US LLC Benefits for International Founders - An Essential Guide

A software developer in India seeks credibility with U.S. clients. An e-commerce entrepreneur in Brazil wants access to payment processors. A consultant in Germany plans to serve U.S. corporate clients. Each scenario involves understanding LLC Benefits for international founders.

Understanding LLC Benefits helps international entrepreneurs evaluate whether U.S. limited liability company structures align with business goals. The US LLC benefits for international founders include liability protection, market access, and tax advantages.

This guide explains five core benefits and essential compliance considerations when forming a US LLC as a non-resident.

Key Takeaways

-

A U.S. LLC can significantly boost credibility with global clients, banks, payment processors, and enterprise partners, making it easier for non‑U.S. founders to win contracts, open accounts, and be taken seriously as a professional business.

-

International entrepreneurs can gain direct access to U.S. banking and major payment platforms (like Stripe and PayPal) by forming a domestic entity and obtaining an EIN, which is often difficult or impossible using only a foreign company.

-

The LLC structure helps protect owners’ personal assets from most business debts and lawsuits, but this protection depends on proper compliance—separate bank accounts, clean records, and avoiding commingling or informal “shadow” operations.

-

In many cases where there is no U.S. office, employees, or U.S.-source income, a foreign‑owned, single‑member LLC taxed as a disregarded entity may owe no U.S. federal income tax, although owners still must report and pay tax in their home country and should confirm details with qualified tax advisors.

-

LLCs give non‑resident owners flexible, relatively simple operations compared to corporations, without board or officer requirements, while still requiring core compliance steps such as state formation, a registered agent, an EIN, a U.S. address for certain activities, and timely annual reports.

-

Foreign‑owned U.S. LLCs have serious federal reporting obligations, including possible Form 5472 and pro forma Form 1120 filings with steep penalties for non‑compliance, along with new beneficial ownership reporting rules that require disclosing who ultimately owns or controls the company.

-

Forming a U.S. LLC does not create any immigration status or work authorization, so non‑U.S. founders must pursue appropriate visa options separately if they plan to live or work in the United States.

The 5 Core Benefits of a US LLC

International founders commonly cite specific advantages when evaluating the US LLC structure for international entrepreneurs.

1. Unmatched Global Business Credibility

Registration in the world's largest economy provides instant credibility with international clients, suppliers, and payment platforms. The question "Can non-US residents form an LLC?" receives a yes answer, and this U.S. business presence enhances perceived legitimacy.

Foreign entities often face heightened scrutiny from European banks and financial institutions. A U.S. LLC registration signals established business operations and reduces friction in commercial relationships. Payment processors, vendors, and corporate clients often prefer to work with U.S.-registered entities rather than foreign businesses.

Market credibility extends beyond perception to practical business advantages. U.S. registration facilitates partnerships, simplifies contract negotiations, and opens doors to opportunities unavailable to purely foreign entities. This credibility advantage proves particularly valuable when entering competitive markets or pursuing enterprise clients. Business structure comparisons help evaluate whether LLC formation meets operational requirements.

2. Access to US Financial Systems

The LLC structure simplifies access to critical U.S. financial infrastructure. Opening U.S. business bank accounts is substantially easier with domestic entity status than with foreign business registration.

Major global payment processors, including Stripe, PayPal, and similar platforms, often require U.S. entities for account approval. This access to payment processing is essential for businesses serving American customers or conducting transactions in U.S. dollars.

Future capital access improves with U.S. entity status. Investors and crowdfunding platforms typically prefer funding domestic entities, making LLC registration valuable for businesses planning eventual fundraising. Entity structure affects investor appeal and funding options.

Banking relationships established through U.S. LLCs provide operational flexibility unavailable to foreign entities. Domestic banking facilitates smoother transactions and reduces international transfer fees.

3. Liability Protection for Personal Assets

The fundamental LLC benefit is the separation of business and personal legal liability. LLCs function as distinct legal entities, shielding owners' personal assets, including homes and savings, from business debts, lawsuits, and liabilities.

This liability protection represents a core reason international founders choose LLC structures. Business creditors typically cannot pursue owners' personal assets to satisfy LLC obligations, provided proper corporate formalities are maintained.

Understanding US LLC requirements for foreign owners includes recognizing that liability protection depends on maintaining proper separation between business and personal activities. Commingling funds or failing to observe corporate formalities can eliminate protection benefits.

