Benefits of LLC vs Sole Proprietorship: Which Business Structure Is Right for You?

Starting a business means making foundational decisions that shape your venture's future. Among the most important is selecting your business structure. Many entrepreneurs weigh two popular options: the limited liability company and the sole proprietorship. Each offers distinct advantages, but understanding which aligns with your goals can determine your business's long-term success and protection.

The benefits of LLC vs sole proprietorship extend far beyond simple paperwork differences, affecting everything from personal asset protection to tax obligations and long-term growth potential. Based on 2022 Census data, 7.36% of businesses in the United States are sole proprietorships (611,049 out of 8,298,562 total businesses), making it a popular choice for many new business owners.

This guide examines the advantages of LLC over sole proprietorship, explores tax considerations, and helps entrepreneurs determine which structure aligns with their business goals.

InCorp is not a law firm and does not provide legal or financial advice. This information is educational. Readers should consult with qualified legal professionals.

Key Takeaways

-

LLCs provide personal asset protection by creating a legal separation between your business and personal finances, shielding your home, savings, and other assets from business debts and lawsuits.

-

Sole proprietorships offer simplicity and low costs with minimal startup requirements, no formation fees, and straightforward tax reporting directly on your personal return using Schedule C.

-

LLCs offer greater tax flexibility through the ability to elect S corporation or C corporation status, potentially reducing self-employment tax obligations as your business grows.

-

Business credibility matters – LLCs typically command more respect from customers, vendors, and lenders, which can lead to better payment terms, partnership opportunities, and access to funding.

-

Starting small and scaling up is common – many entrepreneurs begin as sole proprietors to test their business concept, then convert to an LLC once revenue increases and liability risks become more significant.

-

The right choice depends on your specific situation – consider your industry's liability risks, growth plans, funding needs, and administrative capacity when deciding between these two business structures.

Understanding LLCs and Sole Proprietorships

Before evaluating the benefits of each structure, entrepreneurs need to understand the key differences between these two common business formation options. The choice between forming an LLC or operating as a sole proprietorship shapes how your business handles liability, taxation, and compliance requirements.

What Is an LLC?

A limited liability company is a legal entity separate from its owners, providing a hybrid structure that combines liability protection with operational flexibility. LLCs shield members from personal liability for business debts and legal claims, so creditors typically cannot pursue personal assets such as homes or savings accounts to satisfy business obligations.

LLCs support various ownership structures, from single-member to multi-member. Management flexibility remains a key feature, allowing members to manage the company directly or appoint managers to handle daily operations. For entrepreneurs comparing different entity types, understanding how LLCs differ from S corporations and C corporations helps clarify which structure best fits their specific business needs.

What Is a Sole Proprietorship

A sole proprietorship represents the simplest business structure available to entrepreneurs. This unincorporated business type creates no legal distinction between the owner and the business itself. The owner receives all profits, maintains complete control over business decisions, and bears full responsibility for all debts, losses, and liabilities.

Setting up a sole proprietorship requires minimal formalities. Business owners typically need only basic local licenses or permits to begin operations. Income flows directly to the owner's personal tax return, eliminating separate business tax filings in most cases. According to Bank of America's overview, sole proprietorships remain popular among service providers and small-scale operators who prefer maintaining full autonomy over their ventures.

Key Benefits of an LLC

Limited liability companies offer several distinct advantages that address common concerns business owners face when establishing and scaling their operations.

Limited Liability Protection

The primary advantage of an LLC is the liability shield it provides between personal and business assets. When properly maintained, this protection prevents creditors from seizing personal property to satisfy business debts.

However, LLC members remain personally liable for obligations they personally guarantee. The protection does not cover personal negligence. Maintaining separate business bank accounts and clear financial records remains important. Real-world examples demonstrate how LLCs can shield owners from lawsuits when proper procedures are followed.

Flexible Tax Options

LLCs offer small-business tax flexibility that sole proprietorships cannot match. By default, single-member LLCs are taxed as pass-through entities, with profits reported on the owner's personal tax return. However, LLCs can elect S corporation or C corporation status, potentially reducing tax burdens.

Some LLC owners find that electing S corporation taxation helps reduce self-employment tax liability. The ability to adjust tax treatment as business needs evolve represents a significant advantage. Entrepreneurs should consult tax professionals to determine optimal classifications.

Credibility With Customers and Partners

Operating as an LLC enhances business credibility with customers, vendors, and partners. Many clients perceive LLCs as more established and professional. This perception can influence purchasing decisions.

