How Long Should You Keep Business Records After Closing Your Business

Former business owners often underestimate the ongoing responsibilities that follow the closure of operations. One owner discovered this reality when the IRS requested tax documentation three years after the company's closure, only to find that most records had been discarded weeks earlier. Understanding how long to keep business records after closing a business helps prevent such scenarios and ensures compliance with legal and tax obligations that extend far beyond the final day of operations.

Closing a business involves more than locking the doors and walking away. Boxes of invoices, tax returns, and contracts raise an important question: what happens to all those documents? Understanding how long to keep business records after closing business operations prevents legal issues, protects against audits, and ensures regulatory compliance even after operations cease.

Missing documents during an IRS audit, failing to defend against claims, or lacking proof of transactions can result in penalties and legal exposure. This guide clarifies retention requirements, storage best practices, and proper disposal methods.

Key Takeaways

-

Closing your business does not end your record‑keeping obligations; tax authorities and potential claimants can request documents years after operations cease.

-

Keep tax returns and supporting records for at least 7 years, and longer if there was omitted income, bad‑debt deductions, or other high‑risk issues.

-

Retain employee and payroll records for 3–7 years after termination, with some HR and benefits documents kept longer to cover employment law statutes of limitation.

-

Preserve formation documents, ownership records, major contracts, property records, and key corporate actions permanently or until all possible claims are time‑barred.

-

Digital storage is acceptable if records remain secure, backed up, and easily retrievable; physical and electronic files with sensitive data should be destroyed using secure shredding or deletion methods once retention periods expire.

Why Retaining Business Records Matters

Many former business owners assume that closing ends all record-keeping requirements for closed businesses. However, legal requirements, tax regulations, and potential disputes create ongoing responsibilities that extend for years beyond the final operations. Business record retention serves multiple purposes, protecting different aspects of closed businesses and their former owners.

Maintaining proper records demonstrates compliance, provides a defense against claims, and preserves documentation needed for tax purposes. The fundamentals of business record-keeping remain important even after closing. Following a business record retention schedule ensures that all document types are retained appropriately.

Legal Requirements

Federal, state, and local laws mandate specific retention periods for different document types. These requirements vary by jurisdiction and business structure. Sole proprietorships face different timelines than corporations, and businesses with employees carry additional obligations.

Failing to retain required records can result in penalties ranging from monetary fines to criminal penalties. Tax authorities can assess penalties reaching thousands of dollars when businesses cannot produce documents during examinations. Missing corporate records can complicate efforts to prove business structure or ownership if disputes arise.

Tax and Audit Purposes

The IRS maintains authority to examine returns and supporting documents for several years after filing. Standard examination periods extend three years from filing, though certain circumstances allow longer review periods. Substantial underreporting extends the window to six years, while fraud eliminates time limitations. Understanding how long to keep tax records after closing helps businesses meet IRS requirements.

Tax document retention requirements apply regardless of business status. Closed businesses remain subject to examination for tax years when operations occurred. Returns, receipts, invoices, and supporting documentation must remain accessible throughout applicable periods. State tax authorities impose similar requirements, often with different timelines. Proper accounting records retention after business closure protects against audit risks.

Protecting Against Claims

Former employees, vendors, or customers may file claims after closure. Employment disputes and contract disagreements require documentation to support your position. Without records, former owners face difficulty proving their positions.

Maintaining records provides evidence of transactions and compliance efforts. Employment files demonstrate hiring practices. Contracts establish terms. Financial records prove payments.