Limited liability proves particularly valuable for international founders operating in unfamiliar legal systems. The LLC structure provides predictable protection frameworks recognized throughout U.S. commerce.

4. Tax Efficiency (The 0% Federal Income Tax Advantage)

A powerful tax concept applies to foreign-owned LLCs classified as disregarded entities. When LLCs have no U.S. physical presence, including offices or employees, and earn only foreign-sourced income, the LLC typically faces no U.S. federal income tax liability.

Income passes through the LLC and becomes taxable only in the owners' home countries. This pass-through taxation avoids double taxation scenarios. Tax treaties between the United States and many countries clarify the taxation treatment.

The tax implications of this structure prove substantial for qualifying businesses. Foreign-sourced income remains untaxed by U.S. authorities when LLCs maintain no domestic nexus. However, specific requirements apply, making professional tax guidance essential.

Tax implications vary based on income sources, business activities, and applicable tax treaties. International founders should consult tax professionals familiar with cross-border taxation.

5. Operational Flexibility and Simplicity

LLC structures offer greater flexibility than traditional corporations. S Corporations restrict ownership to U.S. citizens and permanent residents, making them unavailable for international founders. C-Corporations require mandatory annual board meetings and designated officers.

LLCs operate with simpler structures, with owners called members and greater managerial flexibility. No mandatory board meetings or officer requirements apply.

Operating agreements establish management structures without rigid corporate formality requirements.

This operational simplicity proves valuable for international founders managing a US LLC from outside the United States.

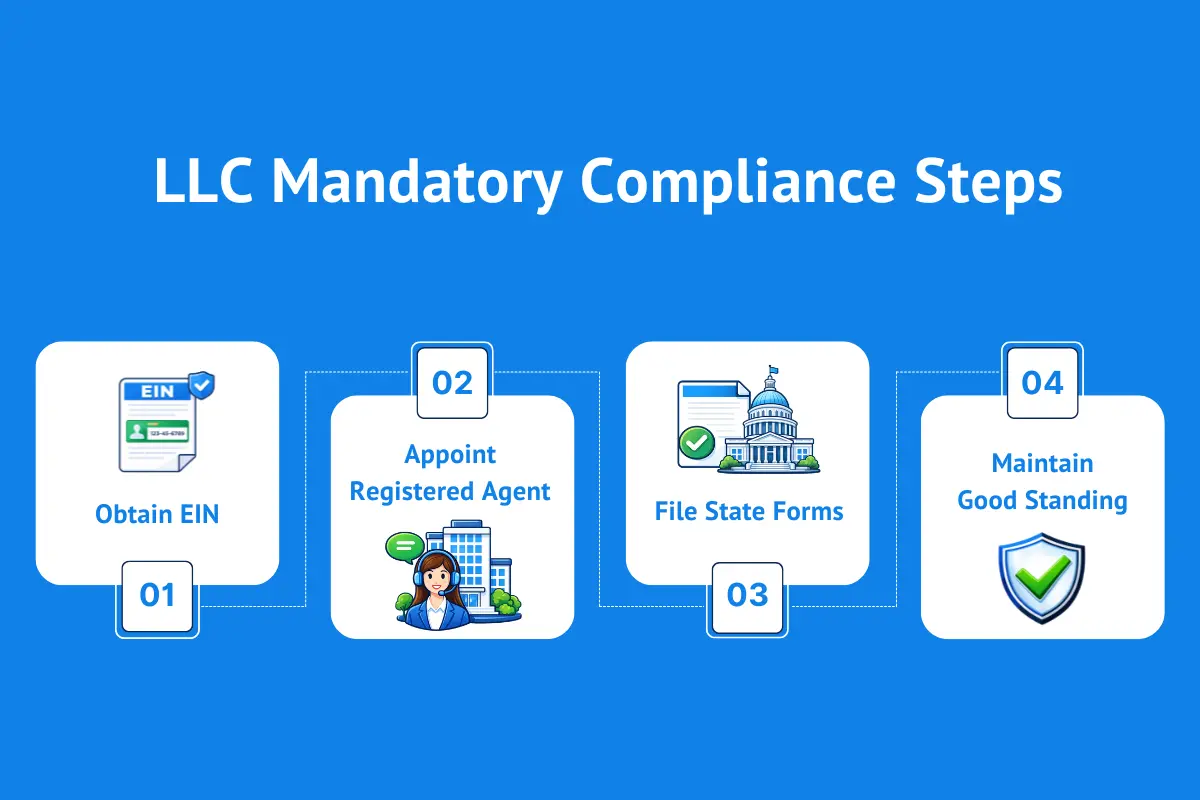

Essential Compliance and Considerations (Mandatory Steps)

Visa options remain separate from LLC formation. Forming U.S. LLCs does not grant automatic immigration status or residency. Visa options for entrepreneurs require separate applications.