Vendors may offer more favorable payment terms to LLCs. When considering selling a business, the LLC structure can affect valuation. The formal structure signals investment in proper organization.

Easier Access to Funding

The LLC liability protection vs sole proprietorship distinction impacts access to capital. Banks generally view LLCs as more creditworthy. The formal structure reduces perceived risk.

LLCs can establish separate business credit histories independent of the owner's personal credit. LLCs can also more easily accommodate equity investors with clear ownership stakes. Sole proprietorships face greater challenges in these areas.

Key Benefits of a Sole Proprietorship

Despite the advantages LLCs offer, sole proprietorships provide distinct benefits that make them appropriate for many business situations.

Simple Setup and Low Costs

Sole proprietorships require minimal paperwork and virtually no startup costs. Entrepreneurs can begin operations immediately without filing documents or paying fees. This simplicity appeals to business owners testing concepts.

The absence of formal business registration requirements allows entrepreneurs to focus their resources on finding customers. For freelancers and consultants, this allows rapid market entry without financial barriers.

Full Control and Decision-Making

Sole proprietors maintain complete autonomy over business decisions. No operating agreement dictates procedures, no partners require consultation, and no formal management structure constrains decision-making. This independence allows quick market adaptation.

Complete control extends to profit distribution and business direction. Sole proprietors answer only to themselves and customers. For entrepreneurs valuing independence, this represents a significant advantage.

Tax Simplicity

Income and expenses from a sole proprietorship flow directly to the owner's personal tax return using Schedule C. This eliminates separate business tax filings. Sole proprietors pay personal income tax and self-employment tax on profits.

Simplified tax treatment means lower accounting costs. Many sole proprietors handle basic bookkeeping themselves. For entrepreneurs requiring Employer Identification Numbers, the process remains straightforward.

Easy Dissolution

Closing a sole proprietorship involves minimal formalities. Sole proprietors simply stop conducting business and cancel licenses or permits. No formal dissolution documents require filing.

This contrasts with corporate dissolution procedures requiring formal filings. The straightforward closure process gives sole proprietors the flexibility to pivot or close without administrative burdens.

