Registered Agent Responsibilities: A Guide to Business Compliance

A small business receives a summons in a lawsuit, but never receives it because its registered agent moved without notice. A corporation misses tax deadlines because annual report reminders went to an outdated address. An LLC is subject to administrative dissolution for failing to maintain a registered agent. Each scenario demonstrates how Registered Agent Responsibilities directly affect a business's legal standing.

Understanding Registered Agent Responsibilities helps business owners ensure compliance, avoid default judgments, and maintain good standing with state authorities. A registered agent serves as the mandatory point of contact between business entities and government agencies.

This guide explains the seven core duties registered agents must fulfill, available options for this role, and state-specific requirements. InCorp is not a law firm and does not provide legal or financial advice. This information is educational. Readers should consult with qualified legal professionals.

Key Takeaways

-

Registered agents are the legal bridge between a business and the state, responsible for receiving lawsuits, tax notices, and official correspondence that directly affect legal standing and good status.

-

Every entity must maintain a physical, in‑state registered office (no PO boxes) with someone available during normal business hours to accept hand‑delivered legal and government documents.

-

Missing service of process or state notices because of an outdated or unattended registered agent address can lead to default judgments, fines, loss of good standing, and even administrative dissolution.

-

Core duties include receiving service of process, accepting official state and tax mail, promptly forwarding all documents.

-

Business owners can serve as their own registered agent, but this creates privacy issues, requires constant physical presence, and increases the risk of being served in front of clients or missing critical notices.

-

Commercial registered agent services provide dedicated staff, nationwide offices, privacy protection, fast electronic document delivery, and automated compliance reminders that help prevent missed deadlines.

-

States add unique nuances—such as written consent requirements, eligibility limits, or additional publication rules—making it essential to understand jurisdiction‑specific obligations when forming or expanding a business.

-

Treating registered agent compliance as a protective system rather than a checkbox helps preserve limited liability, access to financing, contract enforceability, and long‑term business continuity.

The 7 Core Legal and Procedural Responsibilities

State statutes establish specific duties that registered agents must perform to maintain business compliance and legal standing.

Maintaining a Statutory Registered Office

The registered agent must maintain a physical street address in the state where the business is registered. The question “Is a PO box acceptable for a registered office address?” is consistently answered no under state statutes. Post office boxes do not meet requirements because legal documents must be delivered in person.

The reason why the registered agent address is a public record is to ensure courts and government agencies can locate businesses for legal document service. State laws require a genuine physical presence for process servers to provide documents.

Ensuring Availability During Business Hours

The registered agent or authorized staff must be physically present at the registered office during standard business hours, typically 9 a.m. to 5 p.m. local time. This ensures process servers can deliver legal proceedings documents in person.

Personal availability requirements pose challenges for business owners who serve as their own agents. Travel and meetings can leave the registered office unstaffed, potentially resulting in missed service.

Receiving Service of Process (Legal Documents)

Accepting service of process is the most critical duty of a registered agent. Service of process includes summonses, complaints, and subpoenas notifying the business of legal proceedings.

The risks of missing service of process without RA include default judgments against businesses that fail to respond to lawsuits. Understanding how to avoid default judgment due to a registered agent's failure requires ensuring the agent maintains up-to-date contact information and forwards documents promptly.

Accepting Official State and Tax Correspondence

Beyond court documents, registered agents receive Official Documents from state agencies, including Secretaries of State and tax authorities. This correspondence includes Annual Report filing reminders, franchise tax assessments, and compliance notices.

Registered agent duties for annual report reminders include receiving notifications from state filing offices and promptly forwarding them. Many businesses face administrative dissolution because they never received reminders sent to agents who failed to forward them.

Promptly Forwarding All Received Documents

Upon receipt of the documents, the registered agent must immediately forward them to the business. Professional services typically offer same-day digital scanning and electronic notification.

Mail forwarding obligations extend to all Official Documents received. Time-sensitive legal documents must be forwarded immediately, as lawsuit responses typically must be filed within 20 to 30 days of service.