Forming the LLC Under State Law

LLCs must be formally created by filing formation documents with the chosen U.S. state. The State of incorporation determines which state's laws govern an LLC's operations, member relationships, and dissolution procedures.

Articles of Organization filed with the Secretary of State create the LLC as a legal entity. Filing fees vary by state from approximately $50 to several hundred dollars. Processing times range from immediate to several weeks, depending on jurisdiction and filing method.

LLC formation requires selecting a business name, designating a Registered Agent address, and providing basic ownership information. Common formation mistakes include inadequate research and improper documentation.

Appointing a Registered Agent in the United States

Every U.S. LLC must designate a Registered Agent with a physical address in the state of formation to receive official government and legal documents. The registered agent requirement for foreign LLC owners applies uniformly to domestic and international founders.

Registered Agent services maintain physical addresses where process servers deliver legal notifications during business hours. This mandatory requirement cannot be satisfied through post office boxes or mail forwarding services.

Professional Registered Agent selection involves evaluating reliability, communication methods, and service quality. Commercial Registered Agent services charge annual fees typically ranging from $50 to $200.

The Registered Agent requirement persists throughout the LLC's existence. Changing Registered Agent providers or addresses requires filing updates with state authorities.

Obtaining an Employer Identification Number (EIN)

An Employer Identification Number is required for tax reporting, banking, and federal identification purposes. The EIN requirements for foreign owned LLC specify that international founders can obtain EINs without U.S. Social Security Numbers.

Form SS-4 provides the application mechanism for Employer Identification Number requests. International applicants typically submit Form SS-4 by mail or fax rather than through online systems restricted to applicants with Social Security Numbers.

Processing times for international Form SS-4 submissions typically range from four to eight weeks. This timeline affects downstream activities, including bank account opening and payment processor registration, that require EIN documentation.

The Employer Identification Number serves as the LLC's federal tax identifier throughout its existence. EINs cannot be changed or transferred between entities.

Maintaining a U.S. Business Address (When Required)

While LLC ownership can be foreign, certain activities require U.S. business or mailing addresses. Banking institutions and some service providers mandate domestic addresses for account establishment and correspondence.

Virtual address services provide U.S. mailing addresses for businesses without physical offices. These services receive mail and forward it to international locations, satisfying address requirements for various business purposes.

Address requirements vary by institution and service. Some banks accept virtual addresses while others require physical office locations. Understanding specific requirements before selecting address solutions helps prevent complications during account setup.

Filing Annual Reports and State-Required Filings

Understanding annual report filing requirements for US LLCs is essential to maintaining good standing for foreign-owned US LLCs. Most states require periodic reports and fees to keep LLCs active and compliant.

Annual report requirements vary by state, including filing deadlines, fee amounts, and required information. Some states mandate annual filings, while others require biennial submissions. Missing filing deadlines results in penalties, late fees, and potential administrative dissolution.

The US LLC compliance requirements for non-citizens mirror those for domestic owners with respect to state-level filings.

