Steps for Foreigners to Register a Business in the United States

A technology entrepreneur in Singapore wants to serve U.S. clients through a domestic entity. A manufacturing business owner in Mexico seeks access to American supply chains. An e-commerce founder in India plans to establish a U.S. market presence. Each scenario requires understanding how to register a business in the United States as a foreign national.

Learning how to register a business as a foreigner involves following specific procedural steps established by state and federal authorities. The U.S. business registration process for non-residents includes entity formation, tax identification, and ongoing compliance obligations that apply regardless of owner citizenship or residency status.

This guide outlines commonly required steps in the guide for foreign entrepreneurs to open a U.S. company, including entity selection, state filing procedures, and post-registration requirements. InCorp is not a law firm and does not provide legal or financial advice. This information is educational. Readers should consult with qualified legal professionals for advice specific to their situations.

Key Takeaways

-

No U.S. residency or citizenship required – Foreign nationals can register and own businesses in any U.S. state without living in the country or holding a visa, though physically working in the U.S. may require work authorization.

-

Choose the right business structure – LLCs offer flexibility and liability protection for most foreign entrepreneurs, while C-Corporations work best for businesses seeking venture capital, though S-Corporations are restricted to U.S. citizens and permanent residents.

-

State selection impacts costs and compliance – Delaware, Wyoming, Nevada, and Florida offer different advantages in terms of fees, privacy protections, and tax obligations, with annual costs ranging from minimal to several hundred dollars depending on your chosen state.

-

Registered agent services are essential – Foreign entrepreneurs must appoint a registered agent with a physical U.S. address to receive legal documents and government correspondence, typically costing $50-$200 annually.

-

EIN is critical for business operations – Obtaining an Employer Identification Number from the IRS enables you to open U.S. bank accounts, hire employees, and file taxes, though foreign applicants must apply by mail, fax, or phone rather than online.

-

Ongoing compliance is mandatory – Annual reports, franchise taxes, and specialized reporting requirements like Form 5472 for foreign-owned entities must be filed on time to maintain good standing and avoid penalties or administrative dissolution.

Decide on a Business Structure

The first step is to select an appropriate legal structure. Business structure affects taxation, personal liability protection, and administrative requirements.

A Limited Liability Company is a flexible structure that provides liability protection and simplified administrative requirements. LLCs separate business debts from owners' personal assets. Most states permit foreign nationals to form LLCs without citizenship or residency requirements.

LLCs are typically taxed as pass-through entities, with income passing through to owners' personal tax returns. Foreign owners face more complex tax scenarios requiring specific forms. The steps to start a U.S. LLC for foreigners include filing the formation documents, obtaining a tax identification number, and addressing cross-border tax considerations.

Corporations provide distinct legal entity status with the highest liability protection. C-Corporations can raise capital by issuing stock. Corporate structure requires formal governance, including boards of directors and regular meetings.

C-Corporations face double taxation, but are suitable for businesses planning to reinvest profits or seek venture capital. Registering a corporation in the U.S. for non-residents involves procedures similar to LLC formation, with additional governance requirements.

S-Corporations restrict ownership to U.S. citizens and permanent residents, making this structure unavailable for non-resident founders.

Select a State for Registration

Understanding choosing a U.S. state for foreign business registration requires evaluating state-specific fees, tax obligations, and administrative requirements. Each state maintains its own formation procedures, compliance mandates, and fee structures.

Delaware maintains established corporate law precedents and specialized business courts. The state offers streamlined formation and does not require disclosure of member names in public filings. Delaware charges a $90 formation fee plus a $300 annual franchise tax.

Wyoming offers low-cost formation with $100 filing fees and $60 annual report fees. The state imposes no state income tax and maintains strong privacy protections.

Nevada offers business-friendly statutes and no state income tax, but charges higher formation and annual fees. Florida provides accessible formation procedures and substantial consumer markets.

State selection does not restrict where businesses conduct operations. However, substantial business activities in states other than formation states may trigger foreign qualification requirements. Foreign qualification creates dual-state compliance responsibilities.

Choose a Unique Business Name

Business names must comply with state naming requirements and remain available for registration. Each state maintains databases of existing business names, preventing duplicate registrations.

Legal entity names must include designators such as "LLC" or "Corporation," depending on structure type. Some states restrict certain words requiring special permissions or licenses. Name-availability searches on Secretary of State websites confirm whether desired names remain available.

