How to Choose the Best State to Form an LLC

An entrepreneur plans to launch an online retail business and wonders whether Delaware's business-friendly reputation matters. A real estate investor considers forming multiple LLCs for properties in different states. A consultant working from home assesses whether Wyoming's low fees justify establishing there rather than locally. Each scenario raises critical questions about where to form an LLC and how that decision affects costs, taxes, and compliance.

Understanding how to choose the right state to form an LLC helps business owners avoid unnecessary expenses and compliance complications. The decision involves evaluating where the business operates, understanding foreign qualification requirements, and comparing state-specific regulations and costs.

This guide provides a practical framework for selecting the optimal state and business structure for forming a limited liability company, based on business operations, tax implications, and long-term strategic considerations. InCorp is not a law firm and does not provide legal or financial advice. This information is educational. Readers should consult with qualified legal professionals for advice specific to their situations.

Key Takeaways: Choosing the Best State for Your LLC

-

For about 95% of small businesses, forming the LLC in the home (operating) state is the most cost-effective option because it avoids unnecessary foreign qualification, duplicate filings, and extra registered agent fees.

-

“Doing business” is driven by physical presence—such as an office, property, employees, or warehouse—not by where customers live, so simply selling online into other states usually does not require separate state registrations.

-

Forming in a no–income tax state does not eliminate tax on profits earned in a higher-tax state; with pass-through LLCs, owners still pay state income tax where they live and where the business actually operates.

-

Franchise taxes and annual fees vary widely by state (for example, California’s high minimum franchise tax and New York’s publication requirement), so the true cost of forming out of state often exceeds any perceived benefits once double fees and compliance complexity are included.

-

Passive holding companies and real estate LLCs are the main exceptions: holding companies may benefit from states like Wyoming, Delaware, Nevada, or New Mexico for privacy and asset protection, but real estate LLCs generally should be formed in the state where the property is located.

-

Privacy-focused states (such as Wyoming and New Mexico) can help keep ownership information off public records, but if the LLC must foreign qualify in the operating state, that state’s disclosure rules will still apply.

-

Delaware, Wyoming, Nevada, and New Mexico each offer targeted advantages—venture-capital-friendly law, low fees and anonymity, or strong asset protection—but those benefits matter most for venture-backed companies, complex asset structures, or multi-state operations, not for typical local service or online businesses.

-

Because rules, taxes, and asset-protection statutes vary by state and situation, business owners—especially real estate investors, foreign owners, and multi-state operators—should consult qualified legal and tax professionals before selecting a formation state.