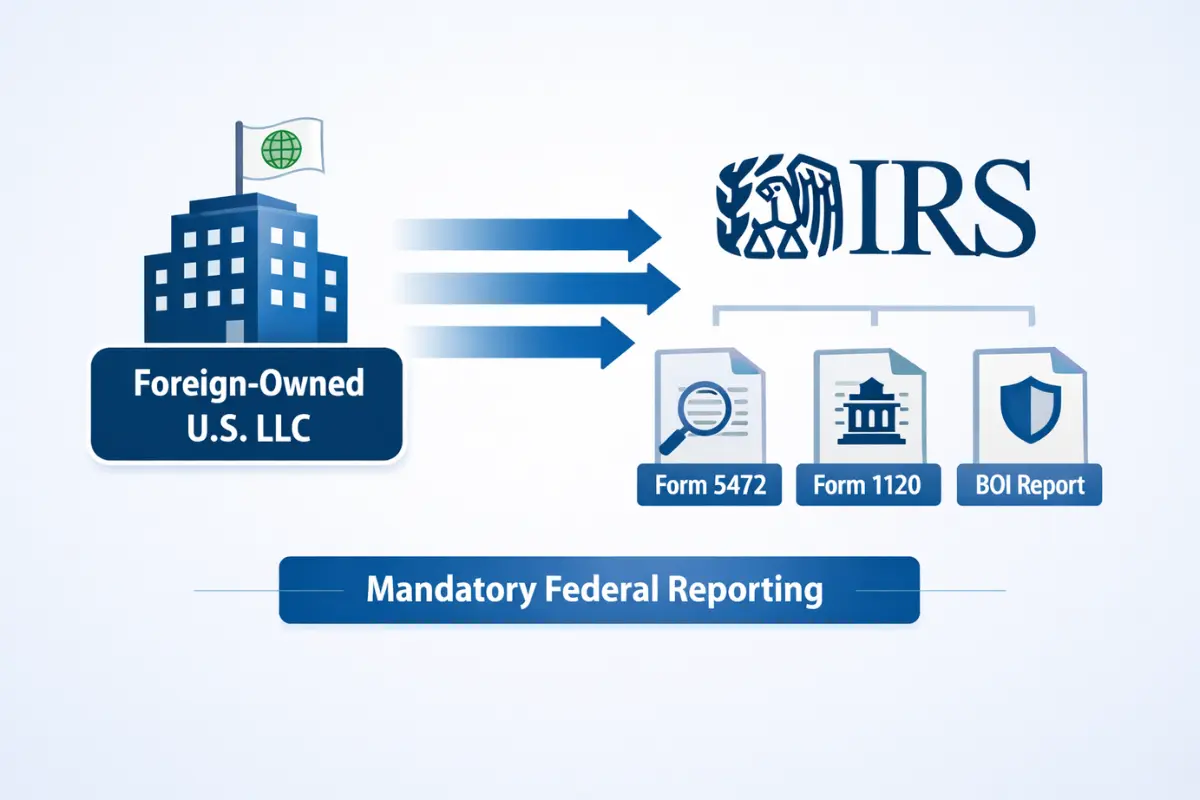

Federal Tax Reporting Obligations for Foreign-Owned LLCs

Understanding federal reporting obligations for foreign-owned LLCs is critical to avoiding substantial penalties. Foreign-owned U.S. LLCs face specific federal reporting requirements even when generating no income.

Form 5472 must be filed annually by foreign-owned domestic corporations and certain disregarded entities. Form 5472 carries $25,000 penalties for late filing, among the most severe information return penalties in the U.S. tax code.

Form 5472 filings require the accompanying pro forma Form 1120 corporate tax return, even when LLCs are classified as disregarded entities for tax purposes.

For foreign tax-exempt organizations claiming exemptions from withholding due to tax-exempt status or claiming withholding at four percent rates, Form W-8 EXP must be provided.

Complying With Beneficial Ownership and Disclosure Rules

U.S. law requires disclosure of ownership information to government authorities under applicable regulations. Beneficial ownership reporting: US LLC foreign owners' obligations apply to entities formed or registered to conduct business in the United States.

These disclosure rules require identifying individuals who own or control entities. Beneficial owners include anyone who owns or controls at least 25 percent of the entity's ownership interests.

Keeping Business and Personal Activities Separate

LLCs function as separate legal entities and must maintain distinct records and activities from owners. Proper separation preserves liability protection.

Commingling business and personal funds undermines LLC liability protection. Separate bank accounts and distinct accounting records prove essential for maintaining entity separation.

Ready to Form Your US Gateway?

The U.S. LLC represents a professional and potentially tax-efficient legal structure for international online entrepreneurs. However, benefits depend on strict compliance with IRS reporting requirements, particularly those for Form 5472.

Understanding US LLC legal requirements for overseas founders extends beyond formation to ongoing compliance. Success requires attention to federal and state obligations throughout the LLC's existence.

InCorp provides administrative support for LLC formation and ongoing compliance requirements. Professional services help international founders navigate U.S. regulatory requirements.

Contact InCorp to learn how formation and compliance services can support international founders establishing a U.S. business presence.

FAQs

Do I need a Social Security Number (SSN) or ITIN to form a US LLC?

No. U.S. Social Security Numbers or Individual Taxpayer Identification Numbers are not required for LLC formation. International founders can form LLCs and obtain an Employer Identification Number using valid passports. The EIN requirements for foreign-owned LLCs allow applications via Form SS-4 without SSN or ITIN documentation.