Doing Business As (DBA) names allow businesses to operate under a trade name that differs from the legal entity name. DBA registration typically occurs at the county or state levels, depending on jurisdiction. Using DBA names requires filing additional registrations beyond initial entity formation.

Appoint a Registered Agent

Every business entity must designate a registered agent with a physical street address in a formation state. Registered agents receive official government correspondence, legal documents, and service of process notifications on behalf of businesses.

Post office boxes do not meet address requirements. Agents must maintain physical presence during standard business hours.

Foreign entrepreneurs typically hire a commercial registered agent service because they lack a U.S. residential address. Professional registered agent services charge annual fees ranging from $50 to $200, depending on the state and service provider. Registered agent selection represents an important compliance decision.

File Formation Documents with the State

The foreign-owned U.S. business registration requirements include submitting formation documents to state authorities. Articles of Organization create Limited Liability Company entities while Articles of Incorporation establish corporations.

Formation documents filed with the Secretary of State include basic business information such as entity name, registered agent details, and management structure. Filing fees vary by state from approximately $50 to several hundred dollars. Processing times range from immediate online approval to several weeks for mail submissions.

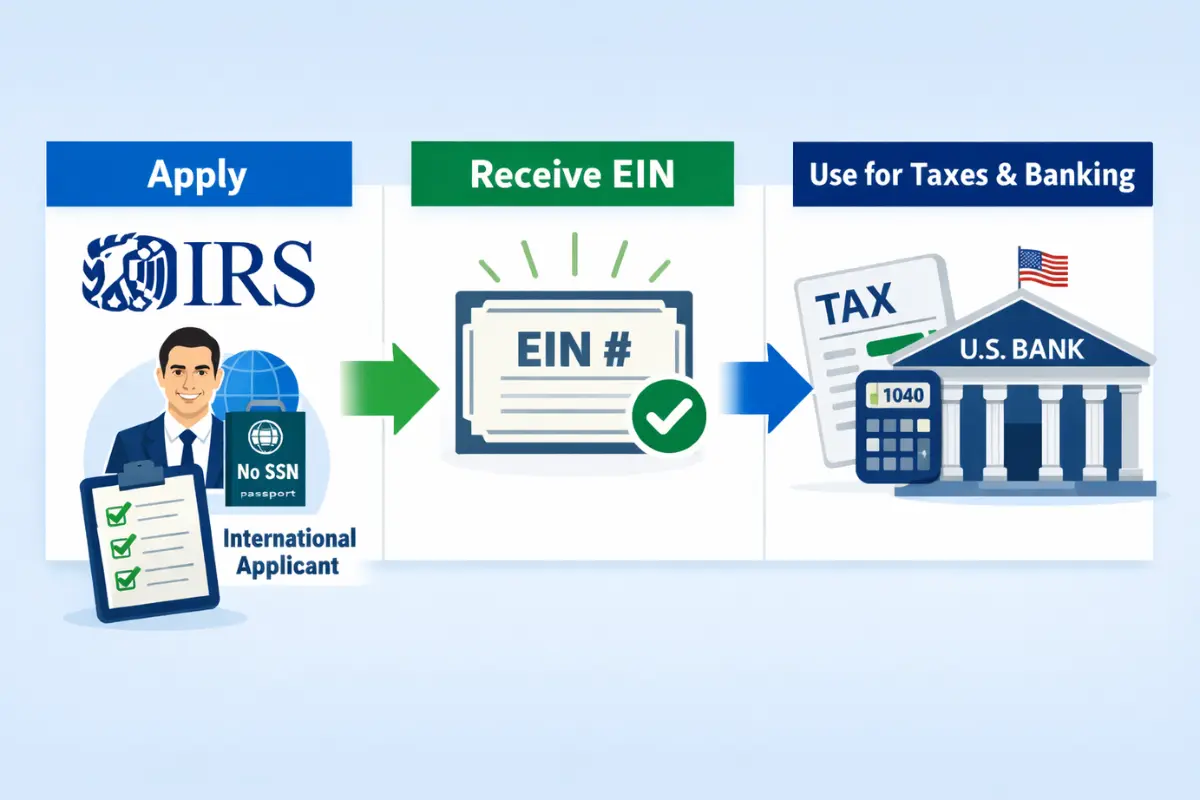

Obtain an Employer Identification Number (EIN)

Understanding obtaining an EIN for foreign-owned U.S. businesses requires following the IRS application procedures. An Employer Identification Number serves as a federal tax identification for businesses, functioning similarly to Social Security Numbers for individuals.

EINs prove necessary for opening U.S. business bank accounts, hiring employees, filing tax returns, and conducting various business transactions. The IRS issues EINs to foreign-owned entities without requiring owners to possess U.S. Social Security Numbers.

Form SS-4 provides the application mechanism for Employer Identification Number requests. Foreign applicants typically cannot use online EIN application systems restricted to applicants with Social Security Numbers or Individual Taxpayer Identification Number credentials.

International applicants submit Form SS-4 by mail, fax, or telephone, with processing typically taking four to eight weeks. EIN issuance is a critical milestone that enables banking and tax compliance.

Open a U.S. Business Bank Account

Opening a U.S. business bank account as a foreigner requires substantial documentation and verification. U.S. banks maintain strict identity verification and anti-money laundering compliance procedures.

Traditional banks require LLC formation documents, confirmation of the Employer Identification Number, valid passports, and proof of business addresses. Many institutions mandate in-person visits.

Financial technology platforms, including digital banking services, offer remote account opening options for international business owners. These services typically have more flexible documentation requirements and streamlined application processes than traditional banks.

Comply with State Tax and Reporting Requirements

The legal requirements for foreigners starting a U.S. business extend beyond formation to ongoing state compliance obligations. Most states require annual or biennial reports to update business information and confirm continued operations.

Annual report requirements vary by state. Missing deadlines results in penalties, late fees, and potential administrative dissolution.

State franchise taxes or annual fees represent separate obligations from annual reports in many jurisdictions. Delaware imposes a $300 annual franchise tax on LLCs, regardless of revenue or activity levels. California imposes a $800 minimum franchise tax on all entities conducting business in the state.

State tax registration is required for businesses with a physical presence, employees, or substantial sales in a state. Sales tax collection obligations arise when businesses exceed economic nexus thresholds defined by individual states. Multi-state operations create complex compliance landscapes.

Obtain Licenses or Permits (If Applicable)

Industry-specific licensing requirements apply at the federal, state, and local levels, depending on business activities. Regulated industries, including healthcare, financial services, food service, and transportation, require specific permits before operations commence.

Professional licenses apply to businesses providing specialized services. Small Business operations may require health permits, safety inspections, and operational licenses.

Federal licensing applies to businesses in specific industries, including aviation, alcohol sales, firearms, and broadcasting. State and local jurisdictions impose additional business license requirements based on business type and location.

Specialized transportation businesses require Department of Transportation registration and Motor Carrier authority. Licensing research should occur before business operations begin to ensure full compliance from launch.

Final Steps After Registration

Following completion of state filings, acquisition of the Employer Identification Number, and initial compliance tasks, foreign-owned businesses are legally registered and authorized to commence operations. However, ongoing obligations persist throughout business existence. Maintaining good standing requires timely annual report submissions, fee payments, and address updates.

Federal and state tax filing deadlines create recurring compliance obligations. Foreign-owned entities often face additional reporting requirements, including Form 5472 for transactions with foreign related parties. This information returns carry substantial penalties for non-compliance.

Maintaining proper records and separating personal and business finances proves essential for preserving liability protection.

InCorp provides administrative support for business formation and ongoing compliance services. Professional assistance helps foreign entrepreneurs navigate U.S. regulatory requirements while maintaining focus on business operations and growth.

Contact InCorp to learn how formation and compliance services can support foreign entrepreneurs establishing a U.S. business presence.

FAQs

Can non-US residents open a business bank account without a physical presence in the United States?

Yes, non-US residents can open a business bank account, though requirements vary by financial institution. Most US banks require an Employer Identification Number (EIN) for your business entity, along with legal documents such as your Articles of Organization or Certificate of Formation. While some banks may require you to visit a branch in person to open an account, others now offer remote account opening specifically designed for foreign entrepreneurs and foreign business owners. You'll typically need to provide identification documents, your business formation paperwork, and potentially additional documentation proving your business activities.

Some banks also require a registered agent service or legal address in the US. It's advisable to research banks that specifically work with international clients and non-resident business owners, as they're more familiar with the documentation requirements for foreign nationals.

What are the tax implications and tax compliance requirements for foreign entrepreneurs operating a US-based business?

Foreign entrepreneurs must navigate both US tax laws and potential tax obligations in their home country. If your US business entity generates income from US business activities, you'll typically need to file federal tax returns and may owe state income tax depending on where your business operates. A limited liability company can choose how it's taxed - as a disregarded entity, partnership, or corporation - each with different tax implications. C corporations face double taxation (corporate taxes plus shareholder dividend taxes), while LLCs can offer more flexibility. Non-US citizens who don't live in the US generally aren't subject to personal income tax on business profits unless they're conducting trade or business within the US. You'll also need to track income, maintain bank statements, and potentially pay employment taxes if you hire employees.

Tax treaties between the US and treaty countries may reduce or eliminate certain tax obligations. Consulting with accounting services or tax professionals familiar with international business is essential for proper tax compliance.

Do I need to be a US citizen or permanent resident to register a business and obtain an Employer Identification Number (EIN)?

No, you don't need to be a US citizen or permanent resident to register a business or obtain an Employer Identification Number (EIN) in the United States. Foreign nationals can establish various business structures including a limited liability company, C corporation, or sole proprietorship. The IRS issues EINs to foreign entrepreneurs regardless of immigration status - you don't need a green card, visa, or any specific legal presence in the US. However, the application process differs slightly for non-residents. While US citizens and permanent residents can apply online, non-US residents typically need to apply by phone, fax, or mail, providing additional documentation such as a foreign tax identification number or passport information.

You will need a registered agent with a physical address in your state of formation to receive legal documents and official correspondence. This registered agent service is required for most business entities and ensures compliance with state regulations even when business owners lack a physical presence in the US.

What business structure provides the best liability protection for foreign business owners investing in the US market?

The limited liability company (LLC) and C corporation both offer strong personal liability protection by creating a separate legal entity that shields personal assets from business debts and legal claims. For foreign entrepreneurs, an LLC often provides the optimal balance of limited liability, operational flexibility, and simpler compliance requirements. With an LLC, your personal income and assets remain protected from business liabilities, and you have flexibility in management structure through an operating agreement. The C corporation offers similar personal liability protection and may be preferable if you plan to raise funds from venture capital firms or issue stock to multiple investors, though it involves more complex corporate law requirements and faces double taxation. Both structures require a registered agent to maintain your legal address and receive official documents.

Many businesses choose LLC formation because it provides liability protection comparable to a corporation while avoiding the administrative complexity and filing fees associated with corporate structures. Some foreign nationals pursuing an immigrant investor visa or employment-based immigration may need to consider how their business structure affects their visa category, such as demonstrating investment in a new commercial enterprise or targeted employment area.

What ongoing compliance requirements should foreign business owners expect when operating a US company?

Operating a US business as a non-resident involves several ongoing compliance obligations beyond initial formation. You'll need to maintain a registered agent service in your state of formation to receive legal documents and ensure you have a current legal address on file. Most states require annual report fees and regular filings to keep your business entity in good standing - failure to file can result in penalties or administrative dissolution. You must maintain accurate business records, including bank statements, track income and expenses, and file appropriate tax returns based on your business structure and business activities. If you hire employees, you'll need to handle employment taxes and payroll compliance. Some states also impose franchise tax based on revenue or net worth, regardless of your physical presence.

Depending on your business activities, you may need specific business licenses or permits. Recent federal regulations also require beneficial ownership information reporting for many business entities. Additionally, if your business interests involve specific regulated industries or international clients, you may face additional reporting requirements. Working with a registered agent service and accounting services familiar with foreign business owners helps ensure you meet all legal documents and tax compliance deadlines while focusing on growing your business in the US market.

Disclaimer: This content is intended for general educational and informational purposes only and does not constitute legal, tax, or accounting advice. Every effort is made to keep the information current and accurate; however, laws, regulations, and guidance can change, and no representation or warranty is given that the content is complete, up to date, or suitable for any particular situation. You should not rely on this material as a substitute for advice from a qualified professional who can consider your specific facts and objectives before you make decisions or take action.

Share This Article:

Stay in the know!

Join our newsletter for special offers.