Which State Is Best For LLC for Non-Residents? A Guide

A software developer in India plans to sell services to U.S. clients through an LLC. An e-commerce entrepreneur in Germany wants to access the US market without relocating. A consultant in Australia seeks asset protection while serving American customers. Each scenario raises the question of which state is best for an LLC for non-resident entrepreneurs.

Understanding which state is best for an LLC for non-resident business owners requires examining state laws, filing requirements, and ongoing compliance obligations. No single state provides universal advantages for all non-resident situations.

This guide explains the factors commonly considered when evaluating states for the formation of a non-resident limited liability company and clarifies when state selection may have limited practical impact.

Key Takeaways

-

Formation eligibility is universal: U.S. citizenship or residency is not required to form an LLC in any state, making business formation accessible to international entrepreneurs seeking to access the US market.

-

The operating state often matters more than the formation state: When your LLC maintains physical presence or conducts substantial business activities in a specific state, you'll typically face tax obligations and compliance requirements there regardless of where you originally formed.

-

Foreign qualification creates dual compliance burdens: Forming an LLC out of state while operating elsewhere usually requires foreign entity registration, separate registered agents, and ongoing costs in both states that often exceed any initial savings from choosing low filing fee jurisdictions.

-

Tax advantages depend on actual business location: States without personal income tax or corporate income tax only provide benefits when your LLC's business activities occur primarily within those states—formation state selection alone doesn't reduce your tax burden.

-

Federal requirements apply uniformly: All non-resident LLC owners face the same federal obligations including obtaining an Employer Identification Number from the Internal Revenue Service and meeting federal tax reporting requirements, regardless of formation state choice.

-

Registered agent services are essential for non-residents: Every LLC must maintain a registered agent with a physical address in its formation state, making commercial registered agent services a necessary ongoing cost for non-resident business owners.

-

Professional guidance protects against costly mistakes: The complexity of multi-state compliance, tax implications, and foreign qualification requirements makes professional administrative support valuable for navigating unfamiliar U.S. state requirements and avoiding penalties.

Can a Non-Resident Form an LLC in the U.S.?

The question "Is a non-US resident required to form an LLC?" reflects common confusion about eligibility. U.S. citizenship or residency is not required to form an LLC in any U.S. state. Non-residents can legally establish limited liability companies and operate businesses serving the US market without residing in the United States.

Business formation procedures require a registered agent with a physical address in the state of formation, Secretary of State filings, and a federal tax identification number, regardless of the owner's residency status.

Federal requirements apply uniformly, including the need to obtain an Employer Identification Numbers from the Internal Revenue Service. A professional service can streamline this process, ensuring that all documentation and filings meet federal standards while helping you stay fully compliant from the start. State-level requirements vary regarding formation fees, ongoing compliance, and privacy protections.

Key Factors That Affect State Choice

Businesses commonly evaluate states based on administrative and legal factors rather than on owners' nationalities. These considerations affect ongoing costs and compliance burdens regardless of residency status.

State Filing and Ongoing Fees

States vary significantly in formation costs and annual or biennial maintenance requirements. State fees range from under $100 to several hundred dollars for initial filing, with ongoing costs including annual reports, franchise taxes, or renewal fees.

Some states charge flat annual fees while others impose franchise taxes calculated based on revenue, capital, or other metrics. Understanding total annual costs, including state fees and registered agent expenses, helps assess the true ongoing financial obligations.

Low-cost states appeal to budget-conscious entrepreneurs, while higher-cost states may offer perceived advantages in legal frameworks or market reputation. Name availability searches are the initial step in formation processes across all jurisdictions.

Registered Agent Requirement

Every LLC must maintain a registered agent with a physical street address in its state of formation. This requirement applies uniformly to resident and non-resident-owned entities.

Registered agents receive legal documents, official state correspondence, and compliance notifications on behalf of the LLC. Non-residents typically hire commercial registered agent services when they lack a physical address in the state of formation.

Annual registered agent costs generally range from $50 to $200, depending on the state and service provider. This recurring expense, along with state-mandated filing fees, should be factored into total annual cost calculations.

Business Activity Location

State laws on "doing business" determine when LLCs must register in states other than their formation jurisdiction. Physical business presence, including offices, employees, or inventory, typically triggers registration requirements in active states.

The question "Do I need to register my LLC in every state I sell in?" generally receives a no answer. Selling products or services to customers located in various states does not, by itself, constitute doing business requiring registration in those states.

Physical nexus creates registration obligations. Understanding when business activities trigger foreign qualification requirements helps avoid the consequences of forming an LLC out of state without proper multi-state compliance.

Commonly Discussed States for Non-Resident LLCs

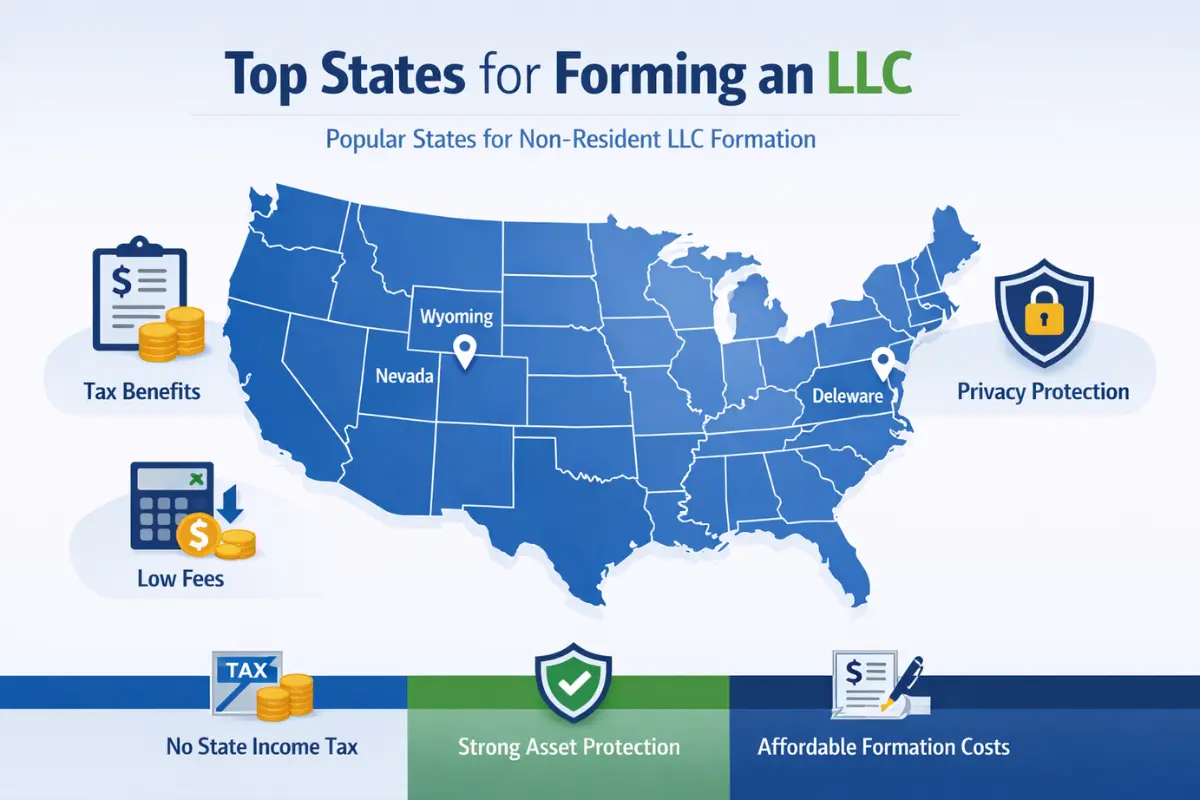

Several states are frequently mentioned in discussions of non-resident LLC formation. These states share characteristics that commonly appeal to businesses operating without a U.S. physical presence.

Delaware

Delaware is known for business laws that favor corporations and for an established legal system that addresses business disputes. The [Delaware Division of Corporations] serves over one million businesses, including more than 66% of Fortune 500 companies. One reason these businesses prefer the state is that it allows them to reduce tax liability in multiple ways.

The Court of Chancery specializes in business law matters and provides a predictable body of legal precedents. This specialized court system appeals to companies with investors or multi-state operations seeking established legal frameworks.

Delaware charges a $90 formation fee plus a $300 annual franchise tax, regardless of business activity or income level. The Delaware vs Wyoming LLC for small business comparison centers partly on this mandatory annual franchise tax that Wyoming avoids.

Privacy protections allow LLC member names to remain off public records when properly structured. The state's reputation among banks and investors provides advantages for businesses seeking financing or venture capital funding.

Wyoming

Wyoming offers straightforward LLC administration and no state income tax on business earnings. Annual report fees total $60, substantially lower than many states, including Delaware's $300 franchise tax.

Strong privacy provisions keep member information from public records. Asset Protection statutes provide charging order protection for single-member and multi-member LLCs, making Wyoming discussions common regarding the best state to form an LLC for anonymity and privacy.

Low ongoing costs appeal to small online businesses and entrepreneurs operating remotely. Formation fees are approximately $100, with minimal ongoing compliance beyond annual reports and registered agent maintenance.

The single-member LLC asset protection by state analysis often highlights Wyoming's explicit statutory protections for single-member entities, addressing concerns that some states treat them differently from multi-member LLCs.

Nevada

Nevada provides business statutes and no state income tax, though state fees and compliance requirements still apply. Annual list fees approximate $150 to $200 for business license maintenance.

The state requires annual list submissions identifying officers and members, which are filed with the Secretary of State, though this information is not fully public. Formation fees start around $425, higher than in Wyoming or Delaware.

Nevada discussions emphasize its tax-free status and business laws that favor corporations, making it sometimes considered for businesses expecting U.S.-based operations or significant domestic revenues.

Federal Requirements That Apply Regardless of State

Certain requirements apply uniformly across formation state selections, affecting all non-resident-owned LLCs similarly.

EIN Requirement

Most LLCs with non-resident owners require an Employer Identification Number from the Internal Revenue Service. EINs are federal tax identification numbers required to file tax returns, open bank accounts, and conduct various business activities.

Non-residents typically apply for EINs by submitting Form SS-4 to the IRS. The process does not require U.S. Social Security Numbers, though it involves additional steps compared to resident applications.

EIN requirements exist independently of state formation choices. All states recognize federal EINs as primary business identification for tax purposes.

Federal Tax Reporting

Federal tax obligations depend on LLC structure, activities, and income sources, rather than on the state of formation. Non-resident owners typically face taxation on income effectively connected with U.S. trade or business.

Pass-through taxation means LLC income passes to owners' personal returns in most cases. Non-resident owners may have additional reporting requirements, including Form 5472 for certain foreign-owned entities.

Tax treaty provisions between the United States and the owners' home countries may affect their tax treatment. Professional tax guidance proves essential for understanding specific federal tax obligations based on individual circumstances.

When State Choice May Be Less Important

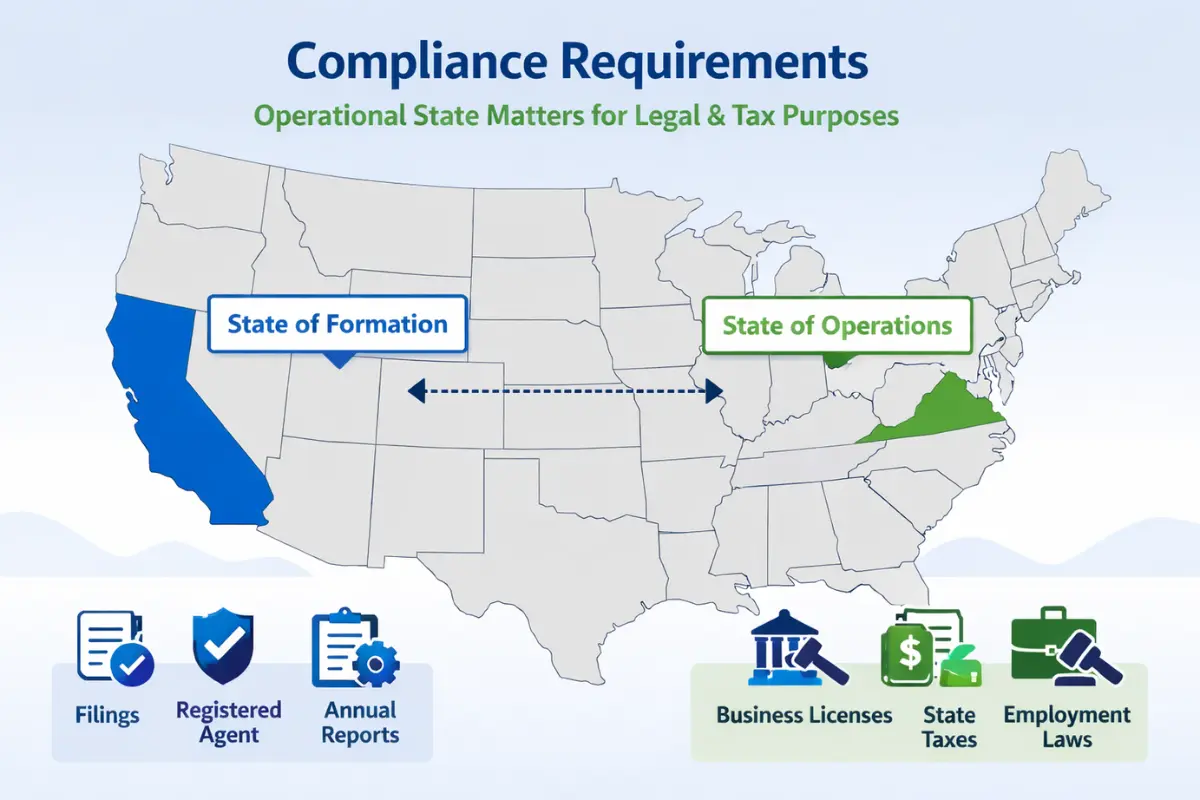

For many businesses, the state where activities occur matters more than the state of formation, given foreign qualification and compliance requirements.

Conducting Business in a Different State

Understanding how to avoid the foreign qualification LLC trap requires recognizing when business activities trigger registration requirements in states outside the formation jurisdiction. LLCs conducting business in states other than formation states typically face registration obligations in activity states.

"Doing business" definitions vary by state but generally include maintaining a physical presence, employing workers, owning property, or conducting substantial ongoing business activities. Temporary or isolated transactions typically do not trigger registration requirements.

The consequences of forming an LLC out of state for operating in another state include mandatory foreign qualification, dual compliance obligations, and potential penalties for operating without proper registration.

Foreign Qualification Requirements

Foreign qualification is the process by which LLCs register to operate in states other than their formation state. This common administrative requirement varies by state but typically involves filing certificates of authority, appointing registered agents, and paying registration fees.

Foreign qualification costs generally approximate initial formation costs, creating dual filing expenses. Virtual addresses cannot substitute for physical registered agent addresses required in each registration state.

States impose foreign qualification requirements on LLCs conducting business within their borders, regardless of where the entities were originally formed. These requirements apply uniformly to resident and non-resident-owned entities.

Ongoing Compliance in the Operating State

Once registered to do business in a state through foreign qualification, LLCs must generally meet that state's ongoing filing and reporting obligations. This includes annual reports, business license renewals, and other compliance requirements.

Operating-state compliance often equals or exceeds formation-state requirements, making formation-state selection less impactful for businesses that must qualify elsewhere. The LLC formation-state vs. operating-state tax analysis recognizes that LLCs pay taxes where income is earned, not merely where formed.

States tax income from sources within their borders. LLCs with substantial business activities in operating states typically face tax obligations there regardless of their formation state.

Additional Costs and Administrative Complexity

Operating in multiple states involves additional state fees, filing requirements, and recordkeeping obligations. Each qualified state requires separate registered agents, annual reports, and compliance monitoring.

Operating agreements help establish management structures regardless of the formation or operating state.

Maintaining good standing in multiple states requires tracking different deadlines, fee structures, and filing requirements. Administrative complexity increases proportionally with the number of states where LLCs maintain registrations.

The New York LLC publication requirement cost exemplifies state-specific regulations adding substantial expenses. New York requires publication of formation notices in newspapers, resulting in costs ranging from $1,000 to $2,000, depending on the county.

Why the Formation State May Have Limited Impact

When most business activities occur in a single state, practical compliance requirements in that state often outweigh the theoretical advantages of forming elsewhere. Businesses with physical presence in specific states generally benefit most from forming directly in operating states.

Formation state selection primarily matters for businesses without substantial U.S. physical presence or those operating genuinely across multiple states. Single-state businesses reduce costs and simplify administration by forming in a single state.

Remote online businesses without U.S. offices are situations in which formation-state selection carries greater significance. Business structure comparisons help evaluate whether LLC formation meets operational needs.

Administrative Support for Non-Resident LLCs

Professional filing and compliance services help manage formation documents, registered agent requirements, and ongoing state filings. These services cannot provide legal or tax advice but handle administrative aspects of maintaining compliance across jurisdictions.

Formation services assist with document preparation, filing submissions, and deadline tracking. Registered agent services ensure reliable receipt and forwarding of official correspondence and legal documents.

Compliance monitoring services track jurisdiction-specific requirements and alert businesses to upcoming deadlines. These administrative services prove particularly valuable for non-residents navigating unfamiliar U.S. state requirements.

Contact InCorp to learn how administrative services can support LLC formation and ongoing compliance for non-resident business owners.

Conclusion & Next Steps

No single state provides universal "best" status for all non-resident LLCs. State selection depends on factual considerations, including business location, compliance requirements, and administrative preferences.

Businesses conducting activities primarily in a single U.S. state typically benefit from forming and operating in a single state to avoid foreign qualification expenses and dual compliance. Remote businesses without a U.S. physical presence consider formation states based on fees, privacy, and administrative simplicity.

Individual circumstances vary significantly. Formation state selection is one of many factors affecting business success and compliance costs. Professional guidance helps evaluate specific situations and make informed decisions based on actual business activities and goals.

FAQs

Do non-resident LLC owners need a U.S. bank account?

A U.S. bank account is not legally required to form an LLC. However, many banks require in-person verification and specific documentation to open accounts. Non-residents often face challenges opening traditional bank accounts without a U.S. physical presence. Some financial service providers offer remote account opening for non-resident business owners, though requirements and availability vary. Banking needs depend on business activities and payment-processing requirements, rather than on state formation.

Can a non-resident own 100% of an LLC?

Yes. U.S. law allows LLCs to be fully owned by non-U.S. residents or foreign entities. No citizenship or residency requirements restrict LLC ownership percentages. Single-member LLCs with sole non-resident owners operate commonly. Ownership structure affects federal reporting requirements, not formation eligibility. Some foreign-owned LLCs face additional information-reporting obligations depending on their ownership structure and business activities.

Is a U.S. address required for the LLC owner?

No. LLC owners do not need U.S. addresses. The LLC itself must maintain a registered agent with a physical address in the state of formation, but this requirement applies to the business entity rather than to individual owners. Non-resident owners typically use international addresses for personal information. Registered agent services provide the required U.S. addresses for legal correspondence, allowing owners to avoid personal U.S. addresses.

Do non-resident LLCs have additional reporting obligations?

Some non-resident-owned LLCs may be subject to additional federal information reporting, depending on their ownership structure and activities. Foreign-owned single-member LLCs disregarded for tax purposes may need to file Form 5472 disclosing transactions with foreign owners. Partnership-taxed LLCs with foreign partners have different reporting requirements. Specific obligations depend on ownership structure, business activities, and applicable tax treaties, rather than on the state of formation.

How do state income tax laws affect non-resident LLC owners?

State income tax treatment varies significantly for non-resident LLC owners. Some states impose no state income tax on business income, making them attractive for remote businesses without physical presence in any particular state. However, LLCs typically pay income taxes in states where they conduct business activities, regardless of formation state. Pass-through taxation means LLC profits flow to the owners' personal tax returns, but non-residents generally only face state income tax obligations in states where the LLC maintains physical presence or substantial business operations. The formation state's tax advantages often become irrelevant once you establish physical presence elsewhere, as most states tax income generated within their borders. Professional tax guidance helps navigate which states may tax your business income based on your specific activities and ownership structure.

What tax benefits can non-resident LLC owners actually expect?

Tax benefits for non-resident LLC owners depend primarily on business activities rather than formation state selection. Pass-through taxation allows LLC income to flow directly to the owners' personal tax returns, avoiding the double taxation that C corporations face with both corporate income tax and dividend taxation. However, non-residents should understand that federal tax purposes and requirements apply uniformly regardless of which state hosts the LLC formation. States without corporate tax or personal income tax provide advantages only when the LLC's business activities occur primarily in those jurisdictions. Once you establish physical presence or conduct substantial business in other states, you typically face tax obligations there regardless of your formation state's tax laws. The most significant tax implications come from where you actually operate, not merely where you file formation documents.

How does forming an LLC out of state affect ongoing costs and compliance?

Forming an LLC out of state initially appears cost-effective when comparing filing fees between low-cost and high-cost states. However, ongoing costs often exceed initial formation fees when businesses must qualify as a foreign entity in their actual operating state. Foreign LLC registration typically requires paying additional filing fees, appointing separate registered agents in each state, and maintaining dual compliance with annual report requirements and ongoing fees in both the formation and operating states. Annual fees, registered agent costs, and compliance obligations in the operating state frequently equal or exceed those in the formation state. The cumulative tax burden and administrative complexity of maintaining good standing in multiple states often eliminates any savings from choosing low initial filing fee states. Businesses conducting activities primarily in one state typically minimize ongoing costs by forming directly in their operating state rather than creating foreign LLC obligations elsewhere.

Can non-residents open a US business bank account for their LLC?

Opening a US business bank account presents challenges for non-resident LLC owners, though it's not legally impossible. Most traditional banks require in-person visits and extensive documentation, including passport verification, proof of business formation, Employer Identification Number from the Internal Revenue Service, and sometimes proof of physical address in the United States. Some banks specifically serve non-residents and offer remote account opening, though requirements vary significantly between institutions. Having a registered agent with a physical address in your formation state helps but doesn't guarantee bank account approval. Alternative financial services and online banking platforms may provide more accessible options for managing business finances remotely. The banking challenges exist regardless of formation state selection, though banks sometimes view Delaware and Wyoming LLCs more favorably due to those states' business formation reputations. Professional services can provide guidance on banking options specifically available to non-resident business owners.

What ownership structure works best for non-resident LLCs?

Ownership structure flexibility represents a key advantage of the limited liability company form for non-residents. LLCs accommodate single-member and multi-member configurations, with LLC members maintaining limited liability protection regardless of citizenship or residency requirements. Non-residents can own 100% of an LLC without restriction, and LLC owners may include individuals, corporations, or other entities from any country. However, ownership structure affects federal reporting obligations and tax forms required. Foreign-owned single-member LLCs disregarded for federal tax purposes may face additional information reporting requirements. Multi-member LLCs with foreign partners have different tax implications and reporting obligations. The operating agreement should clearly define profit distribution, management authority, and membership rights regardless of members' residency status. Consult tax professionals familiar with international business structures to determine which ownership configuration minimizes your specific tax burden while meeting your business goals and protecting the company's assets from personal liabilities.

Disclaimer: This content is intended for general educational and informational purposes only and does not constitute legal, tax, or accounting advice. Every effort is made to keep the information current and accurate; however, laws, regulations, and guidance can change, and no representation or warranty is given that the content is complete, up to date, or suitable for any particular situation. You should not rely on this material as a substitute for advice from a qualified professional who can consider your specific facts and objectives before you make decisions or take action.

Share This Article:

Stay in the know!

Join our newsletter for special offers.