Introduction: The Home State vs. The Formation State

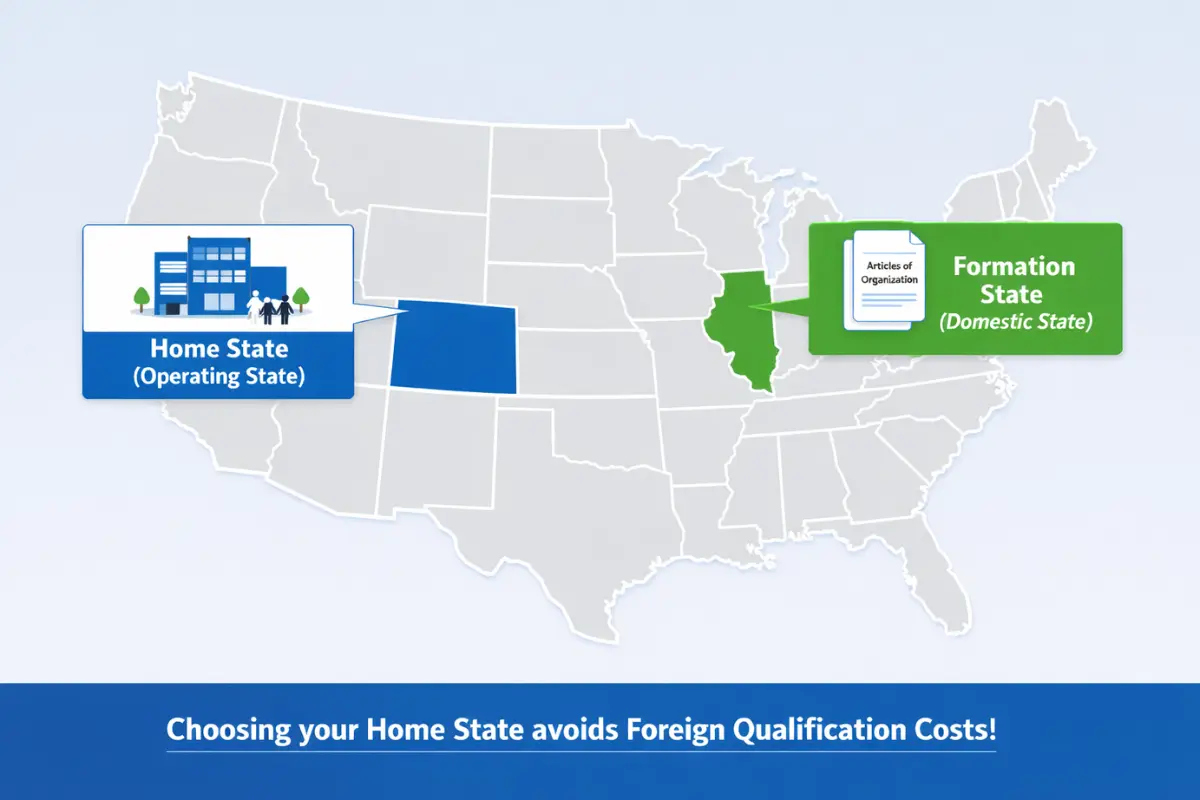

Two critical terms define the geography of LLC formation: the home state and the formation state.

The home state, also called the operating state, is the state where the business is physically located and maintains offices, employs workers, or conducts most of its business activities. This represents the business's physical presence and an operational nexus. For businesses operating from home offices, the home state is typically the state where the owner resides and works.

The formation state, also called the domestic state, is the state where the LLC's Articles of Organization are filed. This typically determines which state's business laws govern the LLC's internal operations, structure, and member relationships. The formation state's statutes define governance requirements, dissolution procedures, and member rights and obligations.

For the vast majority of small businesses—approximately 95%—the home state is the best place to form. This single-state approach avoids the costly, mandatory process of foreign qualification while simplifying compliance and reducing administrative burden.

The foreign qualification requirement requires LLCs formed in one state but operating in another to register as a foreign LLC in the operating state. This registration creates dual compliance obligations, doubles filing fees, and increases ongoing administrative costs without providing corresponding benefits for most small businesses. Many states impose penalties and fines on businesses operating without proper foreign qualification registration.

Simple Steps to Choose Your LLC State

The following numbered steps provide a systematic approach to selecting the appropriate formation state.

Define Your Primary Location (The Home State)

Determine the state where the business physically operates, maintains its main office, or where owners and employees primarily work. This physical presence creates the operational nexus. For companies operating from home, the home state is typically the state of residence.

Understand "Doing Business"

The legal definition of "doing business" focuses on physical nexus rather than customer location. Business operations that constitute doing business include maintaining a physical office, owning property, employing workers, or having warehouse facilities in a state.

Selling products online to customers in a state does not, by itself, constitute doing business in that state. The question "Do I need to register my LLC in every state I sell in?" is typically answered no—sales alone do not trigger registration requirements. Physical presence and operational activities determine registration obligations.

Check the "Foreign Qualification" Rule

Understanding how to avoid the foreign qualification LLC trap requires recognizing when registration becomes mandatory. If an LLC forms in State A but operates in State B, it must register as a foreign LLC in State B. This registration process creates dual compliance obligations in both the domestic state (where formed) and the foreign state (where operating).

The Internal Revenue Service recognizes LLCs regardless of formation state, but state registration requirements remain separate from federal tax treatment. Each state sets its own standards for when a foreign qualification is required.

The consequences of forming an LLC out of state include mandatory foreign qualification, potential penalties for operating without proper registration, and difficulty enforcing contracts in court until appropriate registration is obtained.