Monitoring and Alerting the Client to Deadlines

Professional services extend beyond statutory minimums by tracking compliance calendars and providing automated reminders for deadlines. Registered agent duties for annual report reminders include monitoring state filing calendars and alerting clients well in advance.

This proactive support helps businesses avoid the consequences of failing to maintain a registered agent, including missed filings. States impose penalties on entities that fail to submit required business filings on time. Professional services maintain databases tracking jurisdiction-specific filing requirements.

Notifying the State of Address Changes

When the registered agent changes address or the business designates a new agent, appropriate forms must be filed immediately with the Secretary of State. The Statement of Change of Registered Agent updates the public record and maintains valid service procedures.

Businesses serving as their own agents must file Statement of Change forms whenever they relocate. Failure to update registered agent information can result in documents being sent to incorrect addresses, creating the same problems as having no registered agent.

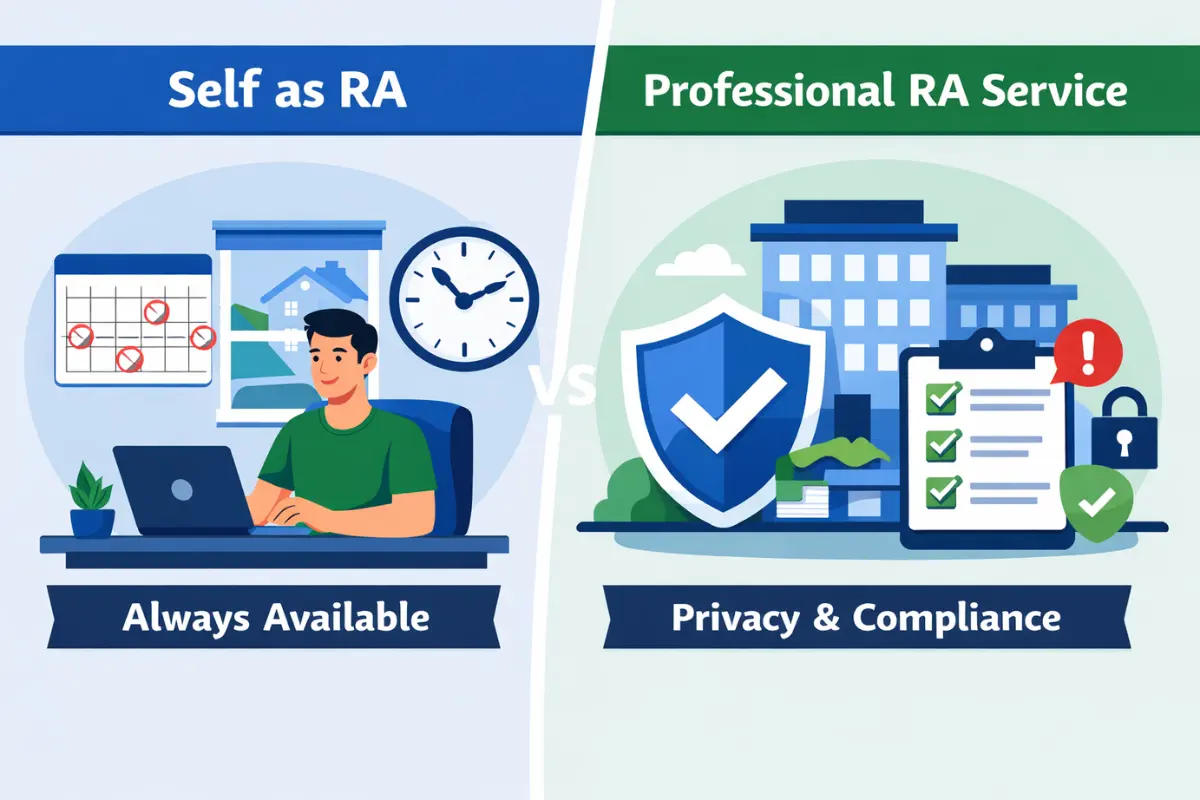

The Two Options for the Registered Agent Role

Businesses must choose between appointing an individual or hiring a commercial registered agent service. Understanding the difference between individual and commercial registered agent services helps businesses make informed decisions.