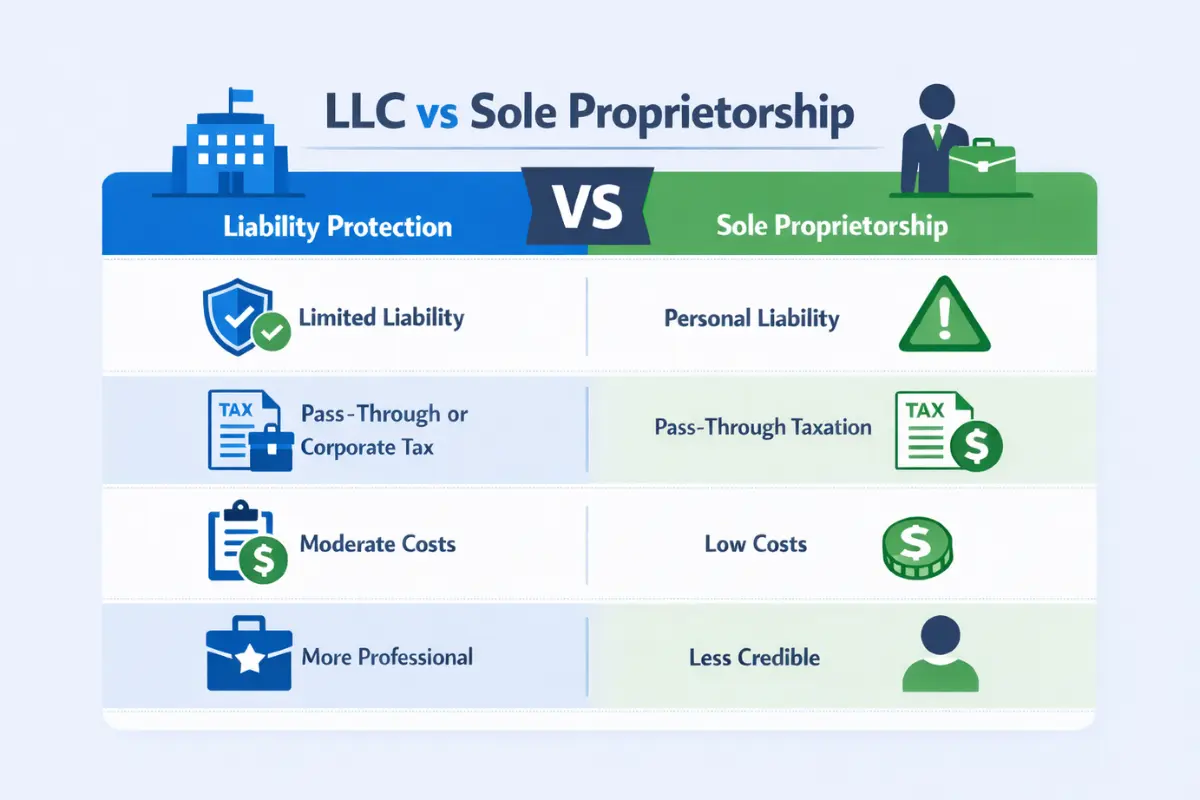

Differences Between LLC and Sole Proprietorship

Understanding the differences between LLCs and sole proprietorships for small-business operations helps entrepreneurs evaluate which structure best aligns with their priorities.

Legal Protection

The most fundamental difference lies in liability protection. LLCs create legal separation between business obligations and personal assets, providing personal asset protection. When an LLC faces lawsuits, creditors typically must pursue business assets rather than personal property.

Sole proprietorships offer no such protection. The owner and the business exist as a single legal entity, meaning sole proprietorship risks include unlimited personal liability. Creditors can pursue personal bank accounts, real estate, and other assets to satisfy business debts.

Tax Considerations

Both structures offer pass-through taxation by default, in which business income flows through to personal tax returns. However, LLC vs sole proprietorship tax benefits differ in flexibility. Single-member LLCs receive identical tax treatment to sole proprietorships unless they elect alternative classifications.

The tax deductions for small businesses remain similar across structures. However, LLC owners who elect S corporation taxation may reduce self-employment tax obligations. Sole proprietors lack this flexibility and pay self-employment tax on all net income.

Formation and Maintenance Costs

Sole proprietorships win on cost grounds. Formation requires no state filings or fees, and ongoing compliance obligations typically extend only to local licenses. Annual costs remain minimal.

LLCs require initial filing fees varying by state. Ongoing compliance includes annual or biennial reports and franchise taxes in some states. Many states require LLC annual report filing, adding recurring tasks. These costs represent the price of liability protection.

Business Credibility and Perception

Market perception differs significantly between structures. LLCs project professionalism and stability, qualities that matter when competing for contracts or negotiating with vendors.

Sole proprietorships may face perception challenges. Some clients prefer working with formally structured businesses. Vendors might offer less favorable terms to sole proprietors. These differences in perception represent real considerations in competitive markets.