Calculate Double Fees

Foreign qualification creates dual compliance obligations. Businesses must compare the total costs of maintaining registrations in both the formation state and the operating state versus forming only in the operating state.

Double costs include formation fees in both states, annual Franchise Tax or report fees in both jurisdictions, registered agent fees in each state, and the administrative burden of tracking compliance deadlines across multiple states.

For most small businesses, these cumulative costs substantially exceed any perceived benefits from forming in a different state. Professional formation services can help evaluate total cost implications.

Identify State Income Tax

Review whether the home state imposes state income tax on business income. States without personal income tax include Florida, Texas, Nevada, Wyoming, Washington, South Dakota, Alaska, Tennessee, and New Hampshire (limited).

Forming an LLC in a no-tax state while operating in a state with income tax provides no tax advantage. The analysis of LLC formation state vs operating state taxes shows that LLCs pay taxes where income is earned, not where the LLC is formed.

Pass-through taxation means LLC income flows through to the owners' personal tax returns. Owners pay state income tax in their state of residence, regardless of where the LLC is formed.

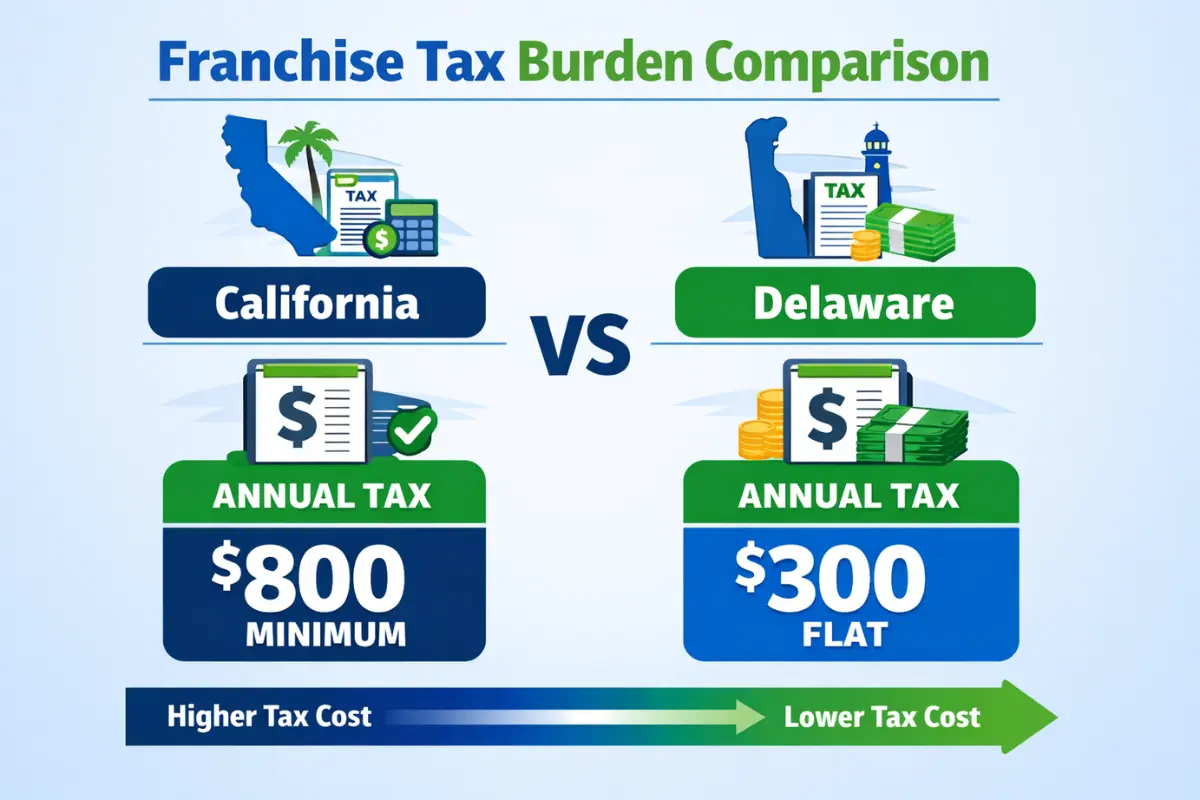

Review Franchise Tax Burden

Many states impose an annual Franchise Tax or minimum annual fees regardless of LLC profitability or activity level. California charges a minimum annual tax of $800. Delaware charges a flat $300 annual franchise tax. These fees apply even if the LLC conducts no business in the state of formation.