Option 1: Serving as Your Own Registered Agent

State laws permit business owners, officers, or employees to serve as registered agents. This option requires the individual to list their personal address on public records and maintain physical presence during all business hours.

Self-appointment raises privacy concerns, which is why the registered agent's address is a public record, and the individual’s address becomes publicly searchable. Operational challenges include mandatory physical presence conflicting with business travel and meetings. Business owners may be served with process in front of clients or employees, creating uncomfortable situations.

Option 2: Hiring a Commercial Registered Agent Service

Professional services provide dedicated personnel, guaranteed availability, privacy protection, and compliance monitoring. The difference between individual and commercial registered agent services includes reliability and value-added compliance support.

Commercial services maintain offices in every state where they operate, allowing businesses to use the same provider across multiple jurisdictions. Benefits include privacy protection, guaranteed availability, immediate document forwarding through electronic scanning, and compliance calendar monitoring with automated reminders.

Professional services prove particularly valuable for businesses operating in multiple states, since registered agent requirements for foreign qualification apply separately in each jurisdiction.

State-Specific Requirements and Nuances

While registered agent requirements share common elements across jurisdictions, specific states impose unique rules affecting appointment and ongoing obligations.

Texas allows business entities to serve as their own registered agents, provided they meet all statutory requirements, including maintaining a physical office in Texas and ensuring availability during business hours. This differs from many states that prohibit entities from serving as their own registered agents.

California requires registered agents to sign formal Consent to Appointment forms confirming they agree to accept the duties and responsibilities of the role. This written consent becomes part of the formation or qualification filing, creating documented evidence of the agent's acceptance.

New York imposes unique publication requirements that require businesses to publish formation notices in designated newspapers, resulting in costs ranging from $1,000 to $2,000 per notice, depending on the county. These publication obligations exist separately from registered agent requirements but demonstrate the complex compliance landscape businesses navigate.

Virginia restricts eligibility for individual registered agents by requiring that agents be members of the Virginia State Bar, corporate officers, or directors. This limitation prevents businesses from appointing random individuals and ensures registered agents have some connection to the legal or business community.

State-specific requirements and nuances persist across other jurisdictions, with variations in filing fees, form requirements, and procedural rules. Understanding jurisdiction-specific requirements helps prevent compliance gaps that could lead to legal issues or administrative penalties.

Compliance is Protection: The Simple Key to Longevity

The registered agent serves as the legal shield and compliance backbone of business entities. Failure in registered agent duties directly compromises the business's ability to operate legally and maintain limited liability protection.

The consequences of failing to maintain a registered agent extend beyond administrative penalties to include loss of good standing with state authorities, administrative dissolution of the business entity, default judgments in legal proceedings due to missed service of process, inability to enforce contracts in state courts, and difficulty obtaining financing or expanding into new jurisdictions.

Good standing status proves essential for businesses seeking loans, attracting investors, or entering contracts with major customers. Many contracts require proof of good standing, and lenders verify entity status before approving financing applications.

Administrative dissolution forces businesses to undergo reinstatement procedures that involve back fees and penalties and often require certified copies of Official Documents and extensive paperwork. Some states impose time limits on reinstatement, after which dissolved entities cannot be restored.

InCorp provides professional registered agent services ensuring reliable document receipt, immediate forwarding, and compliance monitoring. Professional support eliminates the risks of missing service of process without RA while providing business owners peace of mind that critical documents will be handled properly.

Contact InCorp to learn how professional registered agent services can protect your business from compliance gaps and ensure reliable handling of legal and tax documents.

FAQs

What if I move my business to a new state?

You must appoint a new registered agent in the new state immediately and file for foreign qualification in that state. Understanding registered agent requirements for foreign qualification involves appointing a registered agent in every state where the business maintains a physical presence or conducts substantial business. You also need to file a Statement of Change with the previous state to update your registered agent address if you plan to keep the entity registered there. Businesses operating in multiple states often use the same commercial registered agent service across all jurisdictions to simplify administration and ensure consistent handling of documents.

If I use a commercial service, do I still get tax notices?