Will I be double-taxed by the US and my home country?

Generally, no, if the LLC earns foreign-sourced income without a U.S. presence or customers. LLCs with no domestic offices, employees, or U.S.-source income typically face no U.S. federal income tax. Income becomes taxable only in the owners' home countries. Tax treaties between the United States and many countries clarify the taxation treatment. However, tax implications vary based on specific circumstances. Professional tax guidance proves essential.

Can a US LLC help me get a U.S. work visa?

No. Forming a US LLC as a non-resident does not grant automatic immigration status or visa rights. LLC ownership remains separate from immigration status. Visa options require separate applications through the U.S. immigration process. Entrepreneurs seeking U.S. work authorization must pursue appropriate visa options, including E-2, O-1, or International Entrepreneur Parole. LLC formation alone does not provide immigration benefits.

What is the penalty for not filing IRS Form 5472?

The penalty proves severe. Failure to file Form 5472 and accompanying pro forma Form 1120 results in statutory fines of $25,000 per year for each year missed. This is one of the harshest information-return penalties in the U.S. tax code. The federal reporting obligations for foreign-owned LLCs include the timely submission of Form 5472 to avoid substantial penalties.

Can I open a US bank account remotely?

Yes, though processes vary by institution. Traditional banks historically required in-person visits, but many modern financial platforms, including Mercury and Brex, allow non-resident owners to open U.S. business bank accounts remotely after obtaining an EIN. However, documentation requirements remain substantial, including LLC formation documents, confirmation of the Employer Identification Number, and identification verification.

Do foreign founders pay both U.S. and home country taxes on LLC income?

Foreign entrepreneurs may avoid double taxation if their LLC has only non‑U.S. source income and no U.S. trade or business, in which case the U.S. generally does not tax that business income, though home‑country tax still applies. Tax treaties can reduce or eliminate U.S. tax on certain income, but owners must review applicable treaty provisions and coordinate with local rules to determine their overall tax burden and compliance obligations.

How do tax treaties affect a foreign‑owned U.S. LLC's tax obligations?

Tax treaties can provide reduced U.S. withholding tax rates or exemptions on certain types of income, such as interest or royalties, when the owner qualifies as a resident of a treaty country and meets limitation‑on‑benefits rules. To claim treaty benefits, foreign business owners typically must provide the correct IRS forms (such as Form W‑8BEN or W‑8BEN‑E) and may need to file Form 8833 when a treaty position overrides normal Internal Revenue Code rules.

If a foreign‑owned LLC hires employees in the United States, what tax responsibilities apply?

Once a U.S. LLC hires employees, it generally must withhold and remit federal income tax, Social Security and Medicare taxes, and any applicable state payroll taxes on employee wages, regardless of the owner's residence. Employers must also handle payroll tax reporting (for example, Forms W‑2 and 941, and state equivalents) and apply special withholding rules when paying nonresident alien employees, which often require additional documentation and treaty analysis.

Do foreign owners of a single‑member U.S. LLC need an Employer Identification Number even if no U.S. tax is due?

Yes, foreign‑owned single‑member LLCs that are treated as disregarded entities generally must obtain an Employer Identification Number to meet federal information reporting obligations, including Form 5472 and its associated pro forma Form 1120. These reporting obligations can apply even when the LLC has no effectively connected income or U.S. income tax liability, and failure to file can trigger penalties starting at $25,000 per year.

When might a C corporation be a better structure than an LLC for international founders?

For foreign founders seeking venture capital or planning to issue equity to multiple investors, a U.S. C corporation is often preferred because many institutional investors and VC funds are structured to invest in corporations rather than pass‑through entities. A C Corp pays its own corporate income tax, which can increase overall tax exposure compared to an LLC, but it may provide better access to capital markets and clearer rules for stock, options, and intellectual property ownership under the U.S. legal framework.

Disclaimer: This content is intended for general educational and informational purposes only and does not constitute legal, tax, or accounting advice. Every effort is made to keep the information current and accurate; however, laws, regulations, and guidance can change, and no representation or warranty is given that the content is complete, up to date, or suitable for any particular situation. You should not rely on this material as a substitute for advice from a qualified professional who can consider your specific facts and objectives before you make decisions or take action.

Share This Article:

Stay in the know!

Join our newsletter for special offers.