Maintaining good standing requires timely payment of all franchise taxes and annual report fees. Failure to pay results in penalties, interest, and potential administrative dissolution.

Compare total annual costs across potential formation states, including both franchise taxes and annual report fees. For many small businesses, home-state fees are more economical than fees in popular formation states once foreign qualification costs are included.

Prioritize Asset Holding (The Exception)

Passive LLCs that hold only real estate or investments and do not conduct active business are exempt from the home-state-formation rule. These holding companies can be formed in states with strong asset protection laws without triggering foreign qualification in the owner's home state.

Real estate LLCs should form in the state where the property is located, as property ownership constitutes doing business in that state. Licensing requirements often require in-state formation for property-holding entities.

Evaluate Privacy Needs

Business owners seeking anonymity should consider the best state to form an LLC for anonymity and privacy. Wyoming and New Mexico offer the strongest privacy protections by allowing anonymous ownership through trusts or nominee structures.

Most states require disclosure of LLC members or managers in formation documents. Privacy-focused states allow registered agents or nominee managers to appear on public records, keeping beneficial owners' identities confidential.

Privacy considerations must be balanced against operational requirements. If the LLC must register as a foreign entity in the operating state, that state's disclosure requirements apply regardless of the formation state's privacy protections.

Look for Complex Regulations

Some states impose unusual or costly requirements. The New York LLC publication requirement cost can reach $1,000 to $2,000, depending on the county. This requirement mandates publishing LLC formation notices in designated newspapers for six consecutive weeks.

Publication requirements, elevated filing fees, and complex annual reporting obligations can significantly increase the total cost of maintaining an LLC. These state-specific regulations should factor into formation state decisions.

Finalize the Decision

Apply these decision rules:

Rule 1: If the business has physical presence or employees in one state, form an LLC in that state to minimize costs and compliance complexity. Also, consider whether you need an operating agreement for your LLC to protect your business and clarify management structure.

Rule 2: If the business operates as a passive holding company, an online-only business without physical nexus, or requires true anonymity, consider Wyoming, Delaware, or New Mexico for formation. Before forming your company, make sure to check business name availability to avoid legal issues and secure your preferred name.

Rule 3: Consult professionals for complex asset protection strategies, multi-state operations, or situations involving significant tax implications to ensure optimal structure and compliance.

Compare Major Business-Friendly States

Several states offer specific advantages that attract LLCs from across the country. Understanding each state's benefits and limitations helps business owners make informed decisions. The Delaware vs Wyoming LLC for small business comparison is one of the most common debates about the state of formation.

Wyoming pioneered LLC legislation as the first state to authorize limited liability company formation in 1977. The state maintains strong privacy protections, low fees, and favorable asset protection laws. Annual fees start at $60, and the state imposes no corporate or personal income tax. These low costs make Wyoming particularly attractive for small businesses and holding companies.

Wyoming allows anonymous LLC ownership and provides charging order protection for both single-member and multi-member LLCs. Prospective business owners can reserve names for up to 120 days by submitting an Application for Reservation of Name with a $50 filing fee.

Delaware LLC formation attracts large corporations and venture-backed startups due to the state's specialized Court of Chancery and extensive body of business law precedents. The predictable legal environment appeals to businesses seeking outside investment or planning eventual public offerings.

However, Delaware charges a $300 annual Franchise Tax regardless of business activity or income. For small businesses without venture capital aspirations or plans for public offerings, this annual cost often outweighs the benefits of Delaware's legal framework. The Delaware vs Wyoming LLC for small business analysis typically favors Wyoming for cost-conscious entrepreneurs without institutional investor requirements.

Nevada offers strong asset protection provisions and no state corporate or personal income tax. Annual fees approximate $200 or more, higher than in Wyoming. Nevada requires annual lists of officers and members to be filed with the state, though this information does not become a public record.

New Mexico provides high anonymity and minimal ongoing costs. The state requires no annual reports or annual fees after initial formation. Filing fees start at $50, making New Mexico one of the most cost-effective options for entrepreneurs who prioritize privacy and simplicity. The lack of ongoing filing requirements significantly reduces administrative burden for passive holding companies.

State Comparison Table:

| State | Primary Benefit | Key Financial Note | Best For |

|---|---|---|---|

| Wyoming | Strongest privacy and asset protection (first LLC state) | No state corporate or personal income tax. Lowest annual fees ($60) | Holding companies and online businesses prioritize low cost and anonymity |

| Delaware | Flexible, predictable corporate law (Court of Chancery) | Requires a flat $300 annual Franchise Tax (even if no business is conducted in-state) | Venture-backed startups, large businesses, and companies seeking outside investment |

| Nevada | Strong asset protection and no state income tax | Higher fees than Wyoming (approx. $200+ annually). Requires an annual list of officers/members to state (not public) | High-risk industries or businesses prioritizing judicial precedent |

| New Mexico | High anonymity and lowest cost (no annual report required) | Very low initial filing fee ($50). No annual state filings or fees | Budget-conscious entrepreneurs needing privacy and simplicity |

Look for Complex Regulations

Research state-specific requirements that add costs or complexity. The New York LLC publication requirement cost represents one of the most expensive state-specific mandates, requiring publication in newspapers designated by the county clerk.

Other complex regulations include California's $800 minimum franchise tax, regardless of income; franchise tax calculations based on revenue or capital in some states; and mandatory business licenses or permits at the state or local levels.

All states require registered agents with physical addresses in the state. This requirement affects out-of-state formation decisions by adding registered agent service costs.

Finalize the Decision

The optimal formation state balances practical operational needs against theoretical advantages. Most businesses benefit from forming in their state of operation to avoid foreign qualification costs and complexity.

Exceptions include passive holding companies without active business operations, businesses that genuinely operate in multiple states and require foreign qualifications regardless, and entrepreneurs who prioritize specific state benefits, such as Wyoming's privacy laws or Delaware's legal framework for venture-backed companies.

Professional guidance helps evaluate specific circumstances and ensure formation decisions align with business goals and operational realities.

Conclusion: Making the Right Choice

The best state to form an LLC minimizes compliance complexity and costs for specific business circumstances. The initial decision should reflect practical operational needs rather than aspirational goals about future expansion or perceived tax advantages.

For 95% of small businesses, the home state represents the optimal choice. This approach avoids foreign qualification, reduces annual costs, simplifies compliance, and aligns with the business's actual operating location.

The remaining 5%—including real estate investors, holding companies, and businesses with legitimate multi-state operations—may benefit from forming in states that offer specific advantages. These decisions warrant professional consultation to ensure proper structuring and compliance.

Contact InCorp to learn how professional formation services can support LLC formation decisions and help maintain compliance with state-specific requirements.

FAQs

What is "Charging Order Protection" and why does it matter?

A Charging Order is the exclusive legal remedy a creditor can use to collect a personal debt from an LLC owner. It allows the creditor to receive only distributions the LLC chooses to make to the owner; it does not permit the creditor to seize LLC assets or assume management. The single-member LLC asset protection by state varies significantly. States with the strongest protection, such as Wyoming and Nevada, treat the Charging Order as the sole remedy, thereby protecting business assets from personal lawsuits. This asset protection mechanism is particularly valuable for limited liability company structures holding valuable assets.

Does a Single-Member LLC (SMLLC) get the same protection as a Multi-Member LLC?

No, not everywhere. Historically, Charging Order protection was designed to shield non-debtor partners. Courts in some states have ruled that SMLLCs are not eligible for the same protections, leaving creditors with the option to pursue aggressive actions, such as foreclosure. To counter this, Delaware, Nevada, and Wyoming have updated business laws to explicitly grant the same strong, exclusive protection to both single-member and multi-member LLCs. The single-member LLC asset protection by state question requires examining specific state statutes to understand available protections.

What is a "Series LLC" and when should I consider forming one?

A Series LLC is a unique structure available in states like Delaware and Texas that allows a single parent LLC to create multiple segregated internal divisions called "Series." Each Series operates with separate assets, bank accounts, and liability protection. Business owners should consider a Series LLC when owning multiple rental properties or distinct business lines to shield the assets of one Series from the liabilities of another, while paying a single state filing fee and minimal annual fees for the parent entity. This structure reduces administrative costs compared with forming a separate limited liability company for each property or business line.

Can a non-U.S. resident own an LLC?

The question "Is a non-US resident required to form an LLC?" reflects common confusion about ownership eligibility. U.S. citizenship or residency is not required to own or form an LLC in any U.S. state. A non-resident can form an LLC and typically is taxed only on income effectively connected to a U.S. trade or business. However, non-resident-owned LLCs often have additional federal reporting requirements, such as filing Internal Revenue Service Form 5472 to disclose foreign ownership, even if no tax is due. Professional guidance helps non-residents navigate these reporting obligations and optimize their state of formation selection.

How do state income tax and corporate income tax affect which state is the best state to form an LLC?

When choosing how to choose the best state to form an LLC, owners should remember that most limited liability companies are taxed as pass-through entities, so they usually do not pay corporate income tax at the entity level. Instead, business income passes through to LLC members, who pay income tax (and possibly personal state income tax) where they live and where the business operates, meaning forming in a no–income tax state rarely eliminates state income tax obligations.

Do LLC owners always have to pay self-employment taxes on their share of business income?

By default, most LLC owners pay self-employment taxes on their share of trade or business income from the LLC, in addition to federal and state income taxes reported on their personal tax returns. Some LLCs may elect S corporation tax status to potentially reduce self-employment taxes, but that strategy involves stricter payroll rules, reasonable compensation standards, and more complex corporate tax compliance, so a tax professional should be consulted before changing the tax status.

How do different state taxes (income tax, sales tax, and franchise tax) impact online businesses?

Online businesses generally pay income tax based on where they and their owners are located, not where every customer lives, so personal income tax and business operations in the home state usually drive the overall tax burden. However, companies may also face state sales tax registration, franchise tax, or gross receipts tax in states where they have a sufficient physical or economic nexus, which can create additional tax obligations even if the LLC was formed elsewhere.

What is a foreign LLC, and how does it affect fees and legal protections?

A foreign LLC is a limited liability company that was formed (as a domestic LLC) in one state but registers to conduct business in another state where it is considered a foreign entity. Registering as a foreign LLC typically requires extra filing fees, a registered agent service in that state, and ongoing annual report or franchise tax payments, but it also helps preserve liability protection and allows the business to enforce contracts and defend business disputes in that state's courts.

Does forming an LLC in a "business-friendly" state change my personal liability protection or how I pay taxes?

The core legal protections of the LLC business structure—such as limited liability protection that separates owners' personal and business assets—come primarily from following LLC formalities and keeping personal and business finances separate, not from choosing a specific state like Delaware or South Dakota. Forming in a business-friendly state may offer favorable business law, corporate tax rates, or lower annual fees, but LLC owners will still generally pay self-employment taxes and pay income taxes based on federal rules and their home state's tax laws, so state choice should be weighed against the added complexity of managing a foreign LLC.

Disclaimer: This content is intended for general educational and informational purposes only and does not constitute legal, tax, or accounting advice. Every effort is made to keep the information current and accurate; however, laws, regulations, and guidance can change, and no representation or warranty is given that the content is complete, up to date, or suitable for any particular situation. You should not rely on this material as a substitute for advice from a qualified professional who can consider your specific facts and objectives before you make decisions or take action.

Share This Article:

Stay in the know!

Join our newsletter for special offers.