Yes. A professional registered agent receives all legal and state mail, including tax forms and delinquency notices from the Secretary of State or tax authorities. They immediately scan and forward these legal and tax documents to your designated secure online portal or email address. Registered agent duties for annual report reminders include receiving Annual Report notifications from state agencies and ensuring business owners receive timely alerts about upcoming filing deadlines. Professional services maintain document management systems, enabling businesses to access all received correspondence through secure portals and maintain organized records for compliance and audit purposes.

What is the penalty if I don't maintain a registered agent?

The initial penalty is often a fine and a classification of your company as delinquent or out of good standing. Understanding how to avoid default judgment due to a registered agent's failure requires ensuring the agent maintains up-to-date contact information and promptly forwards documents. If the issue is not corrected, the state typically proceeds to administrative dissolution of the company. Additional consequences of failing to maintain a registered agent include an inability to defend against lawsuits due to invalid service of process, loss of limited liability protection if courts pierce the corporate veil for compliance failures, and difficulty conducting business with customers or vendors that require proof of good standing.

Can my attorney or CPA be my Registered Agent?

Yes, your attorney or CPA can serve as your Registered Agent if they meet state requirements, including maintaining a physical street address in the state and being available during normal business hours to receive official documents. However, using an attorney or CPA often results in higher overall costs because many professionals bill by the hour, while commercial registered agent services typically charge a flat annual fee. In practice, many law firms and CPA firms do not handle registered agent duties directly and instead rely on third‑party commercial providers like InCorp for registered agent services and document handling. This allows professionals to focus on legal and tax work, while a dedicated registered agent company provides continuous availability, prompt document forwarding, and compliance monitoring as its core business.

What does a registered agent do to help maintain compliance for a business entity?

A registered agent serves as the official point of contact for receiving legal documents, tax notices, and other official correspondence from the state's business filing agency, helping the business maintain compliance and good standing. Registered agents play a critical role in ensuring that important legal documents, such as service of process and annual report reminders, are received in a timely manner so the business can respond before deadlines and avoid default judgments or administrative dissolution.

Can I use my home or personal address as my registered agent's address?

Many business owners can list a personal or business address as the registered agent's physical address if state registered agent requirements are met, including having an address in the state and being available during normal business hours. However, using a home address makes that address part of the public records and may increase unsolicited mail and privacy concerns, which is why many businesses appoint a professional registered agent or national registered agent service instead.

How does a professional registered agent service protect my business from missing important legal documents?

Professional registered agents are required to be available during standard business hours to accept legal documents on behalf of the business and promptly forward official notices, tax notices, and other legal communications. Many professional registered agent services provide electronic document delivery and compliance alerts, reducing the risk of missing important documents or legal notices that could affect legal compliance or lead to default judgments.

Why is it risky for a business owner to act as their own registered agent in multiple states?

When business owners act as their own registered agent across multiple states, they must maintain a physical address and be available during regular business hours in each jurisdiction, which is difficult for businesses operating in multiple states or multi state operations. If the entity designated as the resident agent or statutory agent is unavailable or the registered agent's location changes without updating registered agent information, the company risks missing critical legal notices and official documents, which can trigger administrative dissolution or loss of good standing.

How do I choose the right registered agent for my corporation or limited liability company?

The appropriate registered agent should have a reliable physical address in the state, the capacity to accept legal documents and government correspondence during business hours, and established processes to forward official documents in a timely manner. Many businesses select professional registered agent services or a national registered agent service that offers additional business services, such as compliance calendars and multi‑state coverage, so the corporation's registered agent or limited liability company's registered agent can support long‑term legal compliance and growth across multiple jurisdictions.

Disclaimer: This content is intended for general educational and informational purposes only and does not constitute legal, tax, or accounting advice. Every effort is made to keep the information current and accurate; however, laws, regulations, and guidance can change, and no representation or warranty is given that the content is complete, up to date, or suitable for any particular situation. You should not rely on this material as a substitute for advice from a qualified professional who can consider your specific facts and objectives before you make decisions or take action.

Share This Article:

Stay in the know!

Join our newsletter for special offers.