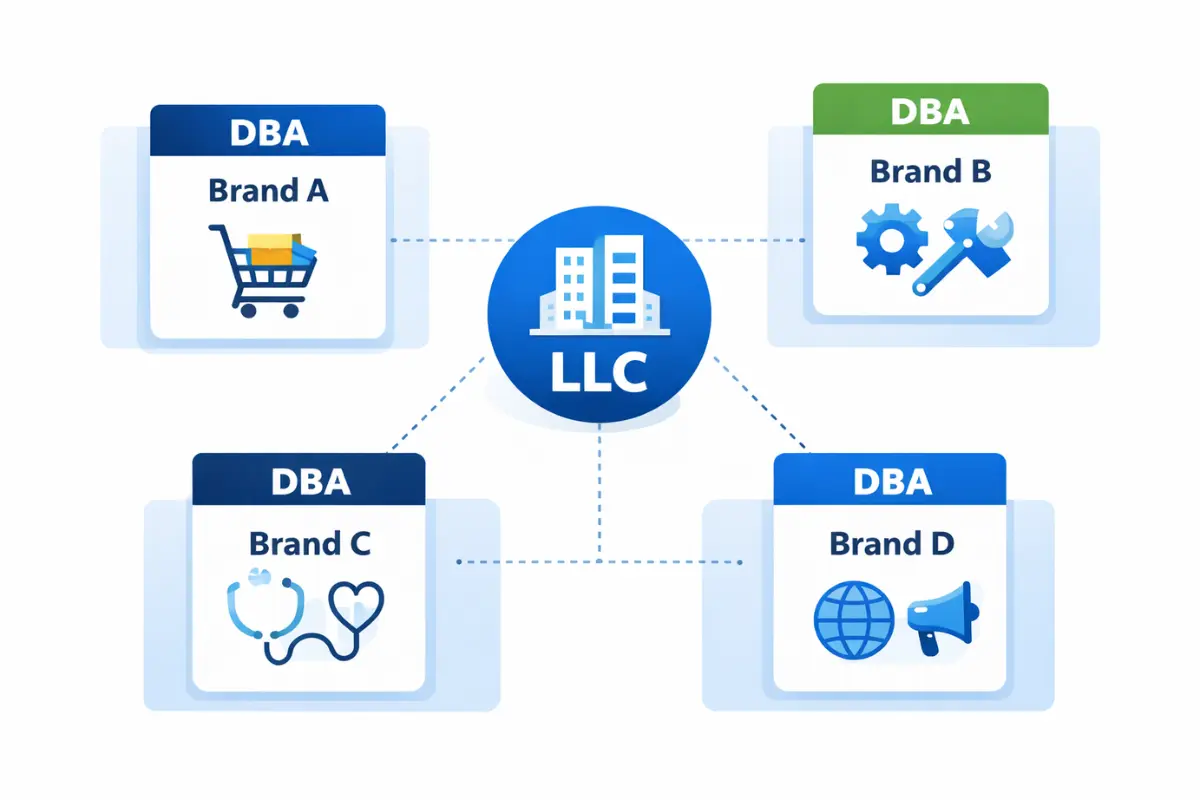

When a Business Might Benefit From Using Both LLC and DBA

Some entrepreneurs find strategic value in combining an LLC structure with additional business names registered as DBAs. An LLC can operate under multiple "doing business as" names, allowing businesses to serve different markets while maintaining unified liability protection.

This approach provides flexibility without requiring multiple formations. A single LLC can maintain a single set of compliance obligations while operating under different brands. According to CNBC's comparison of structures, this flexibility is one of the pros and cons of LLCs versus sole proprietorships that entrepreneurs should consider.

Businesses using this approach must maintain clear internal accounting and ensure that all DBAs are properly registered in accordance with state requirements.

Next Steps for Choosing Your Business Structure

Selecting between an LLC and a sole proprietorship requires evaluating several factors specific to your business situation. Consider your industry's liability risks, growth ambitions, funding needs, and preference for administrative simplicity. Understanding the benefits of an LLC vs a sole proprietorship helps inform this important decision.

Entrepreneurs operating businesses with measurable lawsuit risk or plans for partnership typically benefit from the LLC structure. Those testing business concepts or operating low-risk service businesses may find a sole proprietorship more appropriate initially.

Many business owners start as sole proprietors and later convert to LLCs as operations expand. Understanding why to choose an LLC over a sole proprietorship becomes more important as revenue grows and business assets accumulate.

InCorp helps entrepreneurs navigate business formation decisions and handles the administrative details of establishing and maintaining compliant business structures. For more guidance on choosing and establishing your business structure, visit the Small Business Administration's guide or contact InCorp to discuss your specific needs.

FAQs

What is the main difference between an LLC and a sole proprietorship?

An LLC is a separate legal entity that protects personal assets from business liabilities, whereas a sole proprietorship offers no such separation. The LLC structure provides a legal shield for personal assets, whereas sole proprietors remain personally responsible for all business obligations.

Which is easier to set up, an LLC or a sole proprietorship?

A sole proprietorship is simpler and less costly to set up, often requiring minimal paperwork. An LLC requires filing formation documents and paying state fees, adding both upfront costs and ongoing compliance obligations to maintain good standing.

How does taxation differ between an LLC and a sole proprietorship?

Sole proprietorship income is reported on the owner's personal tax return using Schedule C. LLCs can elect pass-through taxation, identical to that of sole proprietorships, or elect S corporation status for potential tax advantages, providing flexibility that sole proprietorships lack.

Can a business switch from a sole proprietorship to an LLC later?

Yes, many business owners start as sole proprietors and later form an LLC to gain liability protection and access additional benefits as the business grows. The conversion process involves filing LLC formation documents and, in some cases, obtaining new licenses, but it remains a common path for successful businesses.

Does being an LLC improve credibility with customers and partners?

Yes, operating as an LLC often increases business credibility and can make it easier to secure funding or form partnerships. Many customers, vendors, and financial institutions view LLCs as more established and professional than sole proprietorships, which can open doors to better business opportunities.

Disclaimer: This content is intended for general educational and informational purposes only and does not constitute legal, tax, or accounting advice. Every effort is made to keep the information current and accurate; however, laws, regulations, and guidance can change, and no representation or warranty is given that the content is complete, up to date, or suitable for any particular situation. You should not rely on this material as a substitute for advice from a qualified professional who can consider your specific facts and objectives before you make decisions or take action.

Share This Article:

Stay in the know!

Join our newsletter for special offers.