How to Dissolve an LLC Correctly: Step-by-Step Guide

Business owners who simply stop operations without formally closing their LLCs often discover the mistake years later when state agencies assess thousands of dollars in accumulated fees and penalties. One entrepreneur learned this lesson after receiving notice of administrative dissolution and a bill for five years of unpaid franchise taxes, even though the business had closed years earlier. Understanding how to dissolve an LLC properly prevents such scenarios and ensures a clean separation from business obligations.

Many LLC owners assume that closing operations completes the business closure process. However, legal dissolution requires specific steps, filings, and compliance measures that extend beyond simply ceasing activities. Skipping formal dissolution leaves owners exposed to ongoing fees, tax obligations, and potential liability for business actions occurring after closure.

This guide provides comprehensive steps to dissolve an LLC, clarifying requirements, timelines, and best practices for properly ending your limited liability company. InCorp is not a law firm and does not provide legal or financial advice. This information is educational. Readers should consult with qualified legal professionals.

Key Takeaways

-

Simply stopping business activity is not enough; an LLC remains legally active (and subject to fees, taxes, and potential lawsuits) until it is formally dissolved with the state.

-

Proper dissolution starts with internal approval: single-member LLCs decide individually, while multi-member LLCs must follow the voting and documentation rules in their operating agreement or state law.

-

Creditors must be notified in writing and given a specific window to submit claims, and all valid debts should be resolved before any distributions are made to members.

-

Final federal, state, and local tax returns must be filed (and often marked “final”), and some states require tax clearance before they will accept dissolution filings.

-

Licenses, permits, DBAs, and registrations should be inventoried and formally canceled to stop renewals, notices, and compliance obligations from continuing after closure.

-

Filing articles of dissolution (or certificates of cancellation/termination) with the formation state is the step that officially ends the LLC’s legal existence and stops future state fees.

-

Bank accounts, credit lines, vendor accounts, and utilities should be closed only after checks clear and automatic payments are canceled, then remaining assets can be distributed per the operating agreement.

-

States differ on forms, fees, signatures, notarization, and publication requirements, so owners must follow their specific state’s procedures to avoid delays or rejections.

-

Common mistakes—like skipping creditor notice, ignoring final tax filings, or never submitting dissolution paperwork—can lead to personal liability, penalties, and long-term compliance problems.

-

Professional services like InCorp can prepare dissolution documents, coordinate with state agencies, and help navigate multi-state or complex dissolutions, reducing risk and saving time.

What It Means to Dissolve an LLC

Understanding the difference between stopping operations and legally dissolving an LLC proves fundamental to avoiding ongoing obligations. Many business owners conflate these concepts, creating problems that surface months or years after they believe their businesses have closed.

Legal Dissolution vs. Closing Operations

Legal dissolution formally terminates an LLC's existence with the state, ending its status as a recognized business entity. Merely ceasing business activities, closing bank accounts, or notifying customers does not constitute dissolution. Without formal dissolution, states continue to treat LLCs as active entities subject to annual reporting requirements, franchise taxes, and other obligations.

Administrative dissolution occurs when states involuntarily dissolve LLCs for non-compliance with state requirements. Failure to file annual reports, maintain registered agents, or pay franchise taxes triggers administrative action. While administrative dissolution ends the LLC's good standing, it typically does not eliminate accumulated fees or penalties. Owners should address these obligations and may need to formally dissolve the LLC to achieve complete closure.

Why Business Owners Dissolve an LLC

Retirement, business sales, strategic pivots, and financial difficulties all prompt LLC dissolutions. Some owners form LLCs for specific projects or time-limited ventures, planning dissolution from the beginning. Others discover that market conditions or personal circumstances make continuing operations unfeasible.

Dissolving a limited liability company prevents ongoing state fees and reduces liability exposure. States assess annual fees regardless of business activity. Dissolved LLCs stop accruing these charges. Formal dissolution also establishes clear timelines for creditor claims, limiting the window during which former business obligations can arise. Understanding the business closure process helps owners transition cleanly to their next ventures.

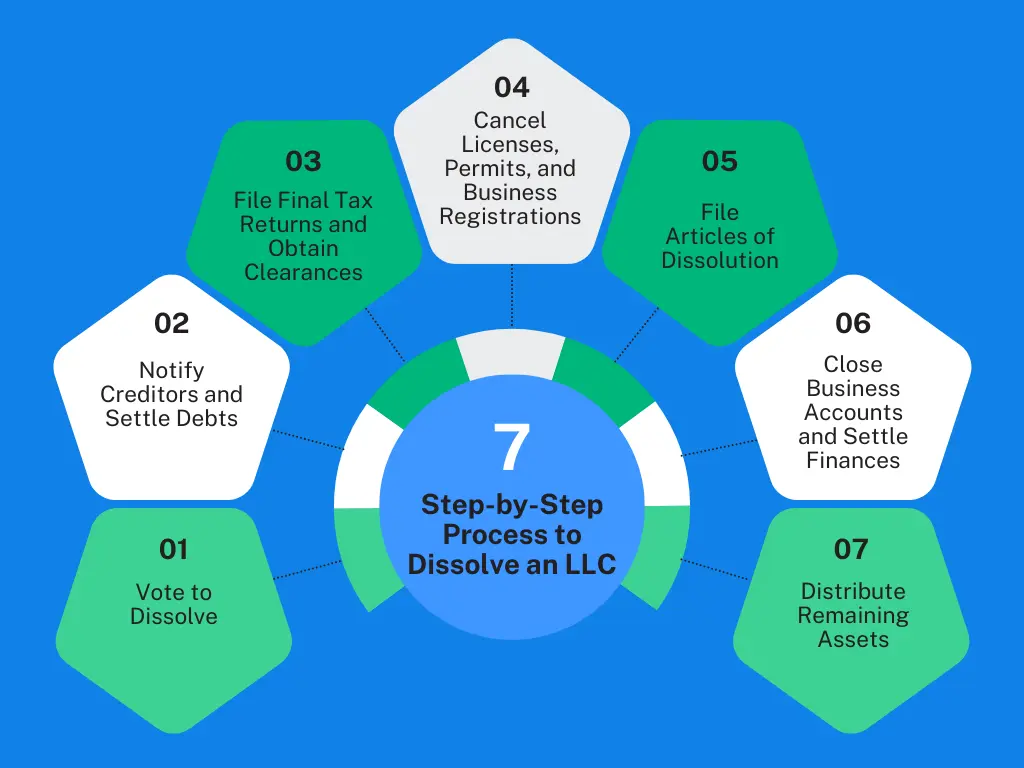

Step-by-Step Process to Dissolve an LLC

LLC termination requirements follow specific sequences designed to protect creditors, state interests, and LLC members. Skipping steps or completing them out of order can delay dissolution or create compliance problems. Following systematic procedures ensures proper closure.

Step 1 – Vote to Dissolve

Member approval for dissolution initiates the formal process. Single-member LLCs require only the owner's decision to proceed. Multi-member LLCs must conduct votes in accordance with their LLC operating agreement. Most operating agreements specify voting thresholds, whether unanimous consent, majority approval, or supermajority requirements.

When operating agreements lack dissolution provisions, state law governs voting requirements. Most states require a majority or unanimous consent from members. Members should document dissolution votes in written resolutions, including the date, attendees, vote results, and the effective dissolution date. These records become part of the LLC's permanent files and may be required when filing articles of dissolution. Understanding LLC formation fundamentals helps owners recognize how dissolution reverses the creation process.

Step 2 – Notify Creditors and Settle Debts

Written notice to known creditors provides legal protection by establishing claim deadlines. Most states require notification specifying how creditors can submit claims and the deadline for doing so. Typical claim periods range from 90 to 180 days from the notice date. Claims submitted after deadlines are generally barred, limiting LLC and member liability.

LLC winding-up procedures require settling legal claims before distributing assets. LLCs should evaluate each claim, pay valid debts, and resolve or contest questionable obligations. Some jurisdictions also require published notice in newspapers serving the LLC's primary business location, providing constructive notice to unknown creditors. Federal bankruptcy courts provide guidance on creditor notification procedures that inform LLC practices.

Step 3 – File Final Tax Returns and Obtain Clearances

Final tax filings encompass federal, state, and local obligations. LLCs must file final income tax returns, marking them as final to prevent future filing requirements. Employment tax returns complete payroll obligations for LLCs with employees. Sales tax, use tax, and other jurisdiction-specific taxes require final reporting based on LLC activities.

Some states mandate tax clearance certificates confirming all taxes are paid before accepting dissolution forms. Clearance certificates verify that the LLC has filed required returns and paid outstanding balances. Without clearance, states may reject dissolution filings or delay processing. The IRS and state revenue departments provide guidance on final filing requirements and procedures for closing business tax accounts.

Step 4 – Cancel Licenses, Permits, and Business Registrations

Active licenses and permits continue generating renewal fees and compliance obligations until formally canceled. Business licenses, professional licenses, industry-specific permits, and DBAs all require separate cancellation actions. Each licensing authority maintains distinct processes and timelines for closures.

Canceling registrations prevents unexpected renewal notices and fees from arriving months after dissolution. Some licenses require formal cancellation requests, while others simply lapse without renewal. LLC owners should inventory all licenses and permits and contact each issuing authority to confirm cancellation procedures. Learn more about why business license applications get rejected to avoid common pitfalls during the application or cancellation process. Guidance on canceling business licenses outlines the steps required for each license type.

Step 5 – File Articles of Dissolution

Articles of dissolution formally notify states that LLCs are ending operations. Also called certificates of dissolution or certificates of cancellation, depending on jurisdiction, these documents contain LLC identification information, dissolution effective dates, and statements confirming member approval and debt settlement.

Filing fees vary significantly by state, ranging from no charge in some jurisdictions to several hundred dollars in others. Processing times also vary: some states complete dissolution within days, while others require weeks. Most states offer online filing through the Secretary of State websites, streamlining submission and payment processes. State LLC regulations determine specific form requirements, signatures needed, and whether notarization is required.

Step 6 – Close Business Accounts and Settle Finances

Bank accounts, credit card accounts, utility services, and vendor relationships all require formal closure. Banks typically require dissolution documentation before closing business accounts. Final checks should clear and any automatic payments should be canceled before initiating closure.

Liquidating LLC assets may be necessary to generate funds for debt payment. Assets are sold at fair market value, with proceeds first covering obligations before any member distributions. Asset sales may trigger tax consequences, making professional tax guidance valuable during this phase.

Step 7 – Distribute Remaining Assets

After paying all debts, taxes, and dissolution expenses, the remaining assets are distributed to members. Operating agreements typically specify distribution formulas, usually based on ownership percentages. State LLC regulations may establish payment priorities, ensuring certain obligations are satisfied before member distributions.

Distributions should be documented with records showing amounts, dates, and recipients. These records prove proper asset handling and protect against future disputes. Some distributions are made in cash, while others involve transferring property or other assets to members.

How Long Does the Dissolution Process Take?

Dissolution timelines vary based on LLC complexity, state processing speeds, and how quickly owners complete required steps. Simple LLCs with no debt, minimal assets, and a single member can complete dissolution in weeks. Complex LLCs with multiple members, significant assets, ongoing contracts, and creditor claims may require months to resolve.

State processing times for filing articles of dissolution range from days to several weeks. States experiencing high filing volumes or operating with limited staff may process dissolutions slowly. Expedited processing options are available in many states for an additional fee. Internal company steps, particularly settling debts and liquidating assets, often consume more time than state processing. Complex asset sales, disputed claims, or member disagreements can significantly extend timelines.

State Variations and Filing Nuances

State LLC regulations vary in dissolution procedures despite general similarities across jurisdictions. Some states require specific forms unavailable in others. Delaware uses certificates of cancellation, while other states file articles of dissolution. Signature requirements vary: some states require all members to sign, while others accept manager or authorized representative signatures.

Notarization requirements vary by state. Some jurisdictions require notarized signatures, while others accept unnotarized filings. Publication requirements exist in certain states, mandating newspaper notices in addition to creditor notifications. Filing fees vary widely, from states that charge nothing to those that assess fees exceeding $200. Corporate formalities around dissolution reflect these state-specific requirements.

Common Mistakes to Avoid When Dissolving an LLC

Inadequate creditor notification creates ongoing liability exposure. Creditors who do not receive proper notice can pursue claims years after owners believed the dissolution was complete. Providing notices with clear deadlines and maintaining proof of notification protects against future claims.

Neglecting final tax obligations exposes former LLC members to personal liability. Payroll taxes, in particular, carry serious consequences for non-payment, with the IRS authorized to seek restitution from responsible individuals. Completing all tax filings and obtaining clearances prevents these complications.

Failing to file dissolution paperwork leaves LLCs technically active despite ceased operations. States continue to assess fees and require annual reports. Accumulated charges can reach substantial amounts before owners notice the issue. Administrative dissolution by the state does not eliminate these obligations or provide the same legal protections as voluntary dissolution.

How InCorp Helps With LLC Dissolution

InCorp's dissolution services assist business owners through the entire closure process. Professional guidance ensures legal compliance for LLC dissolution, covering state-specific requirements and helping owners avoid common pitfalls. InCorp prepares required documentation, manages filing processes, and coordinates with state agencies on clients' behalf.

Experience with dissolution procedures across multiple jurisdictions allows InCorp to navigate variations efficiently. Understanding state-specific nuances, form requirements, and processing procedures helps expedite closures and minimize complications. Professional assistance proves particularly valuable for multi-member LLCs, entities operating in multiple states, or situations involving complex asset liquidation.

Next Steps After LLC Dissolution

Approved dissolution documents should be retained permanently as proof of proper closure. These records may be needed years later if questions arise about the LLC's status or liabilities. Final tax returns, asset distribution documentation, and creditor notification records complete the essential file.

Consulting tax professionals ensures proper reporting of dissolution consequences on personal returns. Asset distributions, debt forgiveness, and final-year operations may carry tax implications that require professional guidance. Financial advisors can help former owners transition business assets and plan next steps.

Finalizing Your LLC Closure With Confidence

Following each dissolution step carefully helps prevent future liability and compliance issues. Understanding how to dissolve an LLC properly ensures a clean separation from business obligations. The LLC closure checklist encompasses member votes, creditor notifications, tax filings, license cancellations, state filings, account closures, and asset distributions. Completing these systematically prevents ongoing fees and liabilities.

InCorp provides support and resources throughout dissolution, helping business owners complete processes efficiently while meeting all requirements. Contact InCorp for assistance with your LLC dissolution and guidance through state-specific procedures.

FAQs

What does it mean to dissolve an LLC?

Dissolving an LLC is the formal legal process of ending the company's existence with the state and winding up its financial and legal obligations. Dissolution stops the LLC from operating as an active business entity and closes out its remaining responsibilities.

How long does it take to dissolve an LLC?

The dissolution timeline depends on the state and how complex the business is, but it often takes anywhere from a few weeks to a few months after all required steps and filings are completed. More complex LLCs with multiple members, significant assets, or outstanding debts can take longer to fully wind down.

Do I still have to pay taxes after dissolving my LLC?

Yes. You must file and pay all required state and federal taxes, including final income, employment, and any other applicable business taxes, through the date the LLC ceases doing business. Tax obligations end only after those final returns are filed and any balances due are paid.

Can I dissolve an LLC myself, or do I need a lawyer?

Many business owners can handle the dissolution process themselves by following state instructions and filing the required forms. Professional support from legal or tax advisors and third-party providers such as InCorp's dissolution services can help ensure compliance with state law, navigate state-specific requirements, and reduce the risk of errors, especially if the LLC has multiple members, substantial assets, or complex obligations.

What happens if I dissolve my LLC without notifying creditors or settling debts?

If you do not properly notify creditors or settle outstanding debts, you may face lawsuits, collection actions, or even personal liability in some circumstances. Proper winding-up procedures, including notice to creditors and payment of valid claims, help limit future disputes and protect members from ongoing obligations.

What is the difference between voluntary dissolution, administrative dissolution, and judicial dissolution of an LLC?

Voluntary dissolution happens when LLC members follow the operating agreement or state law to vote to close the limited liability company and then complete the formal dissolution process with the state's office. Administrative dissolution occurs when the state dissolves an LLC for noncompliance, such as failing to pay state franchise tax or file annual reports, and it does not provide the same legal protections as a properly completed voluntary dissolution. Judicial dissolution is ordered by a court, usually after a lawsuit or serious member dispute, and it forces the business entity to wind up and distribute assets under court supervision.

Do I need to amend or follow my LLC operating agreement when dissolving a single-member LLC or multi-member LLC?

Both single-member and multi-member LLCs should follow the dissolution procedures in the LLC operating agreement, including any vote requirements, winding-up steps, and rules for distributing remaining assets. If the operating agreement is silent or missing, state law provides default rules on how LLC members approve dissolution and how business assets must be used to settle debts before distributions.

How do business taxes and the IRS factor into dissolving an LLC correctly?

Before filing articles of dissolution, LLCs generally must file final tax returns for federal income tax purposes, including income, employment, and payroll taxes, and pay any taxes owed. After all required final returns are filed, the business owner can request closure of the IRS business account tied to the employer identification number by writing to the Internal Revenue Service with the business name, EIN, business address, and the reason for closing.

What happens to business licenses, permits, and contracts when I complete LLC dissolution paperwork?

Dissolving an LLC does not automatically cancel business licenses, permits, or a lease agreement, so the business owner must separately contact each issuing authority or counterparty to terminate or withdraw those authorizations and contractual obligations. Leaving licenses, permits, or existing contracts open after the business officially dissolves can create ongoing fees, future liability, or disputes if regulators or landlords treat the business as still responsible under those records.

Can I dissolve an LLC online, and what information is usually required to file articles of dissolution?

Many states allow small business owners to complete the dissolution process online by filing articles of dissolution (or similar dissolution documents) through the Secretary of State or equivalent state's office and paying the applicable filing fee, which can vary widely. Typical dissolution papers ask for the LLC's legal name, business address, confirmation that LLC members authorized the dissolution and that outstanding debts have been addressed, plus signatures from an authorized person, and some states may also require a tax clearance certificate before accepting the filing.

Disclaimer: This content is intended for general educational and informational purposes only and does not constitute legal, tax, or accounting advice. Every effort is made to keep the information current and accurate; however, laws, regulations, and guidance can change, and no representation or warranty is given that the content is complete, up to date, or suitable for any particular situation. You should not rely on this material as a substitute for advice from a qualified professional who can consider your specific facts and objectives before you make decisions or take action.

Share This Article:

Stay in the know!

Join our newsletter for special offers.