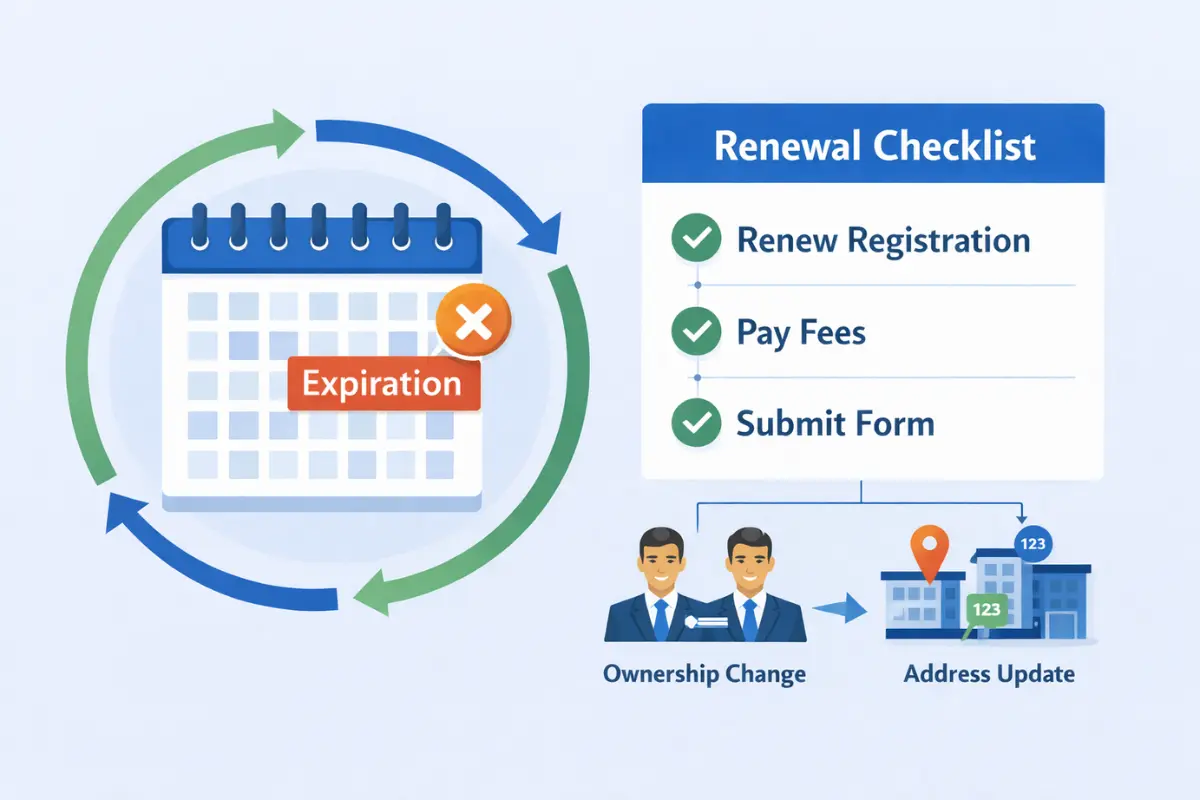

Fictitious name registrations are valid only for the period set by each jurisdiction—commonly a few years up to 10 years or, in some cases, indefinitely—and missing renewal or update deadlines can result in expiration and loss of rights to use the name.

-

Keeping a fictitious name in good standing requires tracking renewals, monitoring changes in ownership or business information, and, when needed, using professional filing services to manage multi-jurisdiction DBA portfolios

What Is a Fictitious Business Name?

A Fictitious Business Name is a registered alternate name that allows a business to operate under a name different from its legal name. State and local registration systems require these filings to create public records that identify the actual owners behind business names.

For sole proprietorships and partnerships, the legal business name defaults to the owner's full name or partners' surnames. A Fictitious Business Name allows these businesses to operate under brand names. For LLCs and corporations, the legal name is recorded on formation documents. A Fictitious Business Name allows these entities to conduct business under different names.

The Legal business name vs DBA distinction is important: the legal name remains the official entity name for legal, tax, and regulatory purposes, while the Fictitious Business Name serves as an alternate operating name.

Fictitious Business Name registrations do not create new legal entities, provide liability protection, or alter business structure. The filing creates a public record linking the alternate name to the legal entity or individuals operating the business.

Key Reasons Businesses Use a Fictitious Business Name

Businesses register fictitious names for various practical and compliance-related purposes.

Meeting State or Local Naming Requirements

Many jurisdictions require a Fictitious Business Name filing when a business operates under a name other than its legal name. State requirements for DBAs vary by location, with some requiring state agency filing while others mandate County business name filing.

The requirement typically applies when the operating name does not include the owner's full surname for sole proprietorships and partnerships, or differs from the exact legal name for corporations and LLCs.

Operating Without Using an Owner's Personal Name

Sole proprietors and partnerships commonly register Fictitious Business Name filings to operate under business names. A fictitious business name for branding purposes allows "Maria Garcia" to operate as "Garcia Design Studio" rather than under her personal name. Opening a business bank account under the business name typically requires presenting the Fictitious Business Name certificate to the financial institution.

Simplifying a Long or Complex Legal Business Name

LLCs and corporations sometimes use Fictitious Business Name registrations to operate under shorter names. "Advanced Technology Solutions, LLC" may register as "Tech Solutions" for marketing purposes. The legal entity name remains unchanged on official documents, but the Fictitious Business Name appears on customer-facing materials.

Running Multiple Lines of Business Under One Entity

LLCs and corporations can register multiple Fictitious Business Name filings to operate different product lines under distinct brands. Operating multiple businesses under a single LLC, each with a separate trade name, maintains a single legal entity while creating separate brand identities.

Rebranding or Reaching a New Audience

Businesses use Fictitious Business Name registrations to test new brand identities or expand into different markets without forming new entities. Business branding strategy considerations might involve naming your business or registering a trade name that appeals to specific market segments.

If the new brand proves unsuccessful, the business can abandon the registration without affecting its core legal entity. For those in the early planning stages, understanding key considerations when starting a business can help inform whether a DBA or a new entity formation is the right strategic choice.

Banking and Payment Processing Requirements

Financial institutions require Fictitious Business Name certificates before opening a business bank account or processing payments under alternate names. The certificate demonstrates proper registration in accordance with state and local requirements.

Can an LLC Have a Fictitious Name?

Yes, an LLC can register and operate under a Fictitious Business Name when conducting business using a name different from its legal LLC name. The question "Do I need a fictitious business name for my LLC?" depends on whether the LLC operates under its exact legal name or uses an alternate name.

LLC DBA filing becomes necessary when the LLC's operating name differs from the name on its Articles of Organization. If "Thompson Development, LLC" wants to operate as "Quality Builders," the LLC must register "Quality Builders" as a Fictitious Business Name.

The registration does not change the LLC's legal status, liability protection, or tax treatment. All business activities conducted under the Fictitious Business Name remain activities of the LLC.

Filing for a Fictitious Business Name

The filing process for Fictitious Business Name registration varies by jurisdiction but generally follows similar steps.

When a Fictitious Name Filing Is Required

Timing requirements vary by jurisdiction. Some states require filing before conducting business under an alternate name. Others allow businesses to begin using the name and require filing within 30 to 40 days. Operating under an unregistered Fictitious Business Name can result in penalties and difficulty opening bank accounts.

Where to File a Fictitious Business Name

Filing location depends on jurisdiction requirements. Some states require Business entity registration with the Secretary of State. Others mandate County business name filing with county clerk offices.

Name availability searches help identify potential conflicts before filing.

Filing Forms, Fees, and Basic Requirements

Steps to file a fictitious business name typically involve completing a form providing the business name, legal entity name, business address, and nature of business. Filing fees differ by location, typically ranging from approximately $10 to $100. LLCs and corporations may need certificates of good standing.

Publication Requirements in Certain Jurisdictions

Many jurisdictions require Fictitious business name publication requirements. The DBA publication requirement typically involves publication of the registration once per week for four consecutive weeks in a newspaper. Publication typically begins 30 to 45 days after filing. Missing this deadline can result in registration expiring.

Validity Periods and Renewal Timelines

Fictitious Business Name registrations remain valid for periods determined by the jurisdiction. Renewing a fictitious business name varies by state, with renewal periods ranging from two to ten years. Business name renewal procedures typically require filing a renewal form before the name expires. Filing offices generally do not send renewal reminders.

How Long Is a Fictitious Business Name Valid?

Fictitious Business Name registration validity periods depend entirely on the jurisdiction where the filing occurred. Common validity periods include two years, five years, or indefinite duration until withdrawn.

In jurisdictions with expiration dates, the registration remains valid through the stated expiration date. Renewing a fictitious business name before expiration maintains continuous registration. Some jurisdictions allow late renewals within a grace period, typically with additional fees, while others require entirely new filings if the registration lapses. Some locations also require new filings when certain information changes, such as ownership, address, or business structure. These amendment requirements vary by jurisdiction: some allow amendments, while others require abandoning the old registration and filing a new statement.

Business name renewal deadlines should be tracked alongside other Business compliance requirements. Missing renewal deadlines can result in losing the right to use the name, potentially allowing others to register the same or similar names.

Keeping Your Fictitious Business Name in Good Standing

Maintaining an active Fictitious Business Name registration requires attention to renewal requirements and timely updates when business information changes.

Professional filing services can help businesses manage registrations by tracking renewal deadlines, preparing filings, and monitoring for necessary updates. InCorp offers support for Fictitious Business Name filing and maintenance, including researching jurisdiction-specific requirements and managing filings across multiple locations.

Contact InCorp to learn how professional filing services can support Fictitious Business Name registration and compliance management.

FAQs

What is the difference between a fictitious business name and an LLC name?

A Fictitious Business Name (also called a DBA or Trade name) is an alternate name a business uses publicly, while an LLC name is the legal name registered during Business entity registration. A Fictitious Business Name does not create a new entity or provide liability protection. The Legal business name vs DBA distinction means the legal name governs official matters while the DBA serves as an alternate name.

Is a fictitious business name required for all businesses?

No, a Fictitious Business Name is only required if a business operates under a name different from its legal name. State requirements for DBAs vary by jurisdiction. Sole proprietors using their full legal names typically do not require registrations.

Can more than one business use the same fictitious name?

In some jurisdictions, yes, depending on local rules. A Fictitious Business Name registration does not grant exclusive rights like trademark protection. Multiple businesses may register similar names in different counties, which is why name searches are important.

Do I need a fictitious business name to open a bank account?

Many banks require proof of a registered Fictitious Business Name before opening a business bank account under that name. Requirements vary by financial institution. The filing provides documentation that the bank needs to verify proper registration.

How often does a fictitious business name need to be renewed?

Renewing a fictitious business name timelines vary by jurisdiction—some require renewal every two years, others every five years, and some maintain registrations indefinitely. Failure to meet renewal deadlines may result in expiration. Tracking Business name renewal dates alongside other Business compliance requirements ensures continuous registration.

How do I know if my business needs a fictitious business name?

A business generally needs to file a fictitious business name (DBA or trade name) when it conducts business under a name that is different from its legal business name, such as when a sole proprietorship operates under a brand name instead of the owner's own personal name or when a corporation or LLC uses a name that does not exactly match its formation documents. Requirements vary depending on state law and county-level rules, so a small business owner should review the filing rules where the business is located and consider registration whenever customers, vendors, or banks will see a name other than the legal entity name to stay compliant and avoid legal trouble.

Does filing a fictitious business name create a separate business entity or provide liability protection?

Fictitious name registration does not create a separate business entity and does not provide limited liability protection; it simply links the trade name or assumed business name to the actual owner in public records. Liability protection comes from the underlying business structure, such as a limited liability company or corporation, so sole proprietors and general partnerships using a fictitious name should understand that their personal assets may still be at risk even after filing a fictitious business name statement.

Where do business owners usually file a fictitious business name statement?

Business owners typically file a fictitious business name statement or dba forms with a state office or the county clerk's office, depending on state law and whether the registration is handled at the state or county level. Some jurisdictions also require publication of a public notice in an approved newspaper of general circulation for a certain period and payment of a filing fee by money order, cashier's check, or similar method, so checking specific local procedures is important to stay compliant.

How does a fictitious business name affect banking and payments?

Banks commonly require proof of fictitious name registration, such as a fictitious name certificate or fictitious business name statement, before allowing a business to open a business bank account or accept payments under that dba name. This helps the financial institution verify the actual owner behind the business name and confirm that the business operates in accordance with legal compliance requirements in that state or county.

Can multiple businesses use the same fictitious business name, and how do trademarks fit in?

At the county level, more than one business may sometimes register the same name or similar assumed names, depending on local rules and whether another company has already filed a conflicting fictitious name statement. Trademark rights are separate from fictitious name registration, so checking federal records with the United States Patent and Trademark Office and state trademark office databases is important to reduce the risk of conflicts with other companies and to align the DBA strategy with broader business strategy and legal protection goals.

Disclaimer: This content is intended for general educational and informational purposes only and does not constitute legal, tax, or accounting advice. Every effort is made to keep the information current and accurate; however, laws, regulations, and guidance can change, and no representation or warranty is given that the content is complete, up to date, or suitable for any particular situation. You should not rely on this material as a substitute for advice from a qualified professional who can consider your specific facts and objectives before you make decisions or take action.

Share This Article:

Stay in the know!

Join our newsletter for special offers.