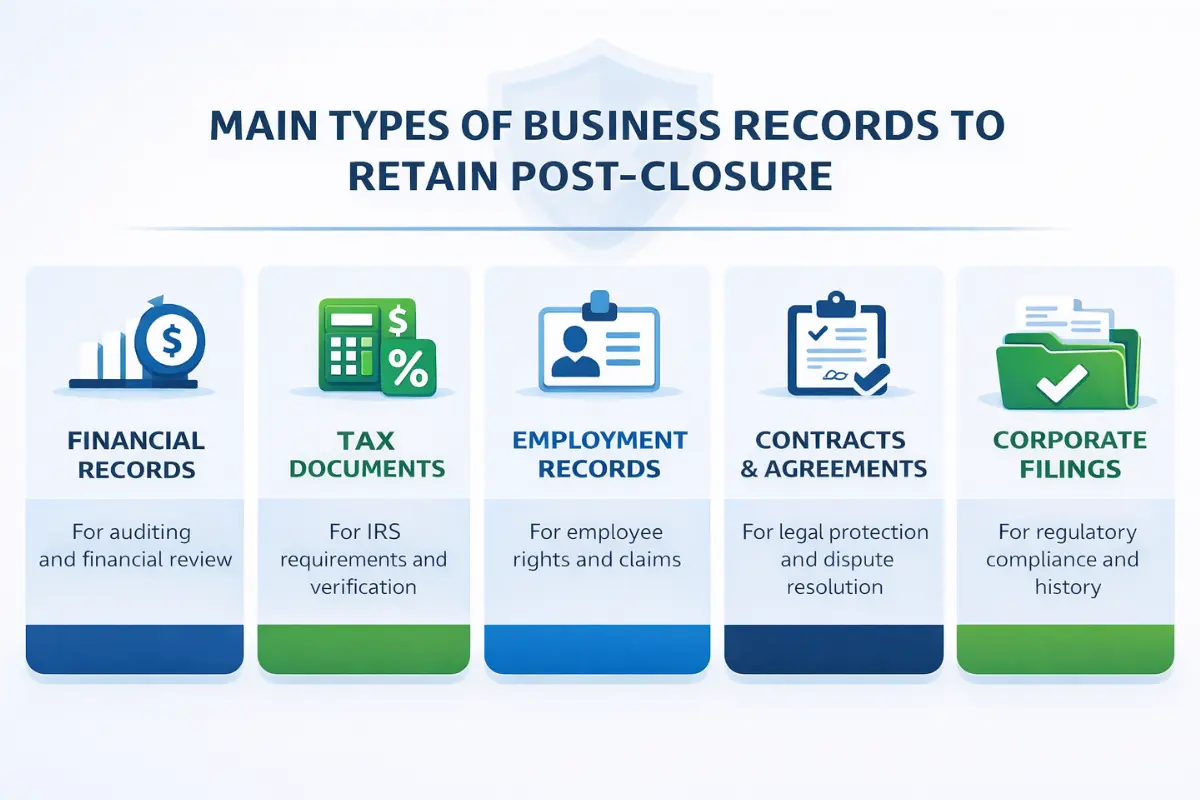

Types of Business Records to Retain

Different document categories serve distinct purposes. Financial record keeping encompasses multiple document types.

Tax Records

Tax-related documents form the foundation of any retention strategy. These materials substantiate the reported income, claimed deductions, and paid taxes. Tax records include filed returns for income, payroll, sales, and other applicable taxes. Supporting documentation includes receipts, invoices, bank statements, and materials that substantiate the figures on returns.

Payroll tax filings and year-end summaries also fall within this category. Businesses that claimed specific deductions must retain evidence. Home-based business tax deductions require documentation of expenses and calculations.

Financial and Accounting Records

Businesses generate extensive financial documentation during operations. Bank statements, canceled checks, and deposit records track money movement. General ledgers, journals, and trial balances record transactions. Profit and loss statements, balance sheets, and cash flow statements provide periodic snapshots. Proper financial documents retention for closed businesses ensures audit readiness.

Accounts payable and receivable records document amounts owed and due. Invoice copies, purchase orders, and payment records substantiate transactions. These materials collectively demonstrate financial activity.

Employee and Payroll Records

Businesses with employees accumulate substantial personnel documentation. Employee record retention requirements extend beyond basic payroll to encompass hiring records, benefit elections, performance evaluations, and termination documentation. W-2 forms, wage records, time sheets, and tax withholding information prove compensation and taxes remitted. Understanding employee records retention after a business closure is essential to ensure compliance with federal and state employment laws.

Payroll record requirements include employee information, employment dates, wage rates, hours worked, and deductions. Benefits documentation covers insurance elections and retirement contributions. Personnel files contain applications, offer letters, reviews, and separation notices.

Legal and Corporate Records

Corporate record retention encompasses formation documents and ongoing compliance materials. Articles of incorporation or organization, bylaws or operating agreements, and stock certificates establish the business structure. Board meeting minutes, shareholder resolutions, and corporate actions document major decisions.

Licenses, permits, and regulatory approvals prove authorization to conduct business. Corporate kits and seals contain many foundational documents. Amendments, registered agent designations, and annual filings complete the collection.

Contracts and Agreements

Written agreements establish rights and obligations. Service contracts and lease documents may include terms that extend beyond the closing date. Some agreements include surviving provisions.

Loan documents establish debt obligations. Insurance policies define coverage. Intellectual property licenses and non-compete contracts impose restrictions that outlast operations.

Recommended Retention Periods by Record Type

Retention requirements vary by document type and regulations. While general guidelines provide helpful starting points, businesses should consult professionals to determine specific requirements. The U.S. Chamber of Commerce offers comprehensive guidance on retention periods.

IRS and Tax Documents

IRS retention rules establish minimum periods for maintaining tax records. The standard period extends three years from the filing or due date, whichever comes later. However, exceptions extend this timeline. Underreporting income by more than 25% extends the period to six years. Bad-debt deductions and worthless securities require a seven-year retention.

The IRS provides specific guidance on retention requirements. Businesses that failed to file or filed fraudulent returns face indefinite retention, as the IRS maintains unlimited examination authority. State tax authorities often impose similar or longer periods.

Employment tax records must be retained for four years from the filing or payment date. This applies to Forms 941, W-2s, and supporting documentation. Sales tax and other records are subject to jurisdictional requirements, typically three to seven years.

Employment and Payroll Records

Federal employment laws establish varying retention periods. The Fair Labor Standards Act requires three-year retention for payroll records and two years for time cards. However, longer periods often apply under other statutes.

Age discrimination laws require retaining hiring records and benefit plan documents for periods ranging from one year to indefinitely, depending on the type. OSHA mandates five-year retention for workplace injury logs. State laws may impose additional requirements.

Former employees can file claims under various employment statutes. Many employment attorneys recommend retaining personnel files for at least seven years after employment ends. Workers' compensation records should remain available for extended periods.

Legal, Corporate, and Contractual Records

Formation documents and ownership records should generally be retained permanently or until the statutes of limitations on potential claims expire. Articles of incorporation, bylaws, and ownership certificates establish the business structure. Meeting minutes and resolutions provide records of corporate actions.

Compliance officer responsibilities often include maintaining these records in organized formats. Contracts should be retained for at least six years after expiration, though longer retention is advisable when agreements include indemnification clauses.

Property deeds and intellectual property registrations should be retained permanently as proof of ownership. Insurance policies should be maintained for periods covering potential claims arising during coverage.

Best Practices for Storing Business Records

Proper storage protects documents from damage, ensures accessibility, and maintains confidentiality. Record-keeping best practices balance security and organization. Both physical and digital storage methods offer advantages.

Physical Storage

Paper documents remain common despite digital alternatives. Fireproof filing cabinets or safes protect critical records. Organized filing systems using consistent naming conventions facilitate quick retrieval. Climate-controlled storage prevents deterioration.

Off-site storage facilities offer secure environments for long-term retention.

Digital Storage

Electronic record-keeping reduces physical storage requirements while improving search capabilities. Scanned documents replicate paper originals while occupying minimal space. Cloud storage provides redundant backups and remote access while maintaining security through encryption.

Legal document storage in digital formats requires attention to authenticity and legibility. High-quality scans preserve document details. Regular backups to multiple locations protect against data loss.

Security and Confidentiality

Sensitive business records require protection against unauthorized access. Employee information, financial data, and customer details demand confidential handling. Physical records need restricted access through locked storage. Digital files require password protection and encryption.

Audit preparation benefits from organized, secure recordkeeping systems. Access logs track who views or modifies records. Disposal procedures should ensure complete destruction when retention periods expire.

When and How to Properly Dispose of Records

Once retention periods expire, businesses can dispose of records, but careful processes help prevent premature destruction or inadequate security. Document disposal guidelines balance completion of retention obligations with protection of sensitive information remaining in expired records. Knowing when records can be destroyed and following disposing of business records securely practices prevents data breaches.

Shredding and Secure Disposal

Paper records containing sensitive information require destruction methods preventing reconstruction. Cross-cut shredding renders documents unreadable while allowing environmentally responsible recycling. Professional shredding services provide certificates of destruction and efficiently handle large volumes. Following IRS record retention guidelines helps determine when documents qualify for disposal.

The Federal Trade Commission offers guidance on protecting personal information during document disposal. Simple disposal in trash bins risks exposing sensitive information. Shredding, pulping, or incineration provide secure alternatives ensuring complete destruction.

Secure Deletion of Digital Files

Digital records require specialized deletion methods. Secure deletion software overwrites data multiple times. Cloud-stored documents should be deleted from all backup locations. Service providers should confirm complete removal from their systems.

Ensuring Compliance and Protecting Your Business Records

Maintaining proper records after closing protects former owners from penalties, supports defense against claims, and demonstrates compliance. Following a “closing a business checklist”, including record retention, helps ensure all obligations are met. The IRS provides guidance on closing operations and meeting ongoing requirements. Understanding how long to keep business records after closing a business remains one of the most important post-closure responsibilities.

InCorp helps business owners navigate record retention requirements, storage solutions, and compliance obligations. Professional guidance ensures appropriate retention periods, proper organization, and secure disposal when documents reach required retention end dates. Contact InCorp for assistance in managing your business records and maintaining compliance after closure.

FAQs

How long should I keep tax records after closing my business?

Generally, retain tax records for at least 7 years to comply with IRS guidelines and be prepared for audits. Some situations require longer retention, particularly when substantial income underreporting occurred or bad debt deductions were claimed.

Do I need to keep employee and payroll records after shutting down?

Yes, keep employment and payroll records for 3–7 years, depending on federal and state regulations. Different record types have varying requirements, with some personnel files warranting longer retention to cover potential employment claims.

How long should I keep contracts and agreements?

Maintain legal, corporate, and contractual records for at least 6 years, or longer if specified in agreements. Some documents, particularly formation records and ownership documents, should be retained permanently or until all applicable statutes of limitations have expired.

Can I store business records digitally instead of physically?

Yes, digital storage is acceptable as long as files are secure, accessible, and backed up regularly. Scanned documents must be legible and organized systematically to facilitate retrieval when needed for audits or legal purposes.

What's the safest way to dispose of old business records?

Shred physical documents and use secure deletion tools for digital files to protect sensitive information. Professional destruction services provide certificates of destruction and ensure the complete elimination of recoverable data from all storage locations.

Do I need to keep business records if my company had no income in its final year?

Yes. Even if you did not report income in the final year, you should still keep tax returns, supporting documents, and other business records for at least seven years to address potential IRS audits, state tax inquiries, or questions about business expenses and losses. Maintaining accounting records, bank statements, and profit and loss statements for that period helps you substantiate that the business was inactive and that no income needed to be reported.

How long should I keep payroll records and employment tax records after my last employee leaves?

Payroll records, personnel records, and employment tax records should generally be kept for at least three to seven years after an employee leaves, depending on federal and state requirements and applicable employment laws. Keeping Forms W‑2, payroll tax records, hiring records, job applicant information, and timekeeping data for this longer period helps you respond to IRS audits, wage claims, and Equal Employment Opportunity Commission or other employment act investigations.

What should a small business owner keep with tax returns for audit and tax purposes?

Along with income tax returns and payroll tax filings, small business owners should keep supporting documents such as invoices for business purchases, canceled checks, bank deposit records, credit card statements, general ledgers, and other accounting documents that prove reported income and deductions. Retain documentation for bad debt deductions, worthless securities, and major business expenses for at least seven years so you can provide details if the Internal Revenue Service questions these items during an audit.

Can I rely only on digital records instead of paper copies for my closed business?

Yes, many businesses rely on digital records, provided the documents are accurate, complete, legible, and backed up in a secure system that allows you to retrieve them throughout the required record retention period. Scanned copies of legal documents, tax documents, insurance policies, financial statements, and operational records can replace paper copies as long as they clearly show all information and can be produced if requested by the IRS, an insurance company, or a court.

How should I safely dispose of business documents after the retention period ends?

When records no longer need to be kept, destroy paper copies using cross‑cut shredding services or in‑house shredders so important documents cannot be reconstructed. For digital records, use secure deletion tools that permanently erase files and backups, especially for employee records, tax records, bank statements, and other documents containing sensitive personal or financial information.

Disclaimer: This content is intended for general educational and informational purposes only and does not constitute legal, tax, or accounting advice. Every effort is made to keep the information current and accurate; however, laws, regulations, and guidance can change, and no representation or warranty is given that the content is complete, up to date, or suitable for any particular situation. You should not rely on this material as a substitute for advice from a qualified professional who can consider your specific facts and objectives before you make decisions or take action.

Share This Article:

Stay in the know!

Join our newsletter